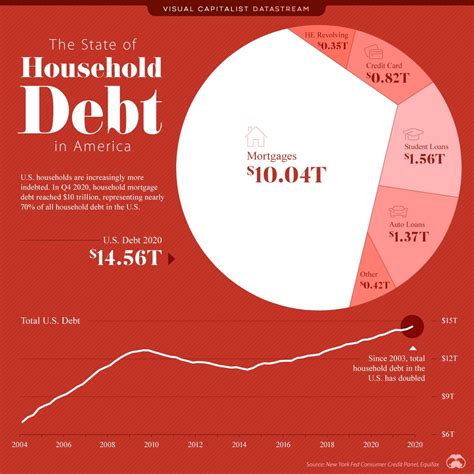

For many men, the drive to provide and achieve is strong, but often, unseen burdens like debt can hold back true financial potential. Crushing debt isn’t just about paying bills; it’s about reclaiming power, building momentum, and ultimately accelerating the path to significant wealth. This article delves into a robust, multi-pronged strategy designed specifically for men to not only eliminate debt but also rapidly build lasting financial security.

Understanding the Male Financial Landscape

Men often face unique pressures and expectations when it comes to finances, from providing for family to funding entrepreneurial ventures. This can lead to accumulating various forms of debt, including student loans, mortgages, car loans, and credit card balances. The first step towards wealth is acknowledging the scope of these liabilities and committing to an aggressive offensive rather than a passive defense.

The Debt Annihilation Blueprint: Aggressive & Strategic

1. The Debt Avalanche or Snowball Method (Accelerated)

While both methods are effective, men often respond well to the “gameification” aspect. The Debt Snowball (paying smallest debts first for motivational wins) or Debt Avalanche (paying highest interest debts first for maximum financial efficiency) can be turbo-charged. The key is to commit every spare dollar – bonuses, raises, tax refunds – directly to debt repayment. This isn’t just about making minimum payments; it’s about making maximum impact.

2. Slash Unnecessary Spending Ruthlessly

Temporary sacrifices lead to permanent gains. Analyze every expenditure. Are there subscription services you don’t use? Can you cook at home more often? Can you delay that new gadget? Every dollar saved is a dollar that can be thrown at debt. This requires discipline and a clear vision of the end goal.

3. Refinance and Consolidate Strategically

Explore options to lower interest rates. Personal loans for high-interest credit card debt or mortgage refinancing could significantly reduce monthly payments and overall interest paid, freeing up more cash for principal reduction. Be wary of fees and ensure the new terms truly benefit your long-term goal.

Supercharging Your Income Streams

Eliminating debt fast requires more than just cutting expenses; it demands boosting income. Men often possess skills and drive that can be leveraged beyond their primary job.

1. Negotiate Raises and Seek Promotions

Proactively seek opportunities within your current role. Document achievements, demonstrate value, and confidently negotiate for higher compensation. Your primary income source is often the quickest way to increase cash flow.

2. Develop High-Income Skills

Invest in yourself. Learn coding, digital marketing, project management, or a skilled trade. These skills can command higher salaries or open doors to lucrative side hustles.

3. Embrace Side Hustles and Entrepreneurship

Whether it’s freelancing, consulting, ride-sharing, or starting a small online business, a side hustle can inject significant extra cash directly into your debt repayment strategy. Think about your existing skills and how they can generate additional revenue.

Transitioning to Wealth Building: Smart Investing for Rapid Growth

Once the bulk of high-interest debt is gone, the focus shifts to aggressive wealth accumulation. This phase is about making your money work harder for you.

1. Prioritize Retirement Accounts (401k/IRA)

Maximize contributions, especially if your employer offers a match – it’s free money. These accounts offer tax advantages and compound over time, providing a solid foundation for long-term wealth.

2. Diversify and Invest Aggressively (Within Reason)

For men with a longer time horizon, a growth-oriented portfolio with a mix of stocks, ETFs, and potentially real estate can offer significant returns. Understand your risk tolerance, but don’t shy away from growth assets.

3. Consider Real Estate Investment

Whether through REITs, direct rental properties, or house hacking, real estate can be a powerful wealth builder, offering appreciation, rental income, and tax benefits. It’s a tangible asset that many men gravitate towards.

The Mindset Shift: Discipline, Patience, and Vision

This isn’t just about financial tactics; it’s about a complete mindset transformation. Men who successfully crush debt and build wealth share common traits:

- Unwavering Discipline: Sticking to the plan even when it’s tough.

- Long-Term Vision: Seeing beyond immediate gratification to future financial freedom.

- Continuous Learning: Staying informed about personal finance and investment strategies.

- Accountability: Tracking progress and adjusting as needed.

Building wealth fast is not about get-rich-quick schemes, but about consistent, aggressive, and intelligent action. It requires a commitment to financial literacy, a willingness to make sacrifices, and the discipline to execute a well-defined strategy.

Conclusion

The ultimate debt-crushing strategy for men to build wealth fast is a powerful blend of aggressive debt repayment, strategic income generation, and disciplined, diversified investing. By adopting a proactive mindset, leveraging their drive, and making smart financial choices, men can not only eliminate the burden of debt but also forge a path to unprecedented financial independence and lasting prosperity. It’s time to take control, execute the plan, and build the legacy you desire.