In an increasingly digital world, technology has become an indispensable tool for optimizing almost every aspect of our lives. From meticulously tracking our physical well-being to diligently managing our financial health, the right gadgets and software can provide insights, automation, and motivation that were once unimaginable. This article delves into the cutting-edge tech gear that stands out in helping you achieve your fitness goals and master your personal finances.

Revolutionizing Fitness Tracking: Wearables and Beyond

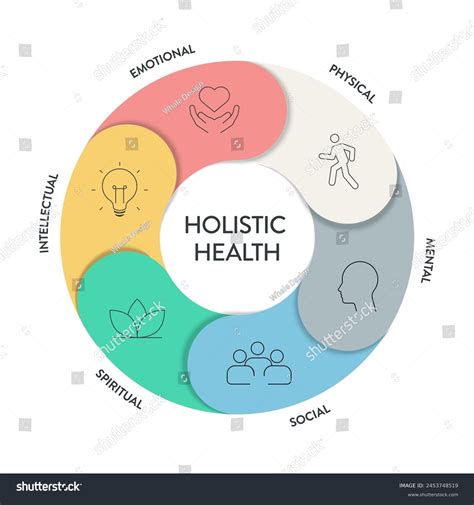

Gone are the days when fitness tracking meant merely counting steps. Today’s tech offers a holistic view of your health, monitoring everything from heart rate and sleep patterns to blood oxygen levels and recovery metrics. Smartwatches and dedicated fitness trackers lead the charge, providing real-time data and actionable insights directly from your wrist.

Devices like the Apple Watch, Garmin Forerunner series, and Fitbit Versa/Sense lines are popular choices, offering GPS tracking, diverse workout modes, heart rate variability (HRV) analysis, and even ECG capabilities. Many integrate seamlessly with third-party apps for nutrition tracking or specialized training programs.

Beyond wearables, smart scales have become a staple for comprehensive body composition analysis. Brands like Withings Body+ and Eufy Smart Scale P2 Pro measure not just weight, but also body fat percentage, muscle mass, bone mass, and hydration levels, syncing data to your smartphone for historical tracking and trend analysis. For more niche fitness pursuits, devices like smart jump ropes or connected bike computers offer specialized metrics to enhance specific training routines.

Mastering Your Money: Tech for Personal Finance

Managing personal finances can often feel overwhelming, but a suite of powerful tech tools can simplify budgeting, saving, investing, and expense tracking. The goal is to gain clarity and control over your financial landscape.

Budgeting apps are perhaps the most accessible entry point. Platforms like Mint, YNAB (You Need A Budget), and Personal Capital automatically categorize transactions from linked bank accounts and credit cards, allowing you to visualize spending habits, set budgets, and track financial goals. Some even offer bill reminders and net worth tracking.

For investors, robo-advisors such as Betterment and Wealthfront offer automated, diversified investment portfolios tailored to your risk tolerance, often with lower fees than traditional financial advisors. These platforms make investing accessible even for beginners. Additionally, secure hardware wallets like Ledger Nano X or Trezor Model T are crucial for safeguarding cryptocurrency assets, providing an offline layer of security against cyber threats.

The Synergy of Wellness and Wealth

While fitness and finance may seem like disparate realms, many innovative technologies are starting to bridge the gap. For instance, some wellness programs or insurance providers offer incentives for meeting fitness goals, which can translate into financial savings. Conversely, financial stability often reduces stress, positively impacting mental and physical health. Some apps even allow data from fitness trackers to be integrated into broader lifestyle management platforms that also track financial goals.

The convergence of these technologies points towards a future where your digital ecosystem supports a truly holistic view of your well-being. By leveraging smart devices for fitness and intelligent software for finance, individuals can gain unprecedented control and insight, leading to healthier bodies and wealthier lives.

Choosing Your Essential Gear

When selecting your tech arsenal, consider your specific needs and existing ecosystem. For fitness, look for devices that are comfortable, accurate, and offer the metrics most relevant to your activities. For finance, prioritize security, ease of use, and comprehensive features that align with your financial habits and goals.

Ultimately, the “top” gear isn’t just about the most expensive or feature-rich product, but rather the tools that best empower you to make informed decisions and maintain consistent habits. Invest in technology that serves as a powerful ally in your journey towards optimal fitness and robust financial health.