Building lasting wealth is a goal many men aspire to, yet the path can often seem complex and daunting. While there’s no single “magic bullet,” a combination of proven principles and disciplined execution forms the bedrock of a successful long-term investment strategy. It’s less about market timing and more about time in the market, coupled with smart, consistent choices.

The Cornerstone: Long-Term Vision and Discipline

The most effective investment strategy for men centers on a long-term perspective. This means resisting the urge to react to short-term market fluctuations and instead focusing on growth over decades. Discipline is paramount – consistently saving and investing, even when economic conditions are uncertain. This steady approach allows the power of compounding to work its magic, transforming modest contributions into substantial wealth over time.

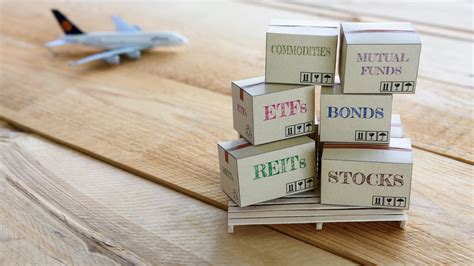

Embrace Diversification: Don’t Put All Your Eggs in One Basket

A diversified portfolio is critical for mitigating risk and maximizing potential returns. For men, this often means moving beyond just a traditional 401(k) or a few individual stocks. Consider a mix of asset classes:

- Equities (Stocks): For long-term growth potential, through index funds, ETFs, or individual stocks if well-researched.

- Fixed Income (Bonds): To provide stability and income, especially as wealth grows or retirement approaches.

- Real Estate: Direct ownership, REITs (Real Estate Investment Trusts), or crowdfunding for diversification and potential appreciation.

- Alternative Investments: Commodities, private equity, or even carefully selected digital assets for advanced investors, though these come with higher risks.

The key is to create a portfolio that aligns with your risk tolerance and financial goals, regularly rebalancing it to maintain your desired allocation.

Automate Your Savings and Invest More Over Time

One of the simplest yet most powerful strategies is to automate your investments. Set up automatic transfers from your checking account to your investment accounts (brokerage, IRA, 401(k)) immediately after you get paid. This “pay yourself first” approach ensures consistency and removes the temptation to spend the money elsewhere. As your income grows, commit to increasing your investment contributions. Even a small percentage increase each year can significantly impact your wealth accumulation over decades.

Leverage Tax-Advantaged Accounts

Smart investors utilize tax-advantaged accounts to their fullest potential. This includes 401(k)s, IRAs (Traditional or Roth), HSAs (Health Savings Accounts), and 529 plans for education. These accounts offer various tax benefits, such as tax-deferred growth or tax-free withdrawals, which can dramatically boost your net returns. Understanding the nuances of each and maximizing your contributions is a crucial part of an effective wealth-building strategy.

Continuous Learning and Professional Guidance

The financial landscape is ever-evolving. Staying informed about economic trends, tax law changes, and new investment opportunities is vital. While self-education is powerful, don’t hesitate to seek professional financial advice. A qualified financial advisor can help you create a personalized plan, navigate complex decisions, and keep you accountable to your long-term goals. They can also provide a valuable objective perspective, especially during volatile market periods.

Beyond the Numbers: Mindset and Protection

Building lasting wealth isn’t just about the investments; it’s also about a resilient mindset and protecting your assets. Develop financial literacy, understand risk, and avoid emotional investing decisions. Furthermore, ensure you have adequate insurance (life, disability, health) to protect your wealth and your family from unforeseen circumstances. Estate planning, while often overlooked by younger men, becomes increasingly important as wealth accumulates, ensuring your legacy is preserved according to your wishes.

Conclusion: The Journey Starts Now

For men aiming to build lasting wealth, the top strategy is a multifaceted approach characterized by long-term discipline, strategic diversification, automated savings, smart use of tax-advantaged accounts, continuous learning, and professional guidance. It’s a journey, not a sprint. The sooner you start, and the more consistently you apply these principles, the more robust and enduring your financial future will be. Begin today, stay disciplined, and watch your wealth grow.