Confronting the Beast: Why High-Interest Debt Demands Immediate Action

For many men, the weight of high-interest debt can feel like a silent burden, impacting everything from daily stress to long-term financial goals. Whether it’s lingering credit card balances, personal loans, or other forms of high-APR debt, these financial obligations act like a relentless tax on your future earnings, preventing wealth accumulation and stifling financial freedom. The “smartest way” isn’t just about strategy; it’s about a disciplined, aggressive, and well-executed plan.

The first step to crushing this debt is to truly understand its destructive power. High interest rates mean that a significant portion of your monthly payment goes towards interest, not the principal. This keeps you on a treadmill, making it feel impossible to get ahead. It’s time to stop the bleeding and reroute your hard-earned money towards building a secure financial foundation.

Mapping Your Battlefield: A Comprehensive Debt Assessment

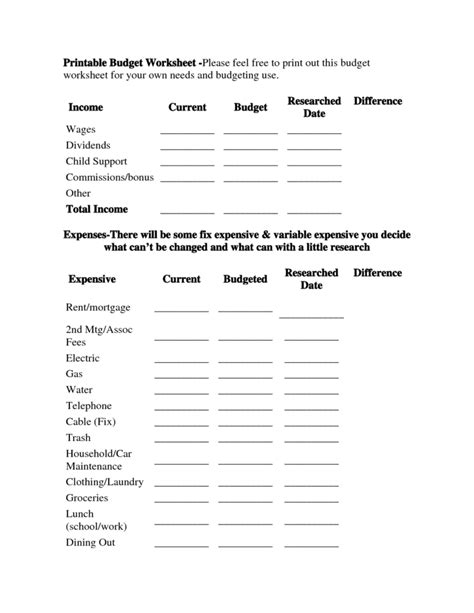

You can’t win a war without knowing your enemy. Start by listing every single debt you have, paying close attention to the interest rate, current balance, and minimum monthly payment for each. This includes credit cards, personal loans, lines of credit, and any other unsecured debt. Organize this information clearly—a spreadsheet works wonders—to gain a full picture of your financial landscape.

Next, create a meticulous budget. This isn’t just an exercise; it’s your strategic command center. Track every dollar coming in and every dollar going out for at least a month. Identify where you can cut expenses ruthlessly. Are there subscriptions you don’t use? Can you reduce dining out or entertainment costs? Every dollar saved is a dollar that can be thrown at your debt.

Choosing Your Weapon: Avalanche vs. Snowball Method

Once you know your debts and your budget, it’s time to pick your primary attack strategy. There are two highly effective methods:

The Debt Avalanche Method

This strategy prioritizes paying off debts with the highest interest rates first. You make minimum payments on all debts except the one with the highest APR, on which you pay as much as you possibly can. Once that debt is paid off, you take the money you were paying on it and apply it to the next highest interest rate debt. Mathematically, this method saves you the most money on interest over time.

The Debt Snowball Method

This method focuses on psychological wins. You pay off your smallest debt first, while making minimum payments on all others. Once the smallest debt is gone, you take that payment amount and add it to the next smallest debt. This creates a snowball effect of accelerating payments and provides motivational boosts as you eliminate debts one by one. While it might cost slightly more in interest, the momentum can be invaluable for staying motivated.

Choose the method that best suits your personality. If you’re driven by logic and want to save the most money, go for the avalanche. If you need quick wins to stay engaged, the snowball might be your best bet.

Accelerating Your Assault: Increase Income and Consolidate Wisely

To truly crush high-interest debt fast, you often need to do more than just cut expenses; you need to increase your offensive power. Look for ways to boost your income. Can you take on a side hustle? Sell unused items around your home? Ask for overtime at work? Every extra dollar earned should go directly towards your highest priority debt.

Debt consolidation can also be a powerful tool, but it requires caution. A low-interest personal loan or a balance transfer credit card (with a 0% introductory APR) can combine multiple high-interest debts into one, often with a lower overall interest rate. However, ensure you have a solid plan to pay off the consolidated debt before the promotional period ends, and resist the temptation to incur new debt on the now-empty credit cards.

Building Future Fortifications: Sustaining Financial Freedom

Crushing high-interest debt is a significant achievement, but the journey doesn’t end there. To prevent falling back into the same traps, establish solid financial habits. Build an emergency fund of at least 3-6 months of living expenses. This acts as a buffer against unexpected costs, preventing you from reaching for credit cards again.

Automate your savings and bill payments to maintain discipline. Continuously educate yourself on personal finance principles and challenge yourself to set new financial goals. Financial freedom isn’t a destination; it’s an ongoing process of smart decision-making and consistent effort. By adopting these strategies, men can not only eliminate high-interest debt but also lay a strong foundation for lasting financial security and prosperity.