High-interest credit card debt can feel like a heavy anchor, dragging down your financial progress and causing significant stress. The good news is that with a targeted strategy and disciplined execution, it’s possible to accelerate your repayment and break free from the cycle. This article will explore the most effective methods to quickly pay off that burdensome debt.

Understanding Your Debt Landscape

Before diving into strategies, take a clear inventory of all your credit card debts. List each card, its outstanding balance, and critically, its interest rate (APR). This information is crucial for determining the most efficient approach.

![44,813 Enough] Images, Stock Photos & Vectors | Shutterstock](/images/aHR0cHM6Ly90czIubW0uYmluZy5uZXQvdGg/aWQ9T0lQLm9ldVYyNTFTNFZkemhtWU0zWnpsQ0FIYUZiJnBpZD0xNS4x.webp)

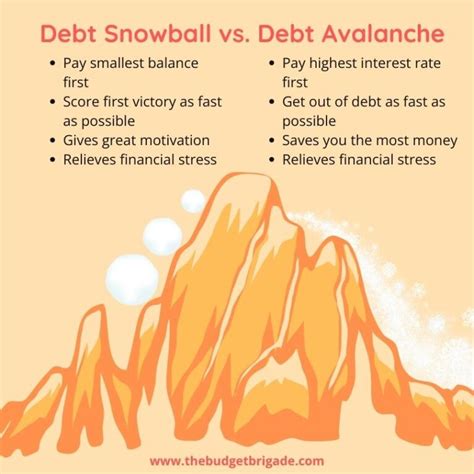

The Debt Avalanche vs. The Debt Snowball

These are two popular methods for tackling multiple debts:

Debt Avalanche Method

This strategy focuses on paying off the credit card with the highest interest rate first, while making minimum payments on all other cards. Once the highest-APR card is paid off, you take the money you were paying on that card and add it to the minimum payment of the card with the next highest interest rate. This method saves you the most money in interest over time because you’re eliminating the costliest debt first.

Debt Snowball Method

Conversely, the debt snowball method prioritizes paying off the smallest balance first, regardless of the interest rate. Once the smallest debt is paid, you apply that payment to the next smallest debt. While it might cost slightly more in interest, many find this method incredibly motivating as they see debts disappear quickly, building momentum.

Balance Transfers: A Temporary Reprieve

A balance transfer involves moving debt from one or more high-interest credit cards to a new credit card with a lower, often 0% introductory APR. This can be a powerful tool, as it gives you a window of typically 6 to 18 months to pay down a significant portion of your principal without accruing additional interest. Be mindful of balance transfer fees (usually 3-5% of the transferred amount) and ensure you can pay off the transferred balance before the promotional period ends, as interest rates can skyrocket afterward.

Debt Consolidation Loan

A personal loan for debt consolidation allows you to combine multiple credit card debts into a single loan with a fixed interest rate and a predictable monthly payment. Often, the interest rate on a consolidation loan is significantly lower than your credit card APRs, making your overall debt more manageable and cheaper to repay. This simplifies your payments and can provide a clear end date for your debt.

![Debt Consolidation Guide: How It Works [July 2025]](/images/aHR0cHM6Ly90czQubW0uYmluZy5uZXQvdGg/aWQ9T0lQLkJia0ZXZFd1eldOQ3JNenU1Q3l5eEFIYUU4JnBpZD0xNS4x.webp)

Implement a Strict Budget and Spending Freeze

Regardless of which repayment strategy you choose, a rigorous budget is paramount. Identify areas where you can cut expenses drastically. Consider a temporary “spending freeze” where you only pay for absolute necessities. Every extra dollar saved should be directed towards your high-interest credit card debt. This requires discipline but is incredibly effective in accelerating repayment.

Negotiate with Creditors

It might sound daunting, but don’t hesitate to call your credit card companies. Explain your situation and ask if they can lower your interest rate or offer a payment plan. You might be surprised by their willingness to work with you, especially if you have a good payment history or are at risk of defaulting. Even a small reduction in your APR can save you hundreds over time.

Maintain Momentum and Stay Accountable

Paying off debt is a marathon, not a sprint. Celebrate small victories, track your progress diligently, and find an accountability partner if needed. Automate your payments to avoid missed deadlines and further fees. The quicker you eliminate high-interest debt, the sooner you can redirect those funds towards savings, investments, and achieving your broader financial goals.

Conclusion

Tackling high-interest credit card debt requires a combination of strategic planning and unwavering commitment. Whether you opt for the debt avalanche, a balance transfer, a consolidation loan, or a strict budget, the key is to choose a method and stick with it. By actively engaging with your debt and making smart financial choices, you can quickly pay off those balances and pave the way for a more secure financial future.