Understanding the Burden of High-Interest Debt

High-interest credit card debt can feel like a financial quicksand, trapping you in a cycle where minimum payments barely cover the interest, let alone reduce the principal. The urgency to eliminate this debt is not just about freeing up cash; it’s about reclaiming your financial future and stopping the erosion of your wealth. While there’s no single magic bullet, a combination of strategic approaches can significantly accelerate your debt-free journey.

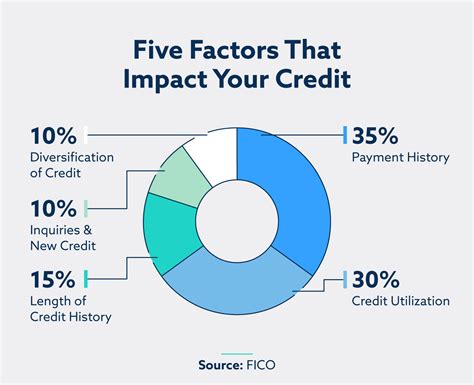

First Steps: Catalog Your Debt and Interest Rates

Before you can attack your debt, you need to understand its landscape. Gather all your credit card statements and list every card, its current balance, and most importantly, its Annual Percentage Rate (APR). This clear picture will be crucial for deciding which debt to tackle first and how. High APRs are your primary enemy, as they make your debt grow fastest.

The Debt Avalanche vs. Debt Snowball: Your Primary Attack Strategy

Two popular methods stand out for aggressively paying down debt, each with its own psychological and mathematical benefits:

The Debt Avalanche Method

This method prioritizes paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the highest-interest card is paid off, you take the money you were paying on it and apply it to the next highest-interest debt. Mathematically, this is the quickest way to save money on interest and become debt-free.

The Debt Snowball Method

The debt snowball focuses on paying off the smallest balance first, while making minimum payments on the rest. Once the smallest debt is eliminated, you roll the payment amount into the next smallest debt. This method provides psychological wins early on, which can be incredibly motivating for those who need a boost to stay on track.

Strategic Tactics: Balance Transfers and Consolidation Loans

Balance Transfers

If you have good credit, you might qualify for a balance transfer credit card with a 0% introductory APR. This allows you to move high-interest balances from one card to another and pay no interest for a promotional period (typically 12-24 months). This can be a game-changer, giving you a window to pay down a significant portion of your principal without interest charges. Be mindful of balance transfer fees (usually 3-5% of the transferred amount) and ensure you can pay off the balance before the promotional period ends, as rates often skyrocket afterward.

Debt Consolidation Loans

A personal loan for debt consolidation can combine multiple credit card debts into one single payment, often with a lower overall interest rate. This simplifies your payments and can reduce the total interest paid over time. It’s crucial to ensure the new loan’s interest rate is significantly lower than your current credit card rates and that the repayment term is manageable. Avoid using consolidated funds to incur new debt.

Aggressive Payment: Increase Income and Cut Expenses

The core of quick debt elimination lies in maximizing the amount you can throw at your principal each month. This means aggressively cutting unnecessary expenses from your budget – temporarily sacrificing luxuries for long-term financial freedom. Simultaneously, look for ways to increase your income: pick up a side hustle, sell unused items, or ask for a raise. Every extra dollar should go directly towards your highest-interest debt.

When to Seek Professional Help: Credit Counseling

If your debt feels overwhelming, a non-profit credit counseling agency can provide valuable guidance. They can help you create a budget, negotiate with creditors for lower interest rates or waiving fees, and even set up a Debt Management Plan (DMP). A DMP consolidates your payments to the agency, which then distributes them to your creditors, often at reduced interest rates. While this can impact your credit score, it’s often a necessary step to avoid bankruptcy and regain control.

Maintain Discipline and Stay Motivated

Eliminating high-interest debt quickly requires discipline and unwavering commitment. Track your progress regularly; seeing your balances shrink can be a powerful motivator. Celebrate small victories along the way, but stay focused on the ultimate goal: becoming completely debt-free. Educate yourself on responsible credit usage to prevent falling back into debt once you’ve achieved your goal.

Conclusion

The quickest way to eliminate high-interest credit card debt involves a multi-pronged approach: prioritizing high-interest accounts (avalanche method), leveraging tools like balance transfers and consolidation loans, making aggressive extra payments by increasing income and cutting expenses, and not shying away from professional help when needed. With a clear plan and consistent effort, you can break free from the burden of high-interest debt and build a stronger financial foundation.