For many men, the journey to financial freedom is marked by two primary milestones: eliminating debt and building lasting wealth. While the principles of sound financial management are universal, the optimal strategy often benefits from a focused, disciplined approach that acknowledges common financial behaviors and goals. This guide outlines a comprehensive budget strategy designed to empower men to take control of their finances, systematically reduce liabilities, and accelerate their path to prosperity.

1. The Foundation: Understand Your Financial Landscape

Before any significant progress can be made, you must have a crystal-clear picture of your current financial situation. This isn’t just about knowing your bank balance; it’s about understanding every dollar that comes in and goes out, and what you owe.

- Track Every Expense: For a month, meticulously record every single expense. Use apps, spreadsheets, or even a notebook. This uncovers hidden spending habits and reveals where your money truly goes.

- Calculate Your Net Worth: List all your assets (savings, investments, property value, car value) and all your liabilities (credit card debt, loans, mortgage). Subtract liabilities from assets to get your net worth. Regularly tracking this number provides a tangible measure of progress.

- Define Clear Goals: What does financial freedom look like for you? Is it being debt-free by 40? Saving for a down payment? Retiring early? Specific, measurable, achievable, relevant, and time-bound (SMART) goals provide direction and motivation.

2. Aggressive Debt Elimination: The Debt Sledgehammer

Debt is an anchor holding back your wealth-building efforts. The most optimal strategy involves attacking it with intensity.

- Prioritize High-Interest Debt: Credit card debt, personal loans, and other high-interest debts should be your primary targets. The interest payments on these accounts erode your ability to save and invest.

- Choose a Payoff Method:

- Debt Avalanche: Pay off debts with the highest interest rates first, while making minimum payments on others. This saves you the most money on interest.

- Debt Snowball: Pay off the smallest debt first to gain psychological momentum, then roll that payment into the next smallest debt. This builds confidence.

- Increase Income or Reduce Spending: To accelerate debt repayment, find ways to create extra cash flow. This could mean taking on a side hustle, negotiating a raise, or drastically cutting discretionary spending for a period.

3. Building a Robust Budget: The Wealth Architect’s Blueprint

Once you understand your money and are actively tackling debt, it’s time to create a budget that supports your goals.

- The 50/30/20 Rule: A popular guideline where 50% of your after-tax income goes to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Adjust these percentages based on your debt load and goals.

- Zero-Based Budgeting: Give every dollar a job. At the beginning of the month, allocate your entire income to expenses, savings, and debt. This ensures no money is wasted and you’re intentional with your funds.

- Automate Savings and Debt Payments: Set up automatic transfers to your savings, investment accounts, and extra debt payments immediately after you get paid. This removes the temptation to spend the money.

- Live Below Your Means: This fundamental principle is crucial. Regardless of how much you earn, always strive to spend less than you make. The gap between your income and expenses is your potential for wealth.

4. Accelerating Wealth Growth: Strategic Investing

With debt under control and a solid budget in place, your focus shifts to making your money work for you.

- Build an Emergency Fund: Before investing, ensure you have 3-6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. This protects you from unexpected events without derailing your financial progress.

- Max Out Retirement Accounts: Contribute as much as possible to tax-advantaged accounts like a 401(k) (especially if there’s an employer match – that’s free money!), Roth IRA, or Traditional IRA. These accounts offer significant tax benefits and long-term growth potential.

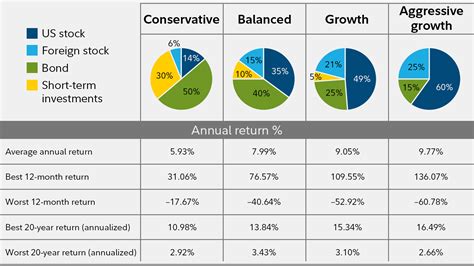

- Diversify Your Investments: Don’t put all your eggs in one basket. Invest in a mix of assets, such as low-cost index funds, ETFs, and potentially individual stocks or real estate, aligned with your risk tolerance and time horizon.

- Avoid Lifestyle Creep: As your income increases, resist the urge to immediately upgrade your lifestyle proportionally. Instead, use a significant portion of your raises or bonuses to increase savings, investments, or accelerate debt repayment.

5. The Long Game: Consistency, Review, and Adaptation

Financial success isn’t a one-time event; it’s a continuous process that requires vigilance and flexibility.

- Regular Review: Schedule monthly or quarterly financial reviews. Check your budget, track your net worth, assess your investment performance, and make adjustments as needed. Life changes, and so should your financial plan.

- Educate Yourself Continuously: The financial landscape evolves. Stay informed about investment strategies, tax law changes, and economic trends. Read books, listen to podcasts, and follow reputable financial advisors.

- Seek Professional Advice: For complex financial situations or when making significant investment decisions, consider consulting a fee-only financial advisor. They can provide personalized guidance and help you optimize your strategy.

- Stay Disciplined and Patient: Building wealth takes time and consistent effort. There will be market fluctuations and unexpected expenses. Stick to your plan, remain disciplined, and trust the process.

Implementing an optimal budget strategy for men involves a combination of aggressive debt elimination, disciplined budgeting, strategic investing, and unwavering consistency. By understanding your finances, making intentional choices, and committing to the long game, you can not only eliminate debt but also build substantial wealth that provides security and opens up new opportunities for the future.