Unlock Financial Freedom: The “Pay Yourself First” Budget Hack

In the quest for financial security and wealth accumulation, many men seek that one game-changing strategy to accelerate their savings and investment goals. While countless budgeting methods exist, one stands out for its simplicity, effectiveness, and ability to overcome common pitfalls: the “Pay Yourself First” principle through automation.

What Exactly is “Pay Yourself First”?

At its core, “Pay Yourself First” means treating your savings and investments as your most important financial obligation, just like rent or a mortgage payment. Instead of saving what’s left after all other expenses, you allocate a predetermined portion of your income directly to your savings and investment accounts before you spend money on anything else. This strategy fundamentally shifts your financial mindset from reactive saving to proactive wealth building.

Why This Hack Resonates with Men

For many men, the appeal of this hack lies in its straightforward, actionable nature. It bypasses the tedious micro-management often associated with traditional budgeting, which can feel restrictive or overwhelming. Instead, it offers a powerful, set-it-and-forget-it solution that delivers tangible results. It taps into a desire for efficiency and impact without constant vigilance. By automating the process, the emotional component of “should I save this money?” is removed, making it easier to stick to long-term goals.

Implementing the “Pay Yourself First” Strategy

The beauty of this hack is its ease of implementation. Here’s a simple step-by-step guide:

1. Determine Your Target Amount or Percentage

Start by deciding how much you can realistically save and invest from each paycheck. A common guideline is to aim for 15-20% of your gross income, but even starting with 5-10% is powerful. Be honest about your current financial situation, but also challenge yourself to stretch a little.

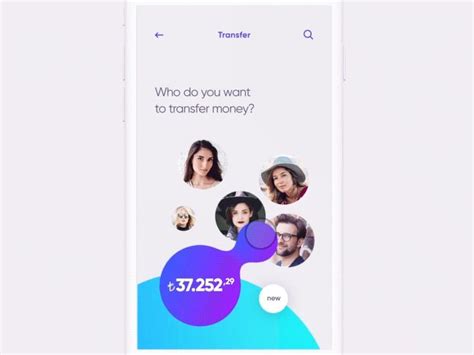

2. Set Up Automatic Transfers

This is the crucial step. Set up recurring automatic transfers from your checking account to your savings accounts (emergency fund, short-term goals) and, most importantly, your investment accounts (retirement funds like 401(k)s or IRAs, and taxable brokerage accounts). Schedule these transfers to coincide with your paydays so the money moves before you even have a chance to miss it.

- Retirement Accounts: If your employer offers a 401(k) or similar plan, maximize your contributions, especially if there’s a company match – that’s free money!

- Emergency Fund: Build at least 3-6 months’ worth of living expenses in an easily accessible, high-yield savings account.

- Brokerage Accounts: Once your emergency fund is solid and retirement is on track, direct funds to a taxable brokerage account for long-term growth.

3. Review and Adjust Regularly

Life changes, and so should your financial strategy. Periodically review your budget and automatic transfers. As your income increases, consider increasing your savings and investment contributions. If you achieve a financial milestone, reassess your next goal. This isn’t a static hack; it’s a dynamic system designed to grow with you.

Beyond Automation: Complementary Strategies

While “Pay Yourself First” is incredibly potent on its own, it can be amplified by complementary strategies. Consider tracking your spending for a month to identify areas where you might be overspending. Look for opportunities to reduce unnecessary subscriptions, negotiate better rates on services, or find more cost-effective hobbies. The goal isn’t deprivation, but conscious spending that aligns with your values, freeing up even more capital to direct towards your automated savings and investments.

Conclusion: The Path to Accelerated Wealth

For men looking for the most effective budget hack to save more and invest faster, the “Pay Yourself First” principle, powered by automation, is unparalleled. It removes willpower from the equation, ensures consistency, and systematically builds your wealth over time. By prioritizing your future self and setting up the financial architecture to support it, you’re not just saving money – you’re building a foundation for lasting financial freedom and accelerating your journey to financial independence. Start today, and watch your financial future transform.