Navigating the Investment World as a Busy Beginner

Many busy men recognize the importance of investing for their future but often feel overwhelmed by the sheer volume of information and the perceived time commitment. The good news is that building wealth doesn’t require constant market monitoring or complex trading strategies. The most effective beginner investment strategy for those with packed schedules focuses on simplicity, automation, and long-term growth.

The key is to set up a robust system that works for you, allowing your money to grow largely on autopilot. This approach minimizes the need for daily decisions, freeing up your valuable time while still putting you on a solid path to financial success.

The Cornerstone: Simplicity and Automation

For the busy man, complexity is the enemy of consistency. A simple strategy is one you can understand, implement, and stick with over the long haul. Automation ensures that your investments happen regularly, removing the psychological barrier of having to make an active decision each time you invest.

Forget trying to pick individual stocks or time the market. These activities are time-consuming, emotionally draining, and often lead to sub-optimal results, even for seasoned professionals. Instead, focus on strategies that offer broad market exposure and are designed to perform well over decades, not days.

Strategy 1: Embrace Low-Cost Index Funds and ETFs

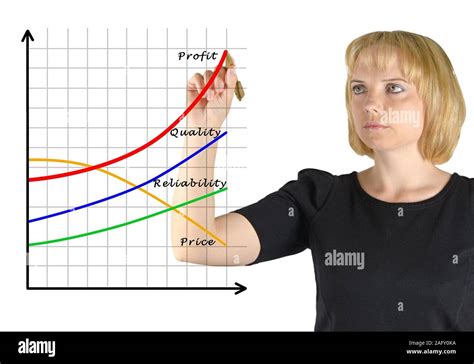

One of the most powerful and time-efficient investment vehicles available today are index funds and Exchange Traded Funds (ETFs). These funds hold a basket of securities, designed to mimic the performance of a specific market index, such as the S&P 500. By investing in an index fund, you instantly gain diversification across hundreds or even thousands of companies, significantly reducing your risk compared to investing in single stocks.

The benefits for a busy individual are clear: extremely low management fees, broad diversification, and a passive approach that requires no research into individual companies. You’re betting on the overall growth of the market, not on the success or failure of a single enterprise. This strategy is often recommended by investment legends like Warren Buffett.

Strategy 2: Leverage Robo-Advisors for Automated Management

If even choosing between different index funds feels like too much, robo-advisors are your ideal solution. These online platforms use algorithms to build and manage diversified portfolios based on your financial goals, risk tolerance, and time horizon. After an initial setup questionnaire, the robo-advisor handles everything:

- Portfolio allocation (e.g., a mix of stock and bond ETFs)

- Automatic rebalancing (adjusting your portfolio back to its target allocation)

- Tax-loss harvesting (for taxable accounts, minimizing your tax burden)

Popular robo-advisors like Betterment and Wealthfront offer professional-grade portfolio management at a fraction of the cost of a traditional human financial advisor. You simply link your bank account, set up recurring deposits, and let the algorithm do the heavy lifting. It’s the ultimate set-it-and-forget-it approach.

Strategy 3: Implement Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a disciplined approach where you invest a fixed amount of money at regular intervals (e.g., $500 every month), regardless of market fluctuations. This strategy removes the need to worry about market timing, which is notoriously difficult even for experts. When prices are high, your fixed amount buys fewer shares; when prices are low, it buys more shares. Over time, this tends to average out your purchase price and reduce your overall risk.

Coupled with automated investing via index funds or robo-advisors, DCA becomes a powerful tool for busy men. You schedule the deposits, and your investments automatically purchase shares without any further intervention. Consistency, not perfect timing, is what builds wealth over the long term.

Don’t Overlook Employer-Sponsored Retirement Plans

For many, the first and most effective step in investing should be maximizing employer-sponsored plans like a 401(k) or 403(b). These plans often come with employer matching contributions, which is essentially free money. If your company offers a 50% match on contributions up to 6% of your salary, you’re getting an instant 50% return on that portion of your investment – a deal you won’t find anywhere else.

Contributions are typically deducted directly from your paycheck, making it an ideal automated strategy. These plans also offer significant tax advantages, either by reducing your taxable income now (traditional 401(k)) or providing tax-free withdrawals in retirement (Roth 401(k)).

Key Takeaways for Busy Investors

To summarize the most effective beginner investment strategy for busy men:

- Start Early and Stay Consistent: Time in the market is more important than timing the market.

- Automate Everything: Set up automatic transfers to your investment accounts.

- Embrace Diversification: Use index funds, ETFs, or robo-advisors for broad market exposure.

- Prioritize Employer Matches: Don’t leave free money on the table in your 401(k).

- Keep Costs Low: High fees eat into your returns over time.

By focusing on these principles, busy men can confidently enter the world of investing, build a robust financial future, and dedicate their precious time to other important aspects of their lives.