Tackling the Beast: Why High-Interest Debt Demands Action

High-interest credit card debt can feel like a relentless weight, constantly growing and chipping away at your financial stability. The high annual percentage rates (APRs) mean that a significant portion of your monthly payments goes towards interest rather than the principal, making it incredibly difficult to make progress. This debt can impede your ability to save, invest, and achieve other financial goals. Fortunately, with the right strategies and discipline, you can accelerate your debt payoff and reclaim your financial freedom.

Understanding the insidious nature of compounding interest is the first step. The longer you carry a high balance, the more interest accrues, making your original debt balloon over time. Prioritizing the elimination of this debt is crucial for your long-term financial health.

Strategy 1: The Debt Avalanche Method

For those focused on minimizing the total amount of interest paid, the Debt Avalanche method is mathematically the most efficient approach. Here’s how it works:

- List all your credit card debts from highest interest rate to lowest interest rate.

- Make minimum payments on all cards except the one with the highest interest rate.

- Direct all extra money you can find towards the card with the highest interest rate.

- Once that card is paid off, take the money you were paying on it (minimum payment + extra funds) and apply it to the card with the next highest interest rate.

- Continue this process until all your debts are eliminated.

While this method may take longer to see the first debt paid off, it saves you the most money in the long run by tackling the most expensive debt first.

Strategy 2: The Debt Snowball Method

If you’re someone who thrives on quick wins and psychological momentum, the Debt Snowball method might be a better fit. Its effectiveness lies in behavioral psychology:

- List all your credit card debts from smallest balance to largest balance.

- Make minimum payments on all cards except the one with the smallest balance.

- Direct all extra money you can find towards the card with the smallest balance.

- Once that card is paid off, take the money you were paying on it (minimum payment + extra funds) and apply it to the card with the next smallest balance.

- Continue this process until all your debts are eliminated.

The debt snowball provides early successes, which can motivate you to keep going, even if it means paying slightly more in interest overall compared to the avalanche method.

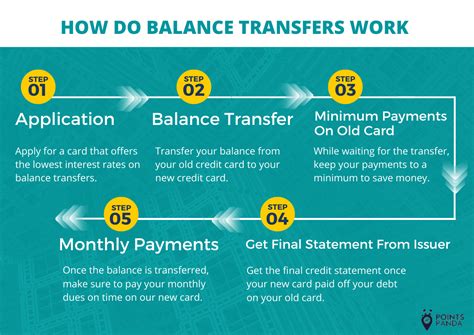

Leveraging Balance Transfers and Consolidation Loans

Balance Transfers: A Temporary Reprieve

A balance transfer allows you to move high-interest debt from one credit card to another, often with a 0% introductory APR for a fixed period (e.g., 12-18 months). This can be a powerful tool if used strategically:

- Pros: You pay no interest on the transferred balance during the promotional period, allowing 100% of your payments to go towards the principal.

- Cons: There’s usually a balance transfer fee (typically 3-5% of the transferred amount). If you don’t pay off the balance before the promotional period ends, the remaining balance will be subject to a much higher standard APR. Avoid racking up new debt on the old cards.

This strategy is best for those disciplined enough to pay off the transferred balance entirely within the introductory period.

Debt Consolidation Loans: Streamlining Your Payments

A personal loan can be used to consolidate multiple high-interest credit card debts into a single, lower-interest loan with a fixed monthly payment. This offers predictability and potentially significant interest savings.

- Pros: A single, often lower, monthly payment, and a set payoff date. If your credit score has improved since you first took on credit card debt, you might qualify for a much lower interest rate.

- Cons: You’ll need a decent credit score to qualify for a favorable rate. If you continue to use your credit cards after consolidation, you risk accumulating more debt.

Boosting Your Payoff Power

No matter which method you choose, you can accelerate your progress by increasing the amount you put towards your debt each month.

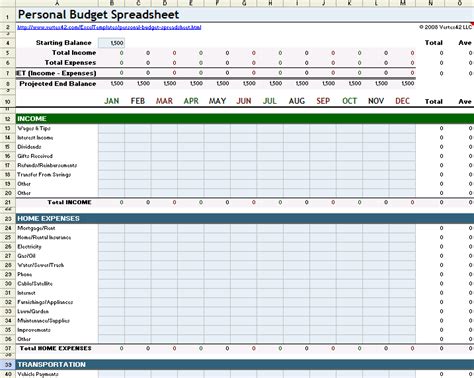

Aggressive Budgeting and Expense Cutting

Create a detailed budget to understand exactly where your money is going. Look for areas to cut back, even temporarily, such as:

- Reducing dining out or entertainment expenses.

- Canceling unused subscriptions.

- Finding cheaper alternatives for groceries or transportation.

- Even small cuts can add up to significant extra payments for your debt.

Increasing Your Income

Consider ways to bring in more money, even short-term:

- Taking on a side hustle (e.g., freelancing, ride-sharing, dog walking).

- Selling unused items around your home.

- Asking for a raise or taking on extra shifts at work.

- Using bonuses or tax refunds specifically for debt payoff.

When to Seek Professional Help

If your debt feels overwhelming, and you’re struggling to make even minimum payments, it might be time to consider professional help. Non-profit credit counseling agencies can offer personalized advice, help you create a debt management plan, and even negotiate with creditors on your behalf. They can be a valuable resource when you feel stuck.

Conclusion: Take Control and Build a Brighter Financial Future

Paying off high-interest credit card debt isn’t just about financial numbers; it’s about regaining control over your life and reducing stress. Whether you choose the mathematical efficiency of the debt avalanche, the psychological boost of the debt snowball, or leverage tools like balance transfers and consolidation loans, consistency and discipline are key. By committing to a plan and maximizing your payments, you can swiftly eliminate your high-interest debt and pave the way for a more secure and prosperous financial future.