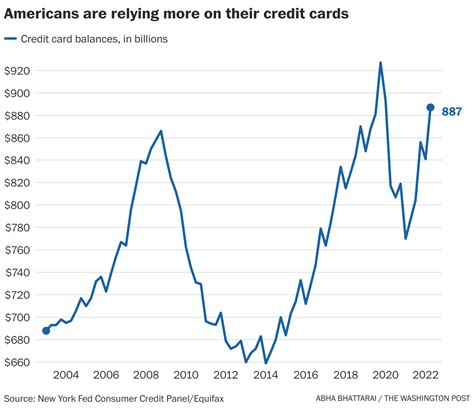

Understanding the High-Interest Debt Burden

High-interest debt, such as credit card balances, personal loans, or certain lines of credit, can feel like a financial anchor, dragging down your progress towards wealth accumulation. The exorbitant interest rates mean a significant portion of your monthly payments goes directly to interest, rather than reducing the principal. This cycle makes it incredibly challenging to build savings, invest, or even feel financially secure. But there’s a powerful, proven strategy that not only crushes this debt quickly but also accelerates your journey to a higher net worth.

The Debt Avalanche: Your Fastest Path to Freedom

While the debt snowball method (paying off smallest balances first) offers a psychological boost, the fastest and most mathematically efficient strategy to eliminate high-interest debt is the Debt Avalanche. This method prioritizes your debts by interest rate, from highest to lowest. You make minimum payments on all debts except the one with the highest interest rate. On that specific debt, you throw every extra dollar you can find.

Once the highest-interest debt is completely paid off, you take the money you were paying on it (minimum payment + extra payments) and apply it to the debt with the next highest interest rate. This ‘snowball’ of payments (though it’s called an avalanche for the interest focus) rapidly accelerates the repayment process, saving you significant money in interest over time and shortening your debt-free timeline.

Why the Avalanche Method Wins for Speed and Savings

The power of the Debt Avalanche lies in its mathematical precision. By tackling the most expensive debts first, you reduce the overall interest you pay, which directly translates to more of your money going towards principal reduction. This means your total debt decreases faster, and you reach the finish line sooner. Over thousands of dollars in debt, this difference can be substantial, shaving months or even years off your repayment schedule and freeing up capital for other financial goals.

Beyond Debt: Simultaneously Boosting Your Net Worth

Crushing high-interest debt is a massive step, but true financial freedom and a boosted net worth require more than just debt elimination. Here’s how to integrate wealth-building alongside your debt repayment:

- Build a Mini-Emergency Fund: Before going all-in on debt, aim for a small emergency fund ($1,000-$2,000). This prevents new debt when unexpected expenses arise.

- Optimize Retirement Contributions (Strategic): If your employer offers a matching 401(k) contribution, contribute at least enough to get the full match. This is essentially free money and an immediate, guaranteed return that often outweighs the interest on some debts (though high-interest credit card debt usually wins).

- Identify and Cut Unnecessary Expenses: Every dollar freed from subscriptions, eating out, or impulse purchases can be redirected to debt repayment or savings.

- Increase Income: Look for opportunities to earn more – a side hustle, overtime, negotiating a raise, or selling unused items. More income directly fuels your avalanche.

Practical Steps to Implement the Strategy

- List All Debts: Gather all your high-interest debts (credit cards, personal loans, etc.) and list them from highest interest rate to lowest. Include the balance, minimum payment, and interest rate for each.

- Create a Budget: Understand exactly where your money is going. Find areas to cut back and free up extra funds for debt repayment.

- Commit Extra Funds: Direct every available extra dollar to the debt at the top of your prioritized list (the one with the highest interest rate).

- Automate Payments: Set up minimum payments for all debts and automate the larger payment to your top-priority debt. This ensures consistency.

- Stay Focused and Celebrate Milestones: Debt repayment can be a long journey. Celebrate each debt paid off to maintain motivation.

The Mindset Shift: From Borrower to Investor

Successfully crushing high-interest debt isn’t just about numbers; it’s about a fundamental shift in your financial mindset. It means moving from a reactive position of owing to a proactive stance of building wealth. Once your high-interest debts are gone, the money you were allocating to payments can be redirected towards aggressive investing, building a robust emergency fund, or saving for major life goals. This transition is where your net worth truly begins to skyrocket, transforming you from someone burdened by debt to a savvy investor with growing assets.

Conclusion

The Debt Avalanche strategy, combined with smart financial habits, is undeniably the fastest and most cost-effective way to eliminate high-interest debt and significantly boost your net worth. It requires discipline and consistency, but the financial freedom and peace of mind it delivers are invaluable. Start today by listing your debts, making a plan, and committing to your financial liberation. Your future self will thank you.