Conquering High-Interest Credit Card Debt: Your Path to Financial Freedom

High-interest credit card debt can feel like a heavy burden, constantly growing and making it difficult to make financial progress. The key to overcoming this challenge isn’t just about paying more; it’s about paying smarter. By understanding your options and committing to a structured plan, you can significantly reduce your debt faster and save a substantial amount on interest.

Understanding the Impact of High Interest

Before diving into solutions, it’s crucial to grasp why high-interest debt is so detrimental. Credit card interest rates, especially for those with less-than-perfect credit, can range from 18% to over 25% APR. At these rates, a significant portion of your minimum payment goes towards interest, leaving very little to reduce the principal balance. This creates a cycle where debt grows, even with regular payments, making it seem insurmountable.

Top Strategies for Eliminating High-Interest Debt

1. The Balance Transfer Strategy

A balance transfer involves moving debt from one or more high-interest credit cards to a new card, usually one offering a 0% introductory APR for a fixed period (e.g., 12-21 months). This strategy gives you a crucial window to pay down the principal without accruing new interest.

- Pros: Eliminates interest for the promotional period, allowing all payments to go towards principal; simplifies payments to a single card.

- Cons: Requires good credit to qualify; typically involves a balance transfer fee (3-5% of the transferred amount); interest rates can jump significantly after the promotional period if the balance isn’t paid off.

Best for: Individuals with good credit who are disciplined enough to pay off the transferred balance before the introductory period ends.

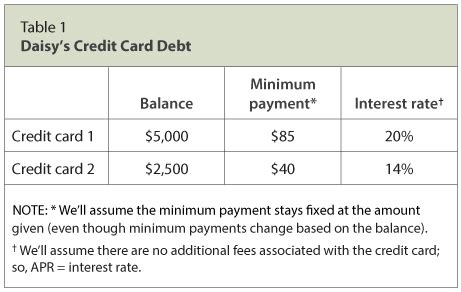

2. Debt Snowball vs. Debt Avalanche Methods

These are two popular psychological and mathematical approaches to debt repayment:

- Debt Avalanche: Focuses on paying off the credit card with the highest interest rate first, while making minimum payments on all others. Once the highest-interest card is paid off, you apply that payment amount to the card with the next highest interest rate. This method saves you the most money on interest over time.

- Debt Snowball: Focuses on paying off the credit card with the smallest balance first, while making minimum payments on all others. Once the smallest debt is paid, you ‘snowball’ that payment amount into the next smallest debt. This method provides psychological wins early on, keeping you motivated.

Best for: Avalanche for maximizing savings, Snowball for motivation and quick wins.

3. Debt Consolidation Loan

A personal loan can be used to consolidate multiple high-interest credit card debts into a single loan with a fixed interest rate and a predictable monthly payment schedule. Often, the interest rate on a personal loan is lower than credit card APRs.

- Pros: Lower, fixed interest rate; single monthly payment; clear payoff date.

- Cons: Requires a good credit score to qualify for the best rates; doesn’t address spending habits, so new debt could accumulate if not careful.

Best for: Those with good credit seeking a single, predictable payment and a lower overall interest rate.

4. Credit Counseling and Debt Management Plans (DMPs)

If you’re overwhelmed and struggling to make minimum payments, a non-profit credit counseling agency can provide guidance. They might help you enroll in a Debt Management Plan (DMP). In a DMP, the agency negotiates with your creditors to potentially lower interest rates and waive fees, consolidating your payments into one monthly sum paid to the agency, which then distributes funds to your creditors.

- Pros: Lower interest rates; consolidated payments; structured plan with professional guidance; avoids bankruptcy.

- Cons: Requires closing enrolled credit card accounts; can have a minor negative impact on credit initially; fees may apply.

Best for: Individuals with significant debt who are struggling to manage it on their own and need structured support.

Tactical Tips to Accelerate Your Payoff

- Create a Detailed Budget: Understand exactly where your money is going and identify areas to cut back. Every extra dollar freed up can go towards your debt.

- Automate Payments: Set up automatic payments to ensure you never miss a due date, which can incur late fees and further interest.

- Make More Than the Minimum Payment: Even an extra $20-$50 per month can significantly reduce your payoff time and total interest paid.

- Negotiate with Creditors: Sometimes, credit card companies are willing to lower your interest rate or set up a payment plan if you explain your financial hardship. It never hurts to ask.

- Avoid New Debt: While paying off high-interest debt, resist the urge to use credit cards for new purchases. Focus solely on repayment.

The Importance of Persistence

Paying off high-interest credit card debt is a marathon, not a sprint. There will be moments of frustration, but staying consistent with your chosen strategy and adhering to your budget will yield results. Celebrate small victories, track your progress, and remember your ultimate goal: financial freedom from overwhelming debt.

By choosing the right strategy for your situation and committing to it, you can take control of your finances, reduce your debt, and build a more secure financial future. Start today by analyzing your current debt, assessing your credit, and selecting the path that best suits your goals and circumstances.