Understanding the Root of Financial Conflicts

Money is often cited as a leading cause of stress and conflict in relationships. Disagreements over finances aren’t just about numbers; they often stem from deeply ingrained values, different upbringings, varying risk tolerances, or individual emotional connections to money. One partner might be a saver, while the other is a spender. One might prioritize long-term investments, while the other values immediate gratification or experiences. Recognizing that these differences are natural, rather than viewing them as personal attacks, is the first crucial step toward resolution.

Before you can effectively tackle specific financial disputes, it’s essential to understand each other’s ‘money story.’ What did money mean in their childhood home? Was it a source of security or stress? Did their parents save diligently or spend freely? These foundational experiences shape our financial habits and beliefs, often unconsciously. Taking the time to explore these narratives can provide invaluable insight into why your partner approaches money the way they do.

Establish Open and Regular Communication

The cornerstone of resolving any relationship issue, especially financial ones, is effective communication. Avoid discussing money only when a problem arises or during heated arguments. Instead, schedule regular, dedicated times to talk about your finances. This could be a weekly check-in or a monthly financial ‘date’ where you review budgets, discuss goals, and address any concerns without the pressure of an immediate crisis. A calm, structured environment promotes productive dialogue over emotional reactions.

When you do discuss finances, practice active listening. Give your partner your full attention, let them finish their thoughts without interruption, and try to understand their perspective. Use “I” statements to express your feelings and needs (“I feel worried when we spend beyond our budget”) rather than accusatory “you” statements (“You always overspend”). This approach reduces defensiveness and encourages a more collaborative problem-solving mindset.

Create a Shared Financial Vision and Plan

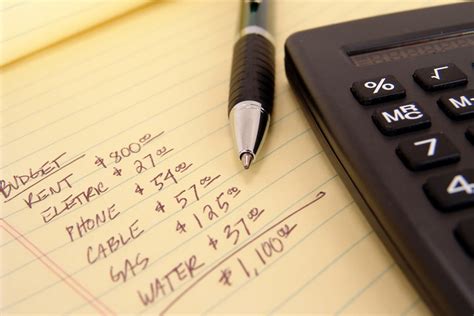

Once you understand each other’s perspectives, work together to create a shared financial vision. What are your collective short-term and long-term goals? Do you want to save for a down payment, a vacation, retirement, or pay off debt? Having common goals provides a framework for decision-making and helps align your individual financial behaviors. Document these goals and regularly revisit them to ensure you’re both still on the same page.

Translate your shared vision into a practical budget. A budget isn’t about restriction; it’s a roadmap for your money, ensuring it goes where you both want it to. Decide together how income will be allocated to necessities, savings, debt repayment, and discretionary spending. It’s crucial to find a balance that respects both partners’ needs and allows for some personal spending autonomy to prevent feelings of deprivation.

Practice Compromise and Empathy

Financial disagreements often require compromise. You won’t always get exactly what you want, and neither will your partner. The goal is to find solutions that work for both of you, even if it means meeting in the middle. This requires empathy – putting yourself in your partner’s shoes and trying to understand why a particular financial choice is important to them. Perhaps they value experiences over material possessions, or feel more secure with a larger emergency fund.

Be willing to negotiate. If one partner wants a significant purchase that the other is hesitant about, can you adjust the timeline, find a less expensive alternative, or offset the cost by cutting back elsewhere? Frame disagreements not as battles to be won, but as problems to be solved together, as a team.

When to Seek Professional Guidance

Sometimes, despite your best efforts, financial disagreements can feel insurmountable. This is a sign it might be time to seek external help. A certified financial planner can act as a neutral third party, offering objective advice, helping you develop a comprehensive financial plan, and mediating discussions. They can help you identify financial blind spots, set realistic goals, and create strategies tailored to your unique situation.

If financial conflicts are deeply rooted in emotional issues, communication breakdowns, or power dynamics, a couple’s therapist specializing in relationship dynamics can be incredibly beneficial. They can help you explore the underlying emotional factors influencing your money habits and teach you healthier communication patterns to navigate these sensitive discussions more effectively.

Building Financial Harmony Together

Handling financial disagreements with your partner is an ongoing process, not a one-time fix. It requires patience, open-mindedness, and a commitment from both individuals to work as a team. By fostering open communication, understanding each other’s money perspectives, creating shared goals, and embracing compromise, you can transform potential conflict into an opportunity for deeper connection and a stronger, more resilient partnership. Financial harmony isn’t about never disagreeing; it’s about having the tools and trust to navigate those disagreements constructively.