Navigating High-Interest Debt and Paving the Way for Wealth

For many men, the twin goals of eliminating high-interest debt and building substantial wealth can feel like an insurmountable challenge. The burden of credit card balances, personal loans, or other high-APR obligations often stifles progress, making wealth accumulation seem like a distant dream. However, with a clear strategy, discipline, and a proactive mindset, it’s entirely possible to overcome debt and lay a robust foundation for financial prosperity.

Understanding the High-Interest Debt Burden

High-interest debt is a significant impediment to financial freedom. Unlike mortgage or student loan debt, which often comes with lower, tax-deductible interest rates, high-interest debt like credit card balances or payday loans can quickly spiral out of control, consuming a large portion of your income in interest payments alone. This not only drains your present resources but also hinders your ability to save and invest for the future. Recognizing the corrosive power of this debt is the first step toward conquering it.

Many men prioritize providing for their families or achieving specific life goals, and high-interest debt can feel like a direct threat to these aspirations. The psychological toll, from stress to feelings of being trapped, can be just as detrimental as the financial impact. A strategic approach is crucial to break free from this cycle.

Phase 1: Aggressive Debt Elimination

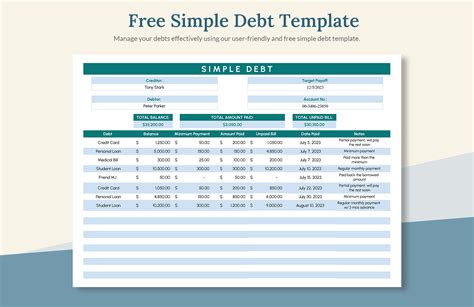

1. Create a Detailed Budget and Cut Expenses

The foundation of any debt elimination strategy is a precise understanding of your income and outflow. Create a realistic budget, tracking every dollar you earn and spend. Identify non-essential expenses that can be cut or reduced, such as subscriptions, dining out, or entertainment. Every dollar saved here can be redirected towards debt repayment, accelerating your progress.

2. Choose a Debt Repayment Method: Avalanche or Snowball

Two popular methods exist for tackling multiple debts:

- Debt Avalanche: Focus on paying off debts with the highest interest rates first, while making minimum payments on others. This method saves you the most money in interest over time.

- Debt Snowball: Focus on paying off the smallest debt first, regardless of interest rate, while making minimum payments on others. The psychological wins of clearing small debts can provide powerful motivation to continue.

Choose the method that best aligns with your personality and financial situation. Consistency is key, whichever you choose.

3. Consider Debt Consolidation or Refinancing

If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can be a smart move. Options include a personal loan, a balance transfer credit card (with a 0% introductory APR), or a home equity line of credit (HELOC) if you own a home. Be cautious with consolidation, ensuring you don’t incur new debt once the old ones are paid off.

Phase 2: Building a Solid Financial Foundation

Once high-interest debt is under control, the focus shifts to creating a stable financial base. This phase is crucial before aggressive wealth building begins.

1. Establish a Robust Emergency Fund

Before investing heavily, build an emergency fund covering 3-6 months of essential living expenses, held in an easily accessible, high-yield savings account. This fund acts as a financial safety net, protecting you from unexpected events like job loss, medical emergencies, or car repairs, preventing you from falling back into debt.

2. Automate Savings and Investments

Make saving and investing effortless by setting up automatic transfers from your checking account to your savings and investment accounts on payday. This “pay yourself first” approach ensures that your financial goals are prioritized and reduces the temptation to spend the money elsewhere.

Phase 3: Strategic Wealth Accumulation

With debt managed and an emergency fund in place, it’s time to accelerate your wealth-building efforts.

1. Maximize Retirement Account Contributions

Prioritize contributing to tax-advantaged retirement accounts like a 401(k) or IRA. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s free money. These accounts offer significant tax benefits and compounding growth over decades.

2. Diversify Your Investments

Beyond retirement accounts, consider investing in a diversified portfolio tailored to your risk tolerance and financial goals. This could include a mix of stocks, bonds, exchange-traded funds (ETFs), mutual funds, and potentially real estate. Avoid putting all your eggs in one basket and regularly review your portfolio’s performance.

3. Focus on Income Growth and Skill Development

One of the most powerful wealth-building tools is increasing your income. Invest in yourself by acquiring new skills, pursuing further education, or seeking career advancement opportunities. Consider side hustles or starting a small business to generate additional income that can be channeled directly into savings and investments.

The Mindset for Long-Term Success

Building wealth is not a sprint; it’s a marathon that requires patience, discipline, and a long-term perspective. Financial literacy is an ongoing journey; continuously educate yourself about personal finance and investment strategies. Avoid get-rich-quick schemes, which often lead to significant losses.

Consider consulting with a fee-only financial advisor. A professional can provide personalized guidance, help you create a comprehensive financial plan, and keep you accountable to your goals. Their expertise can be invaluable in navigating complex financial decisions and optimizing your path to wealth.

Conclusion

Tackling high-interest debt and building wealth is a challenging yet achievable journey for men committed to financial freedom. By first aggressively eliminating debt, then establishing a robust financial safety net, and finally engaging in strategic, diversified investing, you can transform your financial future. It demands consistency, smart decisions, and a long-term vision, but the reward of financial security and independence is well worth the effort.