Confronting High-Interest Debt Head-On

High-interest debt can feel like a financial anchor, weighing down your present and future. For men looking to regain financial control quickly, a direct and strategic approach is essential. Whether it’s credit card balances, personal loans, or other costly obligations, understanding the enemy and deploying effective tactics can accelerate your path to debt freedom.

Step 1: The Debt Audit – Know Your Battlefield

Before you can eliminate high-interest debt, you need a crystal-clear picture of what you owe. Gather all your statements for credit cards, personal loans, and any other high-interest accounts. List them out, noting:

- Creditor name

- Current balance

- Interest rate (APR)

- Minimum monthly payment

Prioritizing by interest rate is crucial here. The higher the APR, the more expensive the debt is, and the faster it drains your resources.

Step 2: Fortify Your Budget and Find Extra Ammo

Rapid debt elimination hinges on freeing up as much cash as possible. This means a ruthless assessment of your current spending habits. Create a detailed budget if you don’t have one, or meticulously review your existing one.

Trim the Fat: Identify Non-Essentials

Look for areas where you can cut back significantly:

- Dining out and takeout

- Subscriptions you rarely use

- Expensive hobbies or entertainment

- Unnecessary shopping

Every dollar saved is a dollar that can go directly towards high-interest debt, saving you significantly on interest charges.

Step 3: Choose Your Attack Strategy – Avalanche or Snowball?

Two primary methods are highly effective for debt repayment:

The Debt Avalanche Method

This strategy focuses on paying off debts with the highest interest rates first, regardless of balance size. You make minimum payments on all other debts and aggressively attack the one with the highest APR. Once that’s paid off, you roll the money you were paying into the next highest-interest debt. This method saves you the most money on interest over time.

The Debt Snowball Method

With this method, you focus on paying off the smallest debt balance first, regardless of interest rate, while making minimum payments on others. Once the smallest debt is gone, you take the money you were paying on it and add it to the payment for the next smallest debt. This creates psychological momentum, as you see debts disappear quickly, which can be highly motivating.

While the avalanche saves more money, the snowball often provides quicker wins that keep you motivated. Choose the method that best aligns with your financial personality.

Step 4: Consider Strategic Maneuvers – Consolidation or Refinancing

For some, a strategic move like debt consolidation or refinancing can provide a significant advantage:

- Debt Consolidation Loan: This involves taking out a new loan, usually with a lower interest rate, to pay off multiple high-interest debts. This simplifies your payments into one monthly bill and can significantly reduce your overall interest expense.

- Balance Transfer Credit Card: If you have an excellent credit score, you might qualify for a balance transfer card with a 0% introductory APR. This gives you a window (typically 12-18 months) to pay down debt interest-free, though a transfer fee usually applies. Be disciplined; if you don’t pay it off within the intro period, the interest rate can jump significantly.

Always compare the total cost, including fees, and ensure the new interest rate is genuinely lower and manageable.

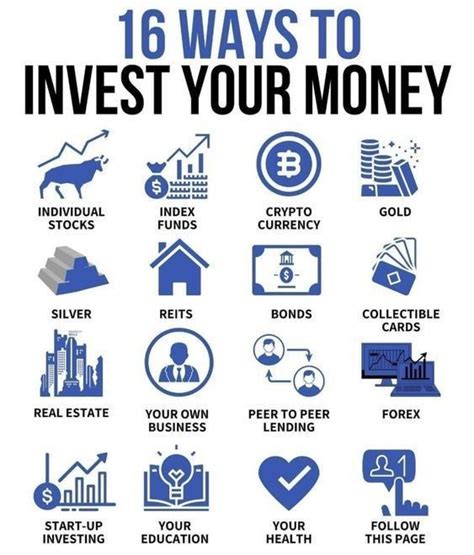

Step 5: Boost Your Income – More Firepower

While cutting expenses is vital, increasing your income can supercharge your debt elimination efforts. Consider:

- Side Hustles: Freelancing, gig work, or starting a small business in your spare time can provide significant extra cash.

- Overtime: If available at your current job, picking up extra hours can directly translate to more debt payments.

- Selling Unused Items: Decluttering your home and selling items you no longer need can provide a quick influx of cash.

Step 6: Build a Defensive Wall – Prevent Future Debt

As you eliminate debt, it’s crucial to put safeguards in place to prevent accumulating new high-interest debt. This includes:

- Building an Emergency Fund: Aim for at least 3-6 months of living expenses. This fund acts as a buffer against unexpected costs, preventing you from resorting to credit cards.

- Mindful Spending: Continue to live below your means and be conscious of purchases, especially on credit.

- Regular Financial Reviews: Periodically review your budget, debt progress, and financial goals.

Conclusion: The Path to Financial Freedom

Eliminating high-interest debt quickly requires discipline, a clear strategy, and consistent action. By auditing your debts, optimizing your budget, choosing an aggressive repayment method, and exploring options like consolidation or income boosts, men can swiftly dismantle their financial burdens. This journey isn’t just about paying off balances; it’s about reclaiming financial power and building a more secure future.