Unleashing Financial Power: The Two-Pronged Attack

For men aiming to decisively defeat high-interest debt and simultaneously accelerate their journey to substantial wealth, a focused and aggressive strategy is paramount. This isn’t just about managing money; it’s about mastering it – shifting from a reactive stance to a proactive powerhouse. The best approach involves a synchronized two-front battle: relentless debt eradication coupled with strategic wealth accumulation.

Phase 1: The Surgical Strike on High-Interest Debt

The first and most critical step is to eliminate the drag of high-interest debt. This is financial dead weight that siphons off potential wealth. Think of it as an anchor holding your ship back.

1. Total Debt Audit and Aggressive Budgeting

- Identify & List All Debts: Catalog every debt, noting the principal balance, interest rate, minimum payment, and due date. Pay particular attention to credit cards, personal loans, and any other unsecured debts with rates exceeding 10-15%.

- Create a Lean, Mean Budget: Implement a zero-based or highly restrictive budget. Every dollar should have a job. Ruthlessly cut non-essential expenses – subscriptions, dining out, unnecessary purchases. The goal is to free up maximum cash flow to throw at debt.

2. The Debt Avalanche Method: Your Weapon of Choice

While the Debt Snowball (paying smallest balance first) offers psychological wins, the Debt Avalanche is mathematically superior for crushing high-interest debt fastest. It saves you the most money on interest.

- Prioritize Highest Interest Rate: Focus all extra payments on the debt with the absolute highest interest rate, while making minimum payments on all others.

- Roll Over Payments: Once the highest-interest debt is paid off, take the money you were paying on it (minimum payment + extra payments) and apply that entire sum to the next highest-interest debt. This creates an accelerating snowball of payments.

Consider income-boosting strategies like side hustles, overtime, or selling unused items to supercharge your repayment efforts. The faster you eliminate high-interest debt, the sooner you stop bleeding money.

Phase 2: Building Wealth – Simultaneously and Strategically

While attacking debt, it’s crucial not to neglect wealth building entirely. A balanced approach can provide stability and capitalize on growth opportunities.

1. Establish a Mini Emergency Fund

Before becoming completely debt-obsessed, build a small emergency fund of $1,000 to $2,000. This acts as a buffer against unforeseen expenses, preventing you from piling on new debt if an emergency arises.

2. Maximize Employer Match (If Available)

If your employer offers a 401(k) match, contribute at least enough to get the full match. This is 100% immediate return on investment – free money you absolutely cannot afford to leave on the table, even while tackling debt.

3. Aggressive Investment Once Debt is Crushed

Once high-interest debt is gone, pivot that intense focus and freed-up cash flow directly into investments. This is where wealth building truly accelerates.

- Fully Fund Emergency Fund: Grow your emergency fund to 3-6 months of essential living expenses.

- Max Out Tax-Advantaged Accounts: Prioritize contributions to Roth IRAs, traditional IRAs, 401(k)s, and HSAs. These offer significant tax benefits and long-term growth potential.

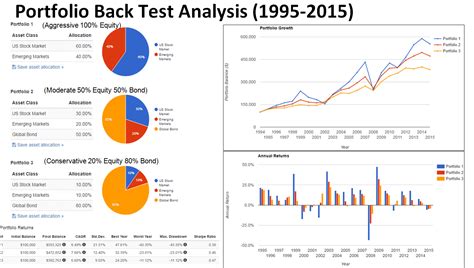

- Diversify and Automate: Invest in a diversified portfolio, typically low-cost index funds or ETFs that track broad market indices. Set up automatic contributions to ensure consistency and benefit from dollar-cost averaging.

- Consider Real Estate & Other Assets: As your portfolio grows, explore other asset classes like real estate (rental properties, REITs) or even starting a business for additional income streams and diversification.

Phase 3: Sustain, Scale, and Secure Your Future

Building wealth isn’t a one-time event; it’s an ongoing process that requires discipline and regular review.

1. Continuous Income Growth

Actively seek opportunities to increase your income. This could involve skill development, career advancement, negotiating raises, or maintaining profitable side ventures. The more you earn, the more you can save and invest.

2. Regular Financial Review

Review your budget, investments, and financial goals quarterly or semi-annually. Adjust your strategy as life circumstances change, market conditions evolve, and your wealth grows. Rebalance your portfolio to maintain desired asset allocation.

3. Seek Professional Guidance

As your financial picture becomes more complex, consider consulting with a fee-only financial advisor. They can provide personalized strategies for tax optimization, estate planning, and advanced investment approaches.

By adopting this disciplined, aggressive, and dual-focused strategy – first obliterating high-interest debt and then channeling that momentum into strategic investments – men can not only crush their financial burdens but also rapidly construct a robust foundation for lasting wealth and financial freedom.