For many men, the pursuit of early financial independence isn’t just about accumulating wealth; it’s about gaining control, freedom, and the ability to dictate one’s own path. It’s the dream of escaping the traditional 9-to-5 grind long before conventional retirement age, allowing for more time dedicated to passions, family, or entrepreneurial ventures. But how does one navigate the complex world of investments to reach this coveted goal sooner rather than later?

Building a Robust Financial Foundation

The journey to early financial independence begins not with market speculation, but with solid financial fundamentals. This means cultivating an aggressive savings rate, often upwards of 30-50% or even higher, of your income. It requires a meticulous understanding of your cash flow, cutting unnecessary expenses, and prioritizing savings and investments over discretionary spending. Think of it as fueling your escape velocity.

Beyond saving, developing a strong financial mindset is crucial. This includes continuous learning about personal finance, understanding basic economic principles, and cultivating patience and discipline. Markets will fluctuate, but a clear long-term vision and adherence to your strategy will prevent impulsive decisions.

Diversification: Your Shield and Sword

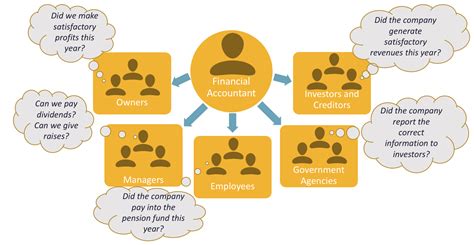

A cornerstone of any successful investment strategy, particularly for those aiming for early independence, is diversification. Spreading your investments across different asset classes reduces risk and can enhance returns. For many, a core portfolio will consist of low-cost index funds or Exchange-Traded Funds (ETFs) that track broad market indices like the S&P 500. These offer instant diversification across hundreds or thousands of companies with minimal effort and expense.

Consider a balanced allocation between equities (stocks) for growth and fixed income (bonds) for stability, adjusting the ratio based on your age, timeline, and risk tolerance. Younger investors with a longer horizon might lean heavier into equities, while those closer to their independence goal might introduce more bonds to preserve capital.

Leveraging Real Estate and Alternative Assets

While stocks and bonds form the bedrock, many men find significant success accelerating their independence through real estate. This could involve direct ownership of rental properties, real estate investment trusts (REITs), or even crowdfunding platforms. Real estate offers potential for passive income, appreciation, and tax advantages, making it a powerful tool for wealth accumulation. However, it often requires more active management or significant capital outlay.

Beyond traditional assets, some explore alternative investments. This might include investing in a small business, peer-to-peer lending, or even carefully selected collectibles or cryptocurrencies. These carry higher risks but can offer disproportionately higher returns if managed wisely. Thorough due diligence is paramount with any alternative investment.

Strategic Growth and Risk Management

To truly accelerate financial independence, strategic growth is key. This means understanding and utilizing tax-advantaged accounts like 401(k)s, IRAs, and HSAs to their fullest potential. Maximizing contributions, especially to accounts with employer matches, is essentially free money and significantly boosts your compounding power.

Risk management isn’t just about diversification; it’s also about understanding your personal risk tolerance and regularly rebalancing your portfolio to maintain your desired asset allocation. Market downturns are inevitable, and having a plan to either ride them out or even invest more during dips (dollar-cost averaging) is crucial for long-term success. Avoid emotional decisions driven by short-term market noise.

The Path Forward: Continuous Learning and Adaptation

The financial landscape is ever-evolving. Achieving early financial independence requires a commitment to continuous learning and adaptation. Stay informed about market trends, economic shifts, and new investment opportunities. Regularly review your financial goals and adjust your strategy as your life circumstances change. Perhaps you start a side hustle that generates additional capital for investment, or you negotiate a significant salary increase – these are opportunities to further accelerate your journey.

Ultimately, the “best” investment strategy is one that aligns with your personal goals, risk tolerance, and time horizon. It’s a dynamic process of saving aggressively, investing wisely, diversifying broadly, managing risk intelligently, and consistently optimizing your approach. With discipline and a clear vision, early financial independence is an attainable goal for men willing to put in the work.