Understanding Fuel Cards: More Than Just a Payment Method

In today’s economy, managing fuel expenses effectively is crucial for both individuals and businesses. Fuel cards offer a specialized solution, going beyond standard credit or debit cards to provide dedicated savings and rewards on gas purchases. But with a plethora of options available, how do you pinpoint the “best” card for your specific needs to truly maximize savings and benefits?

This article will delve into the world of fuel cards, examining their types, key features, and what to look for when choosing one that aligns with your spending habits and financial goals. Whether you’re a daily commuter, a small business owner, or managing a large fleet, the right fuel card can significantly impact your bottom line.

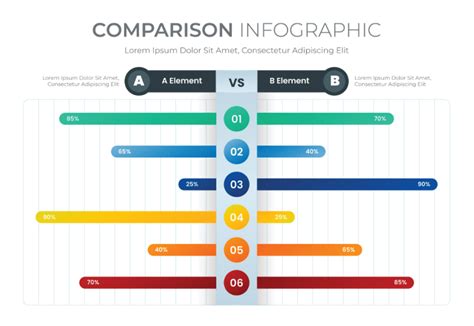

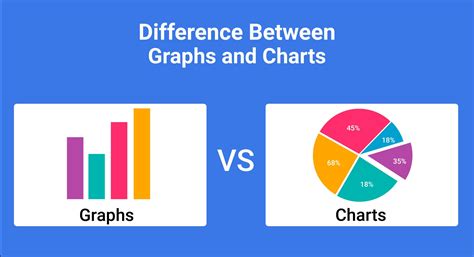

Types of Fuel Cards: Personal vs. Business

Fuel cards generally fall into two main categories: personal (or consumer) and business. While both aim to save you money on gas, their features and target audiences differ significantly.

Personal Fuel Cards

These are often co-branded with specific gas stations (e.g., Shell, BP, ExxonMobil) or offered by financial institutions. They typically provide discounts per gallon or cash back rewards when used at participating stations. The primary benefit for individuals is direct savings and simplified tracking of personal fuel expenses.

Business Fuel Cards

Designed for companies, these cards offer a broader range of features beyond just savings. They provide robust reporting, control over spending limits, fraud protection, and often universal acceptance across various gas stations. Business fuel cards are invaluable for fleet management, helping companies monitor driver spending, track mileage, and streamline accounting processes.

Key Factors for Maximizing Savings and Rewards

Choosing the best fuel card requires a careful evaluation of several critical factors. Prioritizing these will help you identify a card that delivers the most value.

1. Discounts and Rewards Structure

Look for cards that offer substantial per-gallon discounts, a high percentage of cash back, or generous points programs. Understand how these rewards are earned and redeemed. Some cards offer tiered rewards, meaning savings increase with higher spending.

2. Network Acceptance

A card is only useful if you can use it where you fill up. Station-specific cards offer deeper discounts but limited reach. Universal fuel cards (like those from Comdata, FleetCor, WEX) offer wider acceptance but might have slightly lower per-gallon savings or different fee structures. Consider your typical routes and preferred stations.

3. Fees and Charges

Always scrutinize the fee schedule. Common fees include annual fees, transaction fees, monthly service fees, or late payment fees. A card with great discounts can quickly become less attractive if it’s burdened by high recurring charges.

4. Reporting and Management Tools (for Business)

For businesses, detailed reporting is a game-changer. Look for cards that provide online portals with insights into fuel consumption, spending patterns by driver or vehicle, tax preparation features, and customizable spending controls.

5. Additional Perks

Some cards offer extra benefits like roadside assistance, maintenance tracking, or discounts on other vehicle-related purchases. While not primary, these can add value.

Top Fuel Card Considerations for Different Needs

For Personal Use & Maximum Cash Back

Consider general-purpose credit cards that offer high cash back percentages on gas purchases, often 3-5% or more, especially if you also want flexibility for other purchases. Alternatively, look at co-branded cards for your most frequently visited gas station chain if their rewards outweigh the lack of flexibility.

For Small Businesses & Local Fleets

Cards like the WEX FlexCard or various options from Shell or BP for Business can provide a good balance of widespread acceptance, decent discounts, and essential reporting without the complexity of larger fleet solutions.

For Large Fleets & Comprehensive Control

Solutions from providers like FleetCor (e.g., Fuelman), Comdata, or robust WEX cards offer unparalleled control, advanced analytics, real-time tracking, and extensive security features crucial for managing significant fuel expenditures across many vehicles.

Tips for Maximizing Your Fuel Card Benefits

- Match the Card to Your Habits: Don’t get a station-specific card if you drive routes without that brand.

- Understand the Tiers: Some rewards increase after certain spending thresholds. Plan your purchases accordingly.

- Combine with Loyalty Programs: Many gas stations have separate loyalty programs (e.g., Kroger Fuel Points, Safeway Gas Rewards). Combine these with your fuel card for double savings.

- Pay on Time: Avoid interest charges that can negate any savings.

- Monitor Statements: Regularly review transactions for accuracy and to track your savings.

Conclusion

The “best” fuel card isn’t a one-size-fits-all answer; it’s the one that perfectly aligns with your specific fuel consumption, preferred stations, and financial objectives. By carefully evaluating discounts, network acceptance, fees, and additional features, both individuals and businesses can unlock significant savings and streamline their fuel management processes. Take the time to research, compare, and choose wisely—your wallet will thank you.