Laying the Groundwork for Financial Freedom

The pursuit of financial freedom is a noble goal for any man, but identifying the ‘best first investment’ can feel overwhelming amidst a sea of options. While many immediately think of stocks, real estate, or cryptocurrencies, the most effective initial steps are often less glamorous but far more crucial for long-term success. True financial freedom is built on a solid foundation, not just speculative gains.

The Unsung Hero: Investing in Yourself and Your Foundation

Before allocating capital to external assets, the smartest first investment a man can make is in himself and his financial literacy. This means acquiring new skills, pursuing higher education, or starting a side hustle that boosts earning potential. An increased income stream is arguably the most powerful tool for accelerating wealth accumulation.

Equally vital is establishing a robust financial foundation:

- Emergency Fund: Building a safety net of 3-6 months’ living expenses in a high-yield savings account is paramount. This prevents unforeseen events from derailing your financial progress and forces you to sell investments prematurely.

- High-Interest Debt Elimination: Prioritize paying off credit card debt, personal loans, or any other debt with high interest rates. The guaranteed ‘return’ from eliminating 18%+ interest far surpasses most market returns.

- Budgeting and Tracking: Understanding where your money goes is fundamental. Implement a strict budget and track your spending to identify areas for optimization and ensure consistent savings.

Strategic Investments for Beginners

Once your foundation is solid, you can strategically look at external investments. For most men aiming for financial freedom, simplicity and long-term growth are key.

1. Employer-Sponsored Retirement Plans (401k/403b)

If your employer offers a match, contributing enough to capture the full match is essentially free money – an immediate, guaranteed return on your investment that you won’t find anywhere else. These contributions are often pre-tax, reducing your current taxable income.

2. Low-Cost Index Funds or ETFs

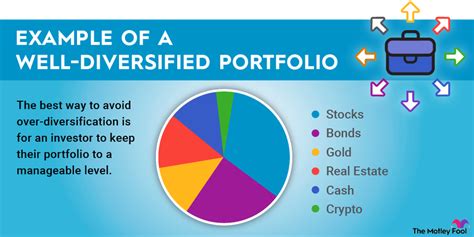

For those without an employer match or looking beyond it, broad-market index funds (like an S&P 500 index fund) or exchange-traded funds (ETFs) are excellent choices. They offer instant diversification across hundreds or thousands of companies, minimizing risk compared to individual stock picking, and boast historically strong long-term returns with minimal fees. They are ideal for passive, set-it-and-forget-it investing.

3. Roth IRA

A Roth IRA allows after-tax contributions to grow tax-free, with qualified withdrawals also being tax-free in retirement. This is a powerful vehicle for tax diversification, especially if you anticipate being in a higher tax bracket in retirement. It offers flexibility as contributions can be withdrawn tax- and penalty-free at any time.

Considering Real Estate and Other Assets

While often seen as a significant step, real estate as a first investment can be complex due to high capital requirements and ongoing management. However, for some, a first home purchase can be a foundational asset, building equity and potentially providing rental income later on. For most, mastering liquid investments first is advisable.

The Importance of Consistency and Patience

Regardless of the chosen path, the most important ingredient for financial freedom is consistency. Regularly contributing to your investments, even small amounts, and allowing compound interest to work its magic over decades will yield far greater results than trying to time the market or chase quick riches. Patience, discipline, and continuous learning are your greatest allies.

Conclusion: A Multi-faceted Approach

Ultimately, the ‘best first investment’ for men aiming for financial freedom is not a single asset but a multi-faceted approach. It begins with strengthening your earning power, establishing a robust financial safety net, and systematically eliminating high-interest debt. Only then should you strategically deploy capital into low-cost, diversified investment vehicles like employer-sponsored plans, index funds, or a Roth IRA, always prioritizing long-term growth and consistency over short-term speculation. This comprehensive strategy creates an unshakeable pathway to enduring financial independence.