In the complex world of personal finance, countless strategies vie for the top spot when it comes to building wealth and achieving true freedom. From diligent budgeting to savvy real estate, each has its merits. But for men, particularly those navigating career progression, family responsibilities, and long-term aspirations, one financial move consistently rises above the rest as the most potent catalyst for a prosperous future: aggressive, long-term investment in growth assets, consistently fueled by maximizing earning potential.

The Unanimous Champion: Aggressive, Long-Term Investment

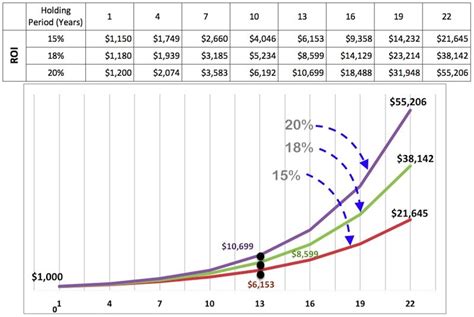

This isn’t about getting rich quick; it’s about getting rich *slowly and surely* through the undeniable power of compounding. Starting early and consistently investing a significant portion of your income into growth-oriented assets, primarily diversified equity funds or ETFs, is the bedrock of serious wealth accumulation. Time is your greatest ally here, allowing small contributions to snowball into substantial sums over decades.

Many men make the mistake of playing it too safe, keeping too much cash or investing conservatively, especially in their younger years. While a balanced approach is wise later in life, the early decades offer the greatest opportunity to take calculated risks in the market, as there’s ample time to recover from downturns and benefit from long-term upward trends. Embrace the volatility for the superior long-term returns stocks historically provide.

The Engine: Maximizing Your Earning Potential

Investment is the vehicle, but your income is the fuel. It’s a symbiotic relationship: the more you earn, the more you can invest, and the faster your wealth compounds. Therefore, continuously investing in yourself – through education, skill development, networking, and career advancement – is a critical component of this #1 financial move.

Men often find themselves in positions where their earning capacity can significantly impact their family’s well-being and their own financial trajectory. Actively seeking promotions, negotiating higher salaries, acquiring in-demand skills, or even starting a side hustle can dramatically increase the capital available for investment. Think of your career as your primary wealth-generating asset; nurture it, and its dividends will fuel your investment portfolio.

Strategic Execution: Consistency, Diversification, and Discipline

Once you’ve committed to aggressive investing and income growth, the execution needs discipline. Set up automated transfers to your investment accounts, treating these contributions as non-negotiable expenses. Employ dollar-cost averaging by investing a fixed amount regularly, regardless of market highs or lows, which helps mitigate risk and removes emotional decision-making.

Diversification is key to managing risk. While focusing on growth, ensure your portfolio isn’t overly concentrated in a single stock or sector. Broad market index funds or well-diversified ETFs offer exposure to thousands of companies, smoothing out individual company performance fluctuations. Resist the urge to constantly tinker with your portfolio; a ‘set it and forget it’ approach, with periodic rebalancing, often yields the best results.

The End Goal: Unlocking True Freedom and Optionality

The ultimate reward for this diligent financial strategy isn’t just a large number in a bank account; it’s the unparalleled freedom and optionality it provides. Financial freedom means having the power to make life choices not dictated by a paycheck. It could mean pursuing a passion project, taking a sabbatical, changing careers without financial strain, or simply enjoying more time with family.

For many men, this also translates into reducing the inherent stress associated with financial insecurity. It provides a robust safety net, the ability to leave a legacy, and the potential to retire on your own terms, rather than being forced to work longer than desired. It’s about building a life where money serves your aspirations, not the other way around.

In conclusion, while many financial habits contribute to success, the #1 move for men to boost wealth and freedom is the powerful combination of aggressive, consistent, long-term investment in growth assets, meticulously fueled by a relentless pursuit of maximizing one’s earning potential. It requires foresight, discipline, and a belief in the future, but the rewards — both financial and personal — are immeasurable.