Why a Starter Emergency Fund is Non-Negotiable

Life is unpredictable, and unexpected expenses can derail your financial stability faster than you can say “surprise bill.” From a sudden car repair to an unforeseen medical co-pay or even a temporary job loss, these events highlight the critical need for an emergency fund. But if you’re just starting, the idea of saving three to six months’ worth of expenses can feel overwhelming. The good news? You don’t have to start there. The most effective approach is to begin with a simple, achievable goal.

An emergency fund isn’t about getting rich; it’s about building a financial cushion that protects you from going into debt when life throws a curveball. It provides peace of mind, reduces stress, and allows you to handle minor financial setbacks without panic.

The First Mile Marker: $1,000 or One Month of Essential Expenses

For most people, a fantastic starting goal for an emergency fund is $1,000. This amount is significant enough to cover many common emergencies without being so large that it feels impossible to save quickly. Alternatively, aim to save one month’s worth of essential living expenses. This includes your rent/mortgage, utilities, groceries, transportation, and minimum debt payments – the absolute necessities.

Why $1,000 is a Sweet Spot:

- Achievable: It’s a tangible number that most people can save within a few months, or even weeks, with focused effort.

- Covers Common Emergencies: Many unexpected costs, like a car battery replacement, a minor appliance repair, or an urgent care visit, often fall within this range.

- Momentum Builder: Reaching this initial goal provides a huge psychological boost, motivating you to save more.

- Debt Prevention: It acts as a buffer, preventing you from putting emergencies on high-interest credit cards, which is a common trap.

Practical Steps to Reach Your Starter Goal

Once you have your target, breaking it down into smaller, actionable steps makes it much easier to achieve. Here’s how to get started:

-

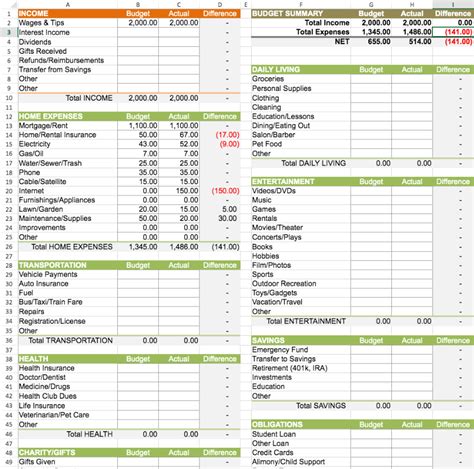

Create a Mini-Budget for Savings

Look at your current income and expenses. Where can you temporarily cut back? Even small, consistent cuts can add up. Think about:

- Temporarily reducing discretionary spending (dining out, entertainment).

- Brewing coffee at home instead of buying it.

- Canceling unused subscriptions.

- Finding ways to save on groceries.

-

Automate Your Savings

Set up an automatic transfer from your checking account to a separate savings account each payday. Even $25 or $50 a week can quickly accumulate. This makes saving consistent and takes the decision-making out of your hands.

-

Find Extra Income (Even Short-Term)

Consider ways to temporarily boost your income. This could include selling unused items around your house, picking up a few extra shifts, or taking on a short-term gig. Directing this extra money straight into your emergency fund can accelerate your progress significantly.

-

Deposit Windfalls and Bonuses

Tax refunds, work bonuses, or unexpected gifts are perfect opportunities to give your emergency fund a jumpstart. Resist the urge to spend these windfalls and instead, dedicate them entirely to your savings goal.

Where to Keep Your Emergency Fund

Your emergency fund needs to be accessible but not too accessible. The best place is typically a separate, high-yield savings account. It should:

- Be separate from your checking account: This reduces the temptation to dip into it for non-emergencies.

- Be easily accessible: You need to be able to get the money within a day or two if a true emergency arises.

- Earn a little interest: While not the primary goal, a high-yield savings account can help your money grow slightly.

Avoid investing your emergency fund in the stock market or other volatile assets. The primary purpose is security and accessibility, not aggressive growth.

The Long-Term Vision: Beyond Your Starter Fund

Once you hit your initial $1,000 or one-month goal, celebrate! You’ve taken a massive step toward financial security. But don’t stop there. The next step is to continue building that fund until you have three to six months’ worth of essential living expenses saved. This larger fund offers protection against more significant events like job loss or major medical issues.

Remember, building an emergency fund is a marathon, not a sprint. Start small, be consistent, and watch your financial resilience grow.