Demystifying the 50/30/20 Budget Rule

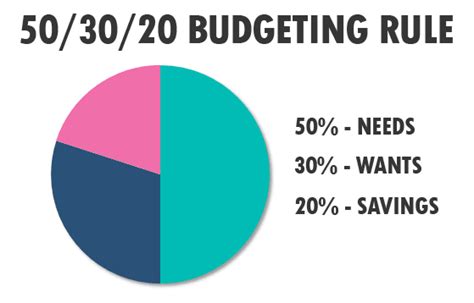

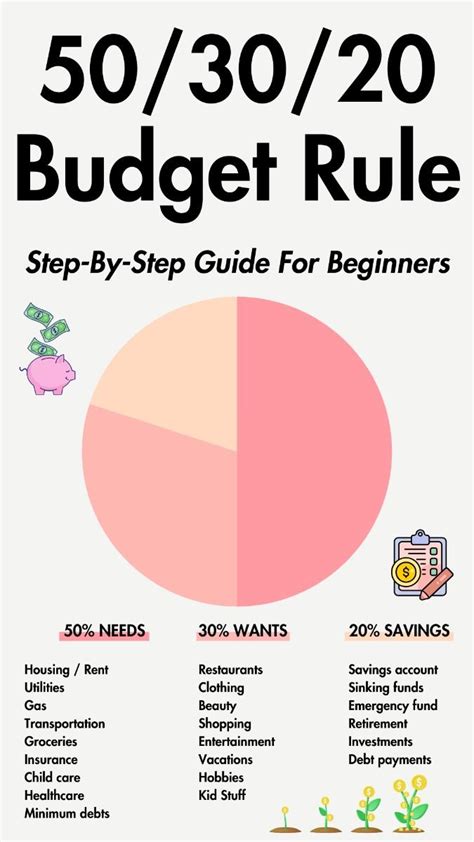

In the vast landscape of personal finance, one budgeting method stands out for its simplicity and effectiveness: the 50/30/20 rule. Developed by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book, “All Your Worth: The Ultimate Lifetime Money Plan,” this guideline offers a straightforward way to manage your money without overly restricting your lifestyle. It proposes that you allocate your after-tax income into three clear categories: 50% for Needs, 30% for Wants, and 20% for Savings & Debt Repayment.

Understanding the Core Components

The beauty of the 50/30/20 rule lies in its clear-cut allocation. It provides a framework to ensure your essential expenses are covered, you still enjoy life, and you’re building a secure financial future. Let’s break down each component to see what falls where.

50% for Needs: Your Essentials

This largest portion of your budget is dedicated to expenses you absolutely cannot live without. These are the non-negotiable costs required to maintain your life and work. If you couldn’t pay for these, your basic safety and well-being would be at risk.

- Housing: Rent or mortgage payments.

- Utilities: Electricity, gas, water, internet.

- Groceries: Food for home consumption.

- Transportation: Car payments, fuel, public transit fares, essential car maintenance.

- Insurance: Health, car, home insurance premiums.

- Minimum Debt Payments: The absolute minimum required payments on credit cards, student loans, or other debts (anything above this goes into the 20% category).

The goal is to keep these essential costs within 50% of your take-home pay. If your needs exceed this, it might be a sign to look for areas to cut back, such as finding a more affordable living situation or reducing transportation costs.

30% for Wants: Enjoying Life

This category covers everything that improves your quality of life but isn’t strictly necessary for survival. Wants are the things you choose to spend money on because they bring you joy, comfort, or convenience.

- Dining Out & Takeaway: Restaurants, coffee shops.

- Entertainment: Movies, concerts, streaming services, video games.

- Hobbies: Gym memberships, art supplies, recreational sports.

- Shopping: New clothes, gadgets, non-essential home decor.

- Travel & Vacations: Trips, weekend getaways.

- Subscriptions: Non-essential apps, magazines, premium services.

- Haircuts & Personal Care: Beyond basic hygiene.

The 30% for wants allows for flexibility and ensures you don’t feel deprived. It’s about finding a balance between enjoying your present and planning for your future. If you’re struggling to meet your 20% savings goal, this is often the first place to look for cuts.

20% for Savings & Debt Repayment: Building Your Future

This crucial 20% is dedicated to securing your financial future and reducing your debt burden. It’s the engine that drives financial freedom and peace of mind.

- Emergency Fund: Building a cash reserve, typically 3-6 months of living expenses.

- Retirement Savings: Contributions to a 401(k), IRA, or other retirement accounts.

- Investments: Money put into stocks, bonds, mutual funds, or real estate.

- Additional Debt Repayment: Paying more than the minimum on credit cards, student loans, or personal loans to accelerate debt freedom.

- Large Purchases: Saving for a down payment on a house, a new car, or other significant goals.

Prioritizing this 20% is vital. It’s recommended to automate these transfers so that the money is moved directly from your paycheck into your savings or investment accounts before you have a chance to spend it.

Making the 50/30/20 Rule Practical for You

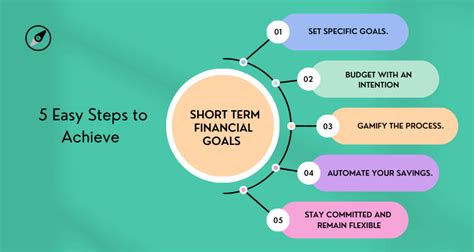

While the 50/30/20 rule is a fantastic starting point, it’s not a rigid law. It’s a guideline that can be adapted to your unique financial situation. Here are some tips for implementation:

- Track Your Spending: Before you can allocate, you need to know where your money is currently going. Use budgeting apps, spreadsheets, or even pen and paper.

- Adjust as Needed: If your needs are currently above 50%, look for ways to reduce them. If your savings are below 20%, consider cutting back on wants.

- Automate Savings: Set up automatic transfers from your checking account to your savings, investment, or debt repayment accounts immediately after you get paid.

- Be Flexible: Life happens. There might be months where your percentages shift due to unexpected expenses or income changes. The goal is progress, not perfection.

Who Benefits from This Budget?

The 50/30/20 rule is particularly beneficial for:

- Budgeting Beginners: Its simplicity makes it easy to understand and implement without complex categories.

- Those Overwhelmed by Debt: It clearly allocates funds for debt reduction, helping to create a path to financial freedom.

- People Seeking Balance: It encourages both responsible saving and enjoying your current income, preventing burnout from overly restrictive budgets.

- Anyone Wanting Financial Clarity: It provides a clear picture of where your money should be going, making it easier to identify and correct financial imbalances.

Conclusion

The 50/30/20 budget breakdown offers a practical and sustainable approach to managing your finances. By categorizing your expenses into Needs, Wants, and Savings & Debt Repayment, you gain clarity and control over your money. It’s a powerful tool for building financial security, achieving your goals, and enjoying a balanced life, all without the overwhelming complexity that often deters people from budgeting in the first place.