Financial security is a cornerstone of adult life, and a robust emergency fund is its bedrock. For men aged 30-50, a period often marked by career growth, family responsibilities, and significant financial commitments, the question of emergency savings becomes particularly pertinent. This article delves into the critical query: what percentage of men in this demographic truly possess the recommended six months or more of living expenses stashed away?

The Importance of an Emergency Fund

An emergency fund acts as a crucial financial safety net, designed to cover unexpected expenses without derailing long-term financial goals or resorting to high-interest debt. From sudden job loss and medical emergencies to urgent home or car repairs, life inevitably throws curveballs. Having a buffer of six months or more in living expenses is widely considered a gold standard, offering significant peace of mind and financial resilience during unforeseen crises.

The Financial Landscape for Men Aged 30-50

This age bracket often represents a complex financial chapter. Many men in their 30s and 40s are navigating peak earning years, but also contend with mortgages, student loan debt, the costs of raising a family, and potentially caring for aging parents. These competing financial demands can make consistently building and maintaining a substantial emergency fund a significant challenge, even for high-earners. Balancing present needs with future security is a constant tightrope walk.

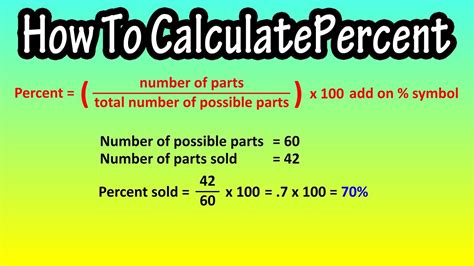

Current Statistics and Trends in Emergency Savings

While precise, real-time data specifically for men aged 30-50 with more than six months of savings can fluctuate and depend on specific economic conditions and survey methodologies, broader trends offer insights. General financial surveys frequently reveal that a significant portion of the population, across various demographics, falls short of the ideal six-month emergency fund. Many individuals, for instance, struggle to cover even a $1,000 unexpected expense without using credit. Achieving the six-month-plus benchmark places individuals in a financially prudent minority, indicating a strong commitment to financial planning and discipline.

Factors Influencing Emergency Fund Accumulation

Several variables play a role in whether men in this age group achieve their emergency savings goals. Income level is an obvious factor, but so are debt obligations, financial literacy, spending habits, and unforeseen life events. High consumer debt (credit cards, personal loans) can significantly impede savings. A lack of clear financial goals or consistent budgeting can also prevent the steady accumulation of funds. Furthermore, major life events like marriage, childbirth, divorce, or business ventures can either accelerate or deplete savings depending on their financial implications.

Strategies for Building a Robust Emergency Fund

For those aiming to reach or exceed the six-month threshold, several strategies can prove effective. Automating savings by setting up recurring transfers to a dedicated, separate savings account ensures consistent growth. Creating and sticking to a detailed budget helps identify areas where spending can be reduced. Tackling high-interest debt frees up more money for savings. Exploring opportunities for supplemental income, such as side hustles or career advancement, can also accelerate fund accumulation. The key is consistency and making saving a non-negotiable part of one’s financial plan.

Conclusion

The percentage of men aged 30-50 with more than six months of living expenses saved in an emergency fund is a critical indicator of financial stability. While the exact figure varies, general trends suggest that while many aspire to this level of security, fewer actually achieve it. Recognizing the importance of this safety net and actively implementing sound financial strategies are essential steps toward building a resilient financial future, enabling men in this pivotal age range to confidently navigate life’s inevitable uncertainties.