The Evolving Landscape of Paternity Leave

Paternity leave, once a rarity, is steadily transitioning from a fringe benefit to an essential component of modern family and work-life balance. As societal expectations evolve and the role of fathers in early childhood development gains greater recognition, so too does the need for financial preparedness for this significant life event. But what about men who aren’t yet planning children? Are they already thinking ahead, actively setting aside funds for a future period of leave?

The Elusive Statistic: A Gap in Data

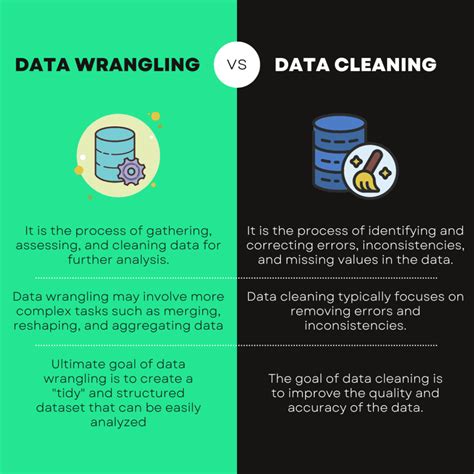

Direct statistics specifically tracking the percentage of men aged 25-35 who are actively budgeting for paternity leave without immediate plans for children are notably scarce. This niche area lies at the intersection of financial planning, evolving social norms, and future family intentions, making it challenging to quantify precisely. While surveys often capture current parental leave uptake or intentions for those actively planning families, granular data on proactive, future-oriented budgeting in this specific demographic is less common.

However, we can infer from broader trends. There’s a growing awareness among younger generations about the importance of financial literacy and long-term planning. Simultaneously, the conversation around parental leave — including paternity leave — has become more prominent, influencing how young professionals view their future family responsibilities.

Why Proactive Budgeting Matters

For those who do consider it, budgeting for paternity leave, even years in advance, offers a multitude of benefits:

- Financial Security: Paternity leave often means a period of reduced or unpaid income. Having a dedicated fund ensures that essential expenses can still be met without undue stress, allowing the father to fully engage in family bonding.

- Supporting the Partner: Financial stability during paternity leave indirectly supports the birthing parent, allowing them more time to recover and bond with the newborn without added financial pressure on the household.

- Flexibility and Choice: Early savings provide greater flexibility. Should an employer offer less generous paternity leave benefits, personal savings can bridge the gap, enabling a longer or more financially comfortable period of leave than otherwise possible.

- Anticipating the Future: Life is unpredictable. Being financially prepared for major life events, even those not yet on the immediate horizon, is a hallmark of responsible adulting and reduces future stress.

Practical Steps for Budgeting for Paternity Leave

For men in the 25-35 age bracket considering this proactive financial step, several strategies can be employed:

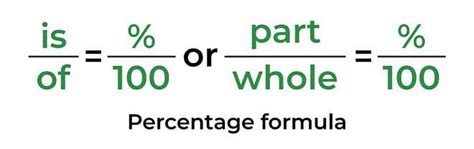

- Estimate Potential Costs: Research the average expenses associated with a new baby and estimate potential income loss during a hypothetical paternity leave period.

- Set a Dedicated Savings Goal: Treat paternity leave savings like any other significant financial goal, such as a down payment on a house or retirement, and allocate a portion of monthly income towards it.

- Utilize High-Yield Savings Accounts: Park these funds in an account that offers better interest rates, allowing the money to grow over time.

- Research Employer Policies: Even if not immediately relevant, understanding current and potential future employer policies on parental leave can inform savings goals.

- Consult a Financial Advisor: Professionals can help integrate paternity leave savings into a broader financial plan.

Societal Shifts and Employer Responsibilities

The very question of men budgeting for paternity leave, even without immediate plans for children, speaks to a broader cultural shift. There’s a growing understanding that active fatherhood from day one is beneficial for child development, family well-being, and gender equality. Employers are also slowly catching up, recognizing that robust parental leave policies (including for fathers) are key to attracting and retaining top talent. This proactive financial planning by younger men reinforces and accelerates this positive societal movement.

Conclusion: Investing in Future Family Well-being

While definitive statistics remain elusive, the concept of men aged 25-35 actively budgeting for paternity leave, even without immediate family plans, signifies a forward-thinking and responsible approach to future family life. It reflects a growing commitment to shared parenting, financial stability, and the overall well-being of the family unit. This proactive financial planning isn’t just about money; it’s an investment in peace of mind, strong family bonds, and a more equitable future for all.