Procrastination is a formidable adversary, a silent saboteur of our best intentions. Whether it’s skipping a workout or delaying a crucial financial decision, its grip can feel unbreakable. But what if there was a unifying mindset strategy, applicable to both our physical well-being and our financial health, that could consistently dismantle this barrier?

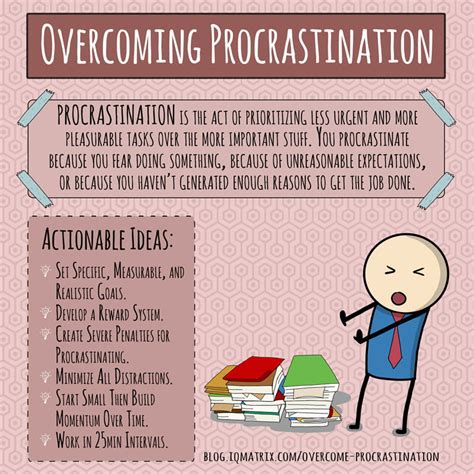

Understanding the Procrastination Trap

At its core, procrastination often stems from a conflict between our present desires for comfort or immediate gratification and our future aspirations. The brain’s limbic system, wired for instant rewards, frequently overrides the prefrontal cortex, which is responsible for long-term planning and decision-making. We tell ourselves we’ll do it “later,” but “later” rarely comes without a structured approach.

The “Future Self” Mindset: A Powerful Strategy

The most effective strategy against procrastination involves cultivating a strong connection with your “future self.” This mindset encourages you to view your present actions through the lens of the person you aspire to become. Instead of making choices based solely on how you feel right now, you ask: “What decision would my future, healthier, wealthier self thank me for today?” This reframing shifts the focus from immediate discomfort to long-term gain and personal identity.

Conquering Fitness Procrastination

In fitness, the future self mindset translates into committing to small, manageable actions that compound over time. Instead of daunting an hour-long gym session, promise your future healthier self just 10 minutes of movement. Lay out your workout clothes the night before, schedule your exercise like an important appointment, or simply visualize the energy and vitality your future self will possess. Each micro-action builds momentum and reinforces your identity as someone who prioritizes their physical well-being.

Overcoming Financial Procrastination

Financially, this strategy is equally potent. Procrastinating on saving, investing, or budgeting can have dire consequences for your future self. Automate your savings — even a small amount — before you have a chance to spend it. Set up recurring transfers to investment accounts. Visualize the freedom and security your future self will enjoy thanks to your consistent efforts today. Breaking down large financial goals into tiny, actionable steps (e.g., reviewing your budget for 15 minutes weekly, saving $5 a day) makes them less intimidating and more achievable.

Building Momentum and Consistency

The key to making this mindset work is consistency, not intensity. Celebrate your small wins. Track your progress, whether it’s checking off workouts or watching your savings grow. This positive reinforcement strengthens the neural pathways associated with discipline and forward-thinking. Accountability partners or communities can also provide valuable external motivation, but the internal drive of serving your future self remains the bedrock.

The Power of Micro-Actions

Remember, monumental achievements are rarely the result of singular, heroic efforts, but rather the cumulative effect of countless small, deliberate actions. Each time you choose the 10-minute walk, or automate a small transfer, you’re not just performing an action; you’re casting a vote for the person you want to become. You’re actively building the bridge to your future self.

Conclusion

The battle against procrastination in fitness and finance isn’t won by sheer willpower alone, but by a strategic shift in perspective. By embracing the “future self” mindset and committing to consistent micro-actions, you empower yourself to make choices today that will profoundly benefit the person you are becoming. This powerful strategy transcends individual domains, offering a holistic path to lasting change and the achievement of your deepest aspirations.