True success, whether in building a stronger body or a healthier financial portfolio, often hinges less on inherent talent and more on the mental frameworks we adopt. The ability to consistently show up for workouts and make intelligent financial decisions stems from remarkably similar mindset shifts. By understanding and cultivating these mental approaches, individuals can unlock new levels of discipline and strategic foresight in both their physical and financial lives.

Embracing Long-Term Vision Over Instant Gratification

One of the most powerful mindset shifts involves moving away from the allure of immediate results towards a sustainable, long-term perspective. In fitness, this means understanding that a single workout won’t transform your body, just as a single missed workout won’t derail your progress. Discipline comes from valuing the cumulative effect of consistent effort over months and years.

Similarly, smart financial risk-taking is rooted in long-term thinking. Instead of chasing get-rich-quick schemes or reacting impulsively to market fluctuations, it involves making strategic investments with a future goal in mind. This might mean enduring short-term market volatility for long-term growth, or consistently contributing to savings despite immediate temptations to spend. It’s about planting seeds today for a harvest far down the road.

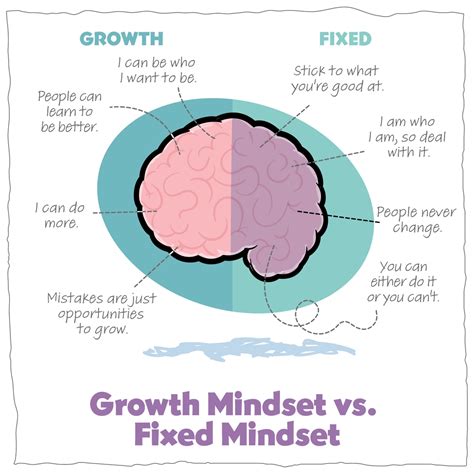

Cultivating a Growth Mindset and Embracing Discomfort

A growth mindset, the belief that abilities can be developed through dedication and hard work, is crucial for both domains. For workout discipline, it means viewing challenging exercises not as barriers, but as opportunities to get stronger. It’s accepting muscle soreness as a sign of progress and pushing past perceived limits to achieve new physical feats. Discomfort becomes a necessary companion on the path to improvement.

In financial risk-taking, this translates to understanding that growth often involves stepping out of your comfort zone. This could mean investing in a new venture, diversifying a portfolio, or making a significant purchase that stretches your budget but promises long-term returns. Smart risk-takers don’t avoid the uncomfortable feeling of uncertainty; instead, they learn to evaluate and manage it, knowing that calculated risks are essential for substantial financial advancement.

Learning from Failure, Not Fearing It

Failure is an inevitable part of both fitness journeys and financial endeavors, yet our response to it dictates our ultimate success. A crucial mindset shift is to view setbacks not as definitive endings, but as invaluable learning opportunities. In workouts, this means not letting a missed session or a plateau in progress lead to quitting entirely. Instead, it’s about analyzing what went wrong, adjusting your routine, and returning with renewed determination.

For financial risk-taking, this perspective is vital. Not every investment will pan out, and not every financial decision will yield optimal results. Smart individuals don’t allow a bad investment or a market downturn to paralyze them with fear. Instead, they meticulously review their decisions, identify lessons learned, and refine their strategies to mitigate future risks. This iterative process of trying, failing, learning, and adapting builds resilience and enhances future success.

Adopting a Process-Oriented Over an Outcome-Oriented Approach

While outcomes are important, an obsession with them can be demotivating. Shifting focus to the process – the consistent habits and actions – is far more effective. For workout discipline, this means celebrating the act of showing up, completing a set, or maintaining good form, rather than solely focusing on a specific weight or physique goal. The consistent adherence to the process eventually leads to the desired outcome.

Financially, this translates to consistently following a budget, regularly contributing to savings or investments, and educating oneself about market trends, rather than solely fixating on a portfolio’s daily fluctuations. By mastering the daily and weekly financial processes, individuals build a robust foundation that inevitably leads to better long-term financial health and the capacity for smart, calculated risks.

Cultivating Self-Compassion and Patience

Finally, integrating self-compassion and patience into your mindset is key. Both workout discipline and financial growth are marathon, not sprint. There will be days of low motivation, unexpected expenses, or periods of slow progress. A harsh inner critic can derail efforts more effectively than any external obstacle.

Practicing self-compassion means acknowledging your humanity, forgiving slip-ups, and treating yourself with the same kindness you’d offer a friend. Patience reminds us that meaningful change takes time. This allows for sustainable progress in fitness and prevents emotional, rash decisions in finance. By being kind and patient with ourselves, we foster an environment conducive to long-term discipline and wise decision-making.

Conclusion

The journey towards enhanced workout discipline and smart financial risk-taking is deeply intertwined with our mental frameworks. By consciously cultivating a long-term vision, embracing discomfort, learning from failures, focusing on process, and practicing self-compassion, individuals can build a powerful internal toolkit. These mindset shifts not only bolster consistency and resilience but also empower us to navigate challenges and seize opportunities effectively across all aspects of life.