The Intertwined Nature of Mindset, Money, and Movement

Many of us strive for better financial health and a more consistent fitness routine, yet often find ourselves cycling through periods of motivation and regression. What’s often overlooked is the profound role our mindset plays in establishing and maintaining these crucial aspects of a well-rounded life. Our underlying beliefs, attitudes, and thought patterns act as the invisible architects of our daily choices, profoundly impacting whether we save for the future or splurge on impulse, or whether we hit the gym consistently or succumb to sedentary habits.

The synergy between financial discipline and fitness consistency is stronger than it appears. Both demand self-control, delayed gratification, and resilience. Cultivating a strategic mindset in one area often spills over, reinforcing positive behaviors in the other. It’s not just about willpower; it’s about reshaping the mental frameworks that govern our actions.

Shift 1: From Instant Gratification to Delayed Gratification

In a world designed for immediate satisfaction, resisting the urge for quick fixes and short-term pleasures is a significant challenge. Whether it’s buying the latest gadget or skipping a workout for an extra hour of sleep, instant gratification can derail both your financial and fitness goals. The pivotal mindset shift involves consciously valuing future rewards over present desires.

This means cultivating the ability to visualize your future self – a financially secure individual, or a vibrant, healthy person – and understanding that every disciplined choice today is an investment in that future. Practice mindful pauses before acting on impulse, asking yourself: “Does this align with my long-term goals?”

Shift 2: From Scarcity/Restriction to Abundance/Empowerment

Often, financial discipline is approached with a mindset of scarcity – feeling deprived by budgeting or saving. Similarly, fitness can feel like a punishment or a strict regimen. This restrictive view is unsustainable. A powerful shift involves moving to an abundance and empowerment mindset.

For finance, this means seeing budgeting as a tool for intentional spending that aligns with your values, creating financial freedom rather than limiting it. For fitness, it’s about embracing movement as a celebration of what your body can do, focusing on strength and vitality rather than just weight loss or obligation. This reframing fosters a sense of control and joy, making sustainable habits feel empowering.

Shift 3: Embracing Consistency Over Perfection

The “all-or-nothing” mentality is a silent killer of progress. Many believe that if they can’t adhere perfectly to a budget or maintain an intense workout schedule, they might as well give up entirely. This mindset sets unrealistic expectations and leads to burnout and abandonment.

The healthier shift is to prioritize consistency over perfection. Understand that small, repeated actions accumulate into significant results over time. Missing one budget tracking day or one workout isn’t a failure; it’s a minor deviation. The key is to get back on track immediately. Focus on showing up, even if it’s for a shorter walk or a smaller saving contribution. Consistency builds momentum and lasting habits.

Shift 4: Viewing Challenges as Learning Opportunities, Not Failures

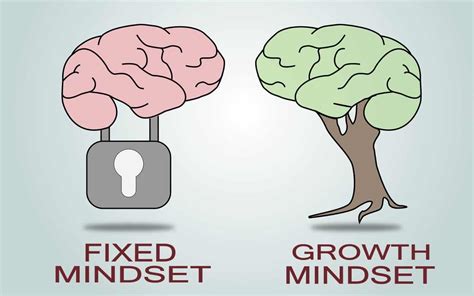

Financial setbacks, like unexpected expenses or investment losses, and fitness plateaus or injuries, are inevitable. A fixed mindset views these as personal failures, leading to discouragement and giving up. A growth mindset, however, transforms these challenges into invaluable learning experiences.

This shift encourages asking: “What can I learn from this? How can I adjust my strategy?” Instead of dwelling on what went wrong, focus on what can be done differently next time. This resilient approach fosters adaptability, innovation, and a stronger resolve to continue forward, equipped with new insights.

Shift 5: Cultivating Intrinsic Motivation

Relying solely on external motivators – praise from others, societal pressure, or fleeting trends – can lead to a rollercoaster of motivation. When the external reward diminishes, so does the drive. The most profound shift is from extrinsic to intrinsic motivation.

This means connecting your financial and fitness goals to deeper personal values: a desire for security, peace of mind, self-reliance, longevity, or mental clarity. When your motivation stems from within, your habits become an expression of who you are and what you genuinely value, making them far more resilient and enduring.

Conclusion: The Path to Sustainable Habits

Transforming your financial discipline and fitness consistency isn’t merely about tactics or willpower; it’s fundamentally about rewiring your brain. By consciously adopting mindset shifts – embracing delayed gratification, viewing resources as abundant, prioritizing consistency, learning from challenges, and tapping into intrinsic motivation – you build a powerful foundation for lasting change. These shifts empower you to navigate life’s complexities with resilience, creating a virtuous cycle where positive habits reinforce a positive outlook, leading to a richer, healthier, and more fulfilling life.