The Universal Challenge of Procrastination

Procrastination is a deeply ingrained human tendency, a silent saboteur of our best intentions. While it can plague any area of life, its impact is particularly acute in domains requiring consistent effort and delayed gratification: personal finance and physical fitness. Whether it’s putting off creating a budget, postponing that workout, or delaying an investment decision, the consequences accumulate, leading to stress, missed opportunities, and a sense of regret.

Often, the root of procrastination in these areas lies in a perceived lack of immediate reward, coupled with the overwhelming feeling of the task ahead. We prioritize instant comfort over future benefits, falling victim to our short-term impulses. But what if the key to unlocking consistent action wasn’t about willpower alone, but about a fundamental shift in how we perceive these responsibilities?

From Obligation to Opportunity: The Core Mindset Shift

The most powerful mindset shift involves moving from viewing financial management and fitness as burdensome obligations to seeing them as empowering opportunities and investments in your future self. Instead of “I have to save money” or “I have to exercise,” cultivate the thought, “I choose to save money because it gives me security and freedom,” or “I choose to exercise because it enhances my well-being and energy.”

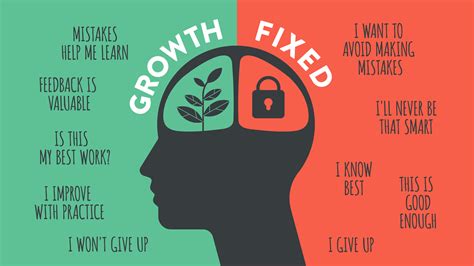

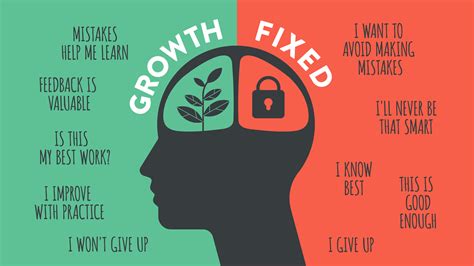

This subtle reframing shifts the locus of control from external demands to internal motivation. It taps into your values and desires, making actions feel less like chores and more like steps towards a desired future. Embracing a “growth mindset,” where challenges are seen as opportunities for learning and improvement rather than obstacles, further fuels this transformation.

Transforming Financial Procrastination

Embracing Your Future Financial Self

In finance, the mindset shift involves visualizing and connecting with your future self. What kind of financial security, freedom, and opportunities do you want for that person? When you view saving, budgeting, or investing as acts of care for your future self, the immediate discomfort of delayed gratification lessens. It transforms from a sacrifice to a strategic investment.

- Budgeting as Empowerment: Instead of a restriction, see your budget as a tool that gives you control and clarity over your money, aligning spending with your values.

- Saving as Freedom: Every dollar saved is a step towards financial independence, a safety net, or a future dream.

- Investing as Growth: Recognize that investing is putting your money to work for you, actively building wealth over time, even with small, consistent contributions.

Breaking down large financial goals into tiny, actionable steps (e.g., “review bank statement for 10 minutes” instead of “create entire budget”) can also significantly reduce overwhelm.

Conquering Fitness Inertia

Fitness as Self-Care, Not Punishment

Similarly, overcoming fitness procrastination requires changing the narrative from punitive workouts to joyful movement and self-care. Many view exercise as a necessary evil to burn calories or lose weight. A more sustainable mindset sees physical activity as a celebration of what your body can do, a stress reliever, an energy booster, and a vital component of long-term health.

- Find Your Joy: Experiment with different activities until you find something you genuinely enjoy, making consistency easier.

- Focus on How You Feel: Shift the focus from aesthetic outcomes to the immediate benefits: increased energy, reduced stress, improved mood.

- Celebrate Small Wins: Acknowledge simply showing up, completing a short walk, or choosing healthier food. Consistency over intensity is key.

This shift helps cultivate intrinsic motivation, making exercise a sustainable and enjoyable part of your lifestyle rather than a dreaded task.

Practical Strategies to Reinforce Your New Mindset

A mindset shift is powerful, but it needs practical reinforcement to become a habit:

- Identify Your ‘Why’: Deeply connect your financial and fitness goals to your core values and aspirations. Why is this important to you?

- Visualize Success: Regularly imagine yourself achieving your goals and experiencing the positive outcomes.

- Break It Down: Transform overwhelming tasks into micro-actions that are easy to start and complete.

- Automate When Possible: Set up automatic transfers for savings/investments and schedule workouts in advance.

- Practice Self-Compassion: Don’t beat yourself up over setbacks. Acknowledge them, learn, and gently guide yourself back on track.

- Seek Accountability: Share your goals with a trusted friend, family member, or mentor.

Conclusion: The Power of Perspective

Ultimately, overcoming procrastination in finance and fitness isn’t solely about brute force or endless willpower. It’s about a profound shift in perspective – moving from a mindset of obligation and dread to one of opportunity, self-care, and investment in your most valuable asset: yourself. By consciously choosing to reframe how you view these critical areas of your life, you empower yourself to take consistent action, build positive habits, and achieve lasting success and well-being.