The Interplay of Body and Bank Account

For many men, the pursuit of consistent fitness and robust financial health often feels like an uphill battle, marked by bursts of enthusiasm followed by frustrating plateaus. Both domains demand sustained effort, foresight, and a resilience that can be challenging to maintain. But what if the secret to consistency in both isn’t about more willpower, but a fundamental shift in how you perceive yourself and your future?

It’s no coincidence that men who excel in one area often find success in the other. Both fitness and finance hinge on principles like delayed gratification, strategic planning, and the compounding effect of small, consistent actions over time. The real challenge, however, isn’t in understanding these principles but in internalizing them to the point where they become second nature.

Shifting from Obligation to Investment

The most profound mindset shift for men seeking consistent fitness and financial discipline lies in transforming the perception of these activities from mere obligations or chores into critical investments in their future selves. Instead of seeing a workout as something you have to do, or saving money as something you should do, reframe them as acts of self-investment that yield exponential returns.

This perspective changes everything. When you view your body as a high-value asset and your finances as the foundation for future freedom, the motivation shifts from external pressure to internal conviction. You wouldn’t neglect a crucial investment, so why neglect your health or wealth?

Embracing Delayed Gratification as a Superpower

At the heart of this investment mindset is the mastery of delayed gratification. In an age of instant satisfaction, choosing long-term gains over short-term pleasures is a superpower. Every healthy meal chosen over junk food, every dollar saved instead of spent impulsively, is an affirmation of your commitment to your future self. This isn’t about deprivation; it’s about strategic prioritization.

Building Consistency Through Small, Non-Negotiable Wins

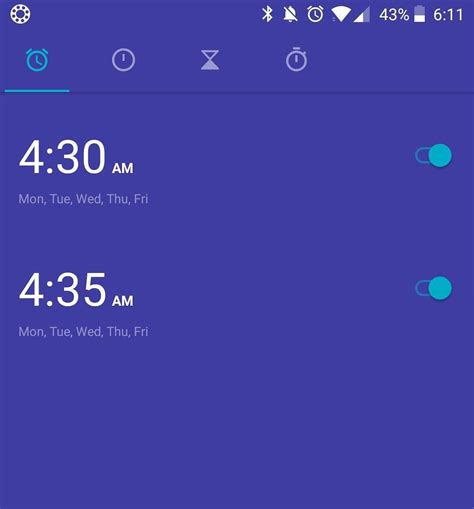

Consistency isn’t born from monumental efforts but from the accumulation of small, deliberate actions. Treat your workouts and financial planning sessions as non-negotiable appointments with yourself. Just as you wouldn’t cancel a critical business meeting, make these commitments sacrosanct. The power lies in showing up, even when motivation wanes, because showing up reinforces your identity as a disciplined individual.

Practical Application: The Investment Playbook

For Fitness: Train Your Future Body

Approach your fitness not just for aesthetics or immediate performance, but as a preventative measure and an enhancement for your life decades from now. Think of each workout as a deposit into your health longevity account. This means prioritizing sustainable practices, injury prevention, and building strength and mobility that serves you long-term.

For Finance: Pay Your Future Self First

Apply the same principle to your finances. Automate savings and investments so that you literally pay your future self before any other expenses. View your investment portfolio not just as numbers on a screen, but as the tangible representation of your future security, freedom, and ability to provide for yourself and your loved ones. This perspective makes financial discipline less about restriction and more about empowerment.

The Compounding Effect of Dual Discipline

Remarkably, progress in one area often fuels the other. As you gain physical discipline, you build confidence and mental fortitude that spills over into your financial decisions. Conversely, as you see your financial wealth grow, the sense of control and accomplishment can inspire greater commitment to your physical well-being. This creates a virtuous cycle, where each success reinforces the other, compounding your overall growth.

Beyond Discipline: Cultivating an Identity

Ultimately, this mindset shift moves beyond simply doing disciplined things to being a disciplined man. It’s about cultivating an identity as someone who values long-term investment in himself, who understands the power of consistency, and who takes proactive steps to shape his future. This identity becomes the bedrock upon which lasting fitness and financial discipline are built, making consistency less about brute force willpower and more about natural alignment with who you are.

The Path Forward

The journey to consistent fitness and financial discipline is not always easy, but the mindset shift from obligation to investment provides a powerful, enduring framework. By viewing your body and your bank account as invaluable assets requiring continuous, strategic investment, you unlock a profound wellspring of motivation and resilience. Embrace this shift, and watch as the discipline you cultivate in one area seamlessly elevates the other, forging a stronger, wealthier, and more capable version of yourself.