The Interconnectedness of Fitness and Financial Discipline

Many might view fitness and financial discipline as distinct realms, yet the underlying psychological blueprints for success in both are remarkably similar. Both demand foresight, self-control, and an unwavering commitment to a future self that is healthier and more secure. Understanding and cultivating this core mindset is not just about achieving specific goals, but about forging a more disciplined, resilient, and empowered way of life.

At its heart, consistent discipline in both areas stems from a profound shift in perspective – moving away from instant gratification towards valuing long-term well-being. It’s about recognizing that small, consistent actions performed daily accumulate into significant results over time. But what specific mental traits and approaches are crucial for building and sustaining this dual discipline?

Pillars of a Disciplined Mindset

1. Long-Term Vision & Delayed Gratification

This is perhaps the most critical shared trait. Whether it’s resisting an unhealthy snack or an impulsive purchase, the disciplined individual prioritizes future benefits over immediate pleasure. They can vividly imagine the person they want to become and the life they want to lead, and this vision acts as a powerful motivator. This isn’t about deprivation but about making conscious choices aligned with deeply held values.

2. Self-Awareness & Honest Assessment

To improve, you must first know where you stand. This means regularly checking your bank balance, tracking your spending, weighing yourself, or monitoring your fitness progress. It requires an honest, non-judgmental look at current habits and their outcomes. This self-awareness fuels the creation of realistic goals and identifies areas needing adjustment.

3. Process-Oriented Thinking

While goals are important for direction, the truly disciplined mindset focuses on the process. It’s about consistently showing up, putting in the work, and trusting that the results will follow. For fitness, it’s adhering to the workout plan; for finance, it’s sticking to the budget and savings plan. The satisfaction comes from the adherence to the process itself, rather than solely waiting for the outcome.

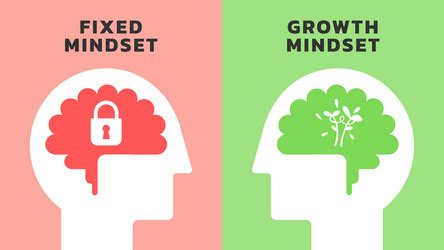

4. Resilience and Adaptability (The Growth Mindset)

Setbacks are inevitable. A missed workout, an unexpected expense, a lapse in diet – these are not failures but opportunities to learn and adjust. A disciplined mindset embodies a growth mindset, viewing challenges as chances to improve strategies rather than reasons to give up. It means getting back on track quickly, without succumbing to guilt or self-pity.

Cultivating the Mindset: Practical Strategies

A. Set Clear, Attainable Goals

Define what ‘fit’ or ‘financially secure’ means to you. Break down big goals into smaller, manageable steps. This makes the journey less daunting and provides tangible milestones to celebrate.

B. Build Sustainable Habits

Discipline thrives on habit. Start small: saving $5 a day, walking 15 minutes, preparing one healthy meal. Consistency over intensity is key. Leverage habit stacking (e.g., going for a walk immediately after dinner) to integrate new routines seamlessly.

C. Automate Whenever Possible

Reduce the need for willpower. Automate savings transfers, set up recurring bill payments, or pre-plan meals and workouts. The less you have to think about making the ‘right’ choice, the easier it becomes.

D. Practice Self-Compassion

Be kind to yourself when you stumble. Acknowledge the slip, learn from it, and recommit. Self-criticism often leads to spiraling negative patterns, while self-compassion fosters resilience and a quicker return to positive habits.

E. Educate Yourself Continually

Learn about nutrition, exercise science, personal finance strategies, and behavioral psychology. Knowledge empowers better decision-making and reinforces the ‘why’ behind your efforts.

Conclusion: A Lifetime of Integrated Discipline

Building consistent fitness and financial discipline isn’t about perfection; it’s about persistent, mindful effort guided by a powerful internal compass. It requires embracing a long-term perspective, cultivating self-awareness, focusing on processes, and developing an unshakeable resilience in the face of challenges. By nurturing these core mindset traits, individuals can not only achieve their health and wealth goals but also build a foundation for an enriched, balanced, and truly disciplined life.