Taking Control: The Power of a Simple Budget for Men

For many men, the idea of budgeting can seem daunting, restrictive, or even unnecessary. However, in an increasingly complex financial landscape, having a clear, effective budget is not just beneficial; it’s a fundamental tool for achieving financial independence, reducing stress, and building a secure future. Whether you’re grappling with credit card debt, striving to save for a down payment, or planning for retirement, a well-chosen budget rule can be the game-changer you need.

The goal isn’t to deprive yourself but to empower yourself with knowledge and control over where your money goes. A strong financial foundation allows for greater freedom, the pursuit of passions, and the ability to weather unexpected storms. The challenge lies in finding a rule that is both simple enough to stick to and robust enough to deliver significant results.

Why the 50/30/20 Rule Reigns Supreme

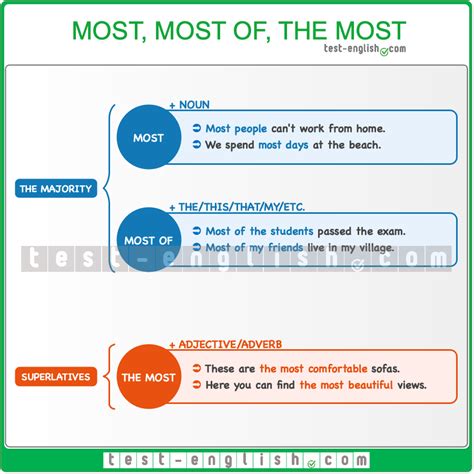

Among the myriad of budgeting strategies, the 50/30/20 rule stands out as perhaps the most effective and widely applicable, especially for men looking for a straightforward yet powerful approach. Popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, this rule simplifies your financial allocation into three core categories:

- 50% for Needs: This covers essential expenses you can’t live without.

- 30% for Wants: These are non-essential expenses that improve your quality of life.

- 20% for Savings & Debt Repayment: This is dedicated to building your financial future and eliminating existing liabilities.

Its effectiveness lies in its balance and clarity. It doesn’t demand meticulous tracking of every penny (like zero-based budgeting) but provides a flexible framework that ensures your core financial goals are met.

Breaking Down the Categories: Needs, Wants, and Financial Goals

- 50% Needs: Think rent/mortgage, utilities, groceries, transportation (gas, public transport), insurance premiums, minimum debt payments, and essential medical care. If you absolutely need it to survive and maintain your job, it’s a need.

- 30% Wants: This is where discretionary spending comes in. Dining out, entertainment, subscriptions (streaming, gym), hobbies, vacations, new gadgets, and upgraded clothing all fall here. These are things that make life enjoyable but aren’t strictly necessary for survival.

- 20% Savings & Debt Repayment: This is the engine of your financial progress. It includes contributions to your emergency fund, retirement accounts (401k, IRA), investment portfolios, and any payments above the minimums for high-interest debt like credit cards or personal loans. This category is crucial for boosting savings and accelerating debt elimination.

Implementing the 50/30/20 Rule: A Step-by-Step Guide

- Calculate Your Net Income: Start with your take-home pay after taxes and deductions. This is the total amount you have to work with each month.

- Categorize Your Expenses: For one or two months, meticulously track all your spending. Use a spreadsheet, a budgeting app, or even a notebook to identify what goes into ‘Needs,’ ‘Wants,’ and ‘Savings & Debt.’ Be honest with yourself about what truly is a ‘need’ versus a ‘want.’

- Adjust and Automate: Compare your actual spending to the 50/30/20 percentages. If your ‘Needs’ are over 50%, look for areas to cut back (e.g., cheaper housing, reducing grocery bills). If ‘Wants’ are too high, identify where you can trim. The key is to funnel at least 20% consistently into savings and debt repayment. Automate transfers to savings accounts or investment vehicles on payday to ensure you ‘pay yourself first.’

Beyond the Rule: Enhancing Your Financial Journey

While the 50/30/20 rule provides an excellent foundation, integrating a few complementary strategies can supercharge your progress:

- Automate Everything Possible: Set up automatic transfers for your savings, investments, and even bill payments. This removes the decision-making fatigue and ensures consistency.

- Tackle High-Interest Debt First: Within your 20% allocation, prioritize paying down high-interest debt (like credit cards) using either the debt snowball (smallest debt first for psychological wins) or debt avalanche (highest interest rate first for mathematical efficiency) method.

- Utilize Budgeting Apps: Tools like Mint, YNAB (You Need A Budget), or Personal Capital can link to your bank accounts, categorize transactions, and provide visual insights into your spending habits, making adherence to the 50/30/20 rule easier.

Overcoming Common Budgeting Hurdles

Sticking to any budget can present challenges. Unexpected expenses, a desire for instant gratification, or simply losing motivation are common pitfalls. To overcome these:

- Build an Emergency Fund: Aim for 3-6 months of living expenses in a separate, accessible savings account. This prevents unexpected costs from derailing your budget and prevents new debt.

- Regularly Review and Adjust: Your financial situation and goals will evolve. Review your budget monthly or quarterly and make necessary adjustments.

- Find an Accountability Partner: Share your financial goals with a trusted friend, partner, or financial advisor. Having someone to discuss your progress and challenges with can provide crucial motivation.

- Celebrate Small Wins: Acknowledge your progress, no matter how small. Paying off a credit card, hitting a savings milestone, or simply sticking to your budget for a month are all victories worth celebrating responsibly.

Your Path to Financial Freedom

The 50/30/20 rule offers a simple, powerful, and sustainable framework for men to take command of their finances. By clearly delineating between needs, wants, and financial goals, it provides a roadmap to boost savings, aggressively cut debt, and ultimately build a secure and prosperous future. It’s not about restriction, but about smart allocation that paves the way for greater freedom and peace of mind. Start today, stay consistent, and watch your financial landscape transform.