Understanding Men’s Financial Aspirations for Long-Term Wealth

The pursuit of long-term financial security and wealth accumulation is a common goal, yet the specific strategies and targets can vary significantly among individuals. When it comes to men, specifically, aiming to save or invest a certain percentage of their take-home pay each month, several factors come into play, making a single ‘average’ figure elusive but allowing for an exploration of common benchmarks and influencing variables, excluding immediate debt repayment strategies.

Common Financial Benchmarks and Rules of Thumb

Financial experts often recommend general savings guidelines that apply broadly, regardless of gender. The most widely cited is the ’50/30/20 Rule,’ which suggests allocating 50% of your take-home pay to needs, 30% to wants, and 20% to savings and debt repayment. For long-term wealth accumulation specifically, without counting immediate debt repayment, this 20% target is a popular aspirational benchmark. Some go further, advocating for saving 10-15% of gross income (which translates to a higher percentage of take-home pay) for retirement alone.

While these rules provide a solid foundation, individual aims can diverge based on personal circumstances, career stage, and financial literacy. Men, often influenced by societal expectations of providing and securing a family’s future, may feel a strong impetus to meet or exceed these benchmarks, particularly as they approach key life milestones such as marriage, parenthood, or mid-career.

Factors Influencing Saving and Investing Goals

Several factors critically shape how much men aim to save or invest:

- Income Level and Career Stage: Higher earners often have greater capacity to save a larger percentage of their income. Younger men might start with lower percentages but aim to increase them as their careers advance and salaries grow.

- Age and Retirement Horizon: Those closer to retirement typically aim to save more aggressively to catch up or ensure a comfortable post-work life. Younger individuals, while having time on their side, also need to build substantial momentum.

- Family Responsibilities: Men with dependents often face competing financial demands, such as childcare, education savings, or supporting elderly parents, which can influence the percentage they can realistically allocate to personal long-term wealth.

- Cost of Living: Residing in high-cost-of-living areas can significantly reduce the discretionary income available for saving, even for those with good salaries.

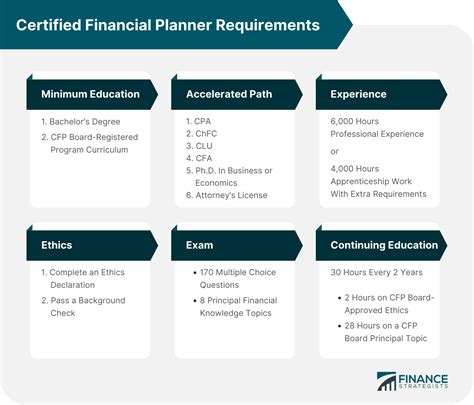

- Financial Education and Awareness: A strong understanding of compound interest, investment vehicles, and retirement planning can motivate men to set higher and more consistent saving targets.

- Cultural and Social Norms: In some cultures, there’s a strong emphasis on intergenerational wealth transfer or providing substantial financial security for family, which can drive higher saving rates.

Aspirational vs. Actual Saving Rates

It’s important to differentiate between aspirational saving targets and actual saving rates. While many men might aim for a significant portion, such as 15-20% or even higher for aggressive wealth builders, real-world constraints can lead to lower actual contributions. Surveys and studies often show median saving rates for individuals and households varying, but few break down these aspirations specifically by gender for long-term goals without debt. However, a common aspirational target for financial independence or early retirement often hovers around 25% or more of take-home pay, especially within the FIRE (Financial Independence, Retire Early) community.

For the average man, a realistic and ambitious aim for long-term wealth accumulation (excluding debt) could fall anywhere between 15% and 25% of take-home pay. This range allows for significant growth over decades, assuming consistent contributions and reasonable investment returns.

Strategies to Achieve Saving Goals

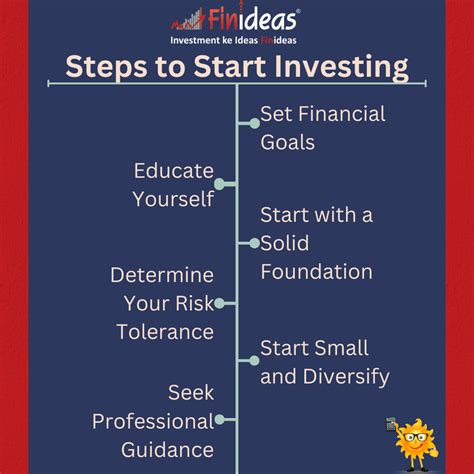

To meet or exceed these ambitious saving targets, men often employ various strategies:

- Automate Savings: Setting up automatic transfers from checking to savings or investment accounts ensures consistency.

- Maximize Employer-Sponsored Plans: Contributing at least enough to get the full employer match in 401(k)s or similar plans is crucial.

- Utilize Tax-Advantaged Accounts: Maximizing contributions to IRAs, Roth IRAs, HSAs, and other tax-efficient vehicles.

- Increase Income: Seeking raises, side hustles, or career advancement to boost earning potential.

- Control Expenses: Budgeting and mindfully reducing unnecessary spending to free up more funds for investment.

- Educate Continuously: Staying informed about investment strategies and market trends.

Conclusion

While there isn’t a universally agreed-upon ‘average percentage’ that men specifically aim to save or invest each month for long-term wealth, a strong aspirational target for many, excluding immediate debt repayment, often falls in the range of 15% to 25% of take-home pay. This goal is influenced by a complex interplay of personal income, age, family obligations, financial literacy, and broader economic conditions. Ultimately, the most effective saving strategy is one that is consistently maintained, adjusted as life circumstances change, and aligned with individual financial aspirations for a secure future.