Achieving financial independence (FI) is a dream for many – the freedom to live life on your own terms, unconstrained by the need to work for money. While the concept sounds appealing, turning it into a reality requires a disciplined and optimized approach to your investments. It’s not just about saving; it’s about making your money work smarter and harder for you. This article will outline actionable steps to streamline your investment strategy, putting you firmly on the path to financial freedom.

1. Define Your Financial Independence (FI) Number

The first and most crucial step is to quantify your goal. Financial independence isn’t a vague concept; it’s a specific number. A common rule of thumb is the “25x Rule,” where your FI number is 25 times your anticipated annual expenses. For example, if you expect to spend $50,000 per year in retirement, your FI number would be $1,250,000. Calculating this target provides a clear destination for your investment journey. Don’t forget to factor in inflation and potential healthcare costs when projecting future expenses.

2. Supercharge Your Savings Rate

While investment returns are vital, your savings rate is often the most powerful lever you can pull, especially in the early stages. The higher your savings rate, the faster you can reach your FI number. This involves a two-pronged approach: increasing your income and aggressively reducing your expenses. Look for opportunities to earn more through side hustles, skill development, or salary negotiations. Simultaneously, scrutinize your budget for areas where you can cut back without sacrificing your quality of life too much. Automate your savings to make it a consistent habit rather than an afterthought.

3. Prioritize Tax-Advantaged Investment Vehicles

Optimizing for FI means making the most of every dollar, and tax efficiency plays a massive role. Maximize contributions to tax-advantaged accounts like 401(k)s, IRAs (Roth or Traditional), and Health Savings Accounts (HSAs). These accounts offer significant tax benefits, such as tax-deferred growth or tax-free withdrawals, which can dramatically accelerate your wealth accumulation over time. Understand the contribution limits and choose the accounts that best align with your current income and projected future tax bracket.

4. Invest in Low-Cost, Diversified Index Funds or ETFs

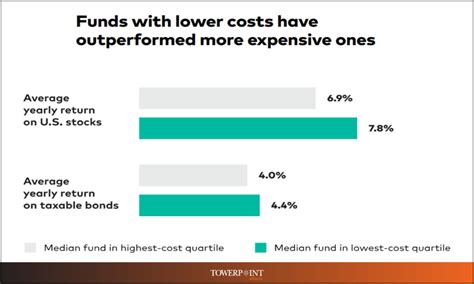

For most people, attempting to beat the market through individual stock picking is a losing game. A far more effective strategy is to invest in broadly diversified, low-cost index funds or Exchange Traded Funds (ETFs). These funds track an entire market index (like the S&P 500) and offer instant diversification across hundreds or thousands of companies, minimizing risk while capturing overall market growth. Their low expense ratios mean more of your money stays invested and compounds for you, rather than going to management fees.

5. Automate Contributions and Rebalance Regularly

Consistency is key. Set up automatic contributions from your checking account to your investment accounts immediately after payday. This “pay yourself first” strategy ensures you’re always investing and eliminates the temptation to spend the money. Equally important is regular portfolio rebalancing. Over time, some assets will grow faster than others, throwing your desired asset allocation out of balance. Periodically (e.g., annually), adjust your portfolio back to your target allocation by selling appreciated assets and buying underperforming ones, or by directing new contributions to underweighted asset classes. This maintains your risk profile and ensures long-term optimization.

6. Minimize Fees and Taxes

Every percentage point in fees or taxes eats into your returns and delays your FI date. Be vigilant about minimizing both. Choose investment products with the lowest possible expense ratios. For taxable accounts, employ strategies like tax-loss harvesting where applicable, and be mindful of capital gains taxes. Consider the tax implications of your withdrawals during retirement, leveraging different account types (taxable, tax-deferred, tax-free) strategically to optimize your income stream.

7. Continuously Learn, Adapt, and Stay Patient

The financial landscape is always evolving, and so too might your personal circumstances. Stay informed about market trends, economic changes, and new investment strategies. Review your FI plan periodically (e.g., annually) to ensure it still aligns with your goals and adjust as necessary. Financial independence is a marathon, not a sprint. There will be market downturns and periods of slow growth. Patience, discipline, and a long-term perspective are essential to weathering these storms and staying on track.

Conclusion

Optimizing your investments for financial independence is a systematic process that combines clear goal setting, aggressive saving, smart investing in tax-advantaged and low-cost vehicles, automation, and continuous learning. By consistently implementing these actionable steps, you can significantly accelerate your journey towards financial freedom and build a secure future where your money works for you.