Achieving financial fitness and building wealth isn’t a mystical journey; it’s a series of deliberate, actionable steps taken consistently over time. Whether you’re just starting out or looking to refine your strategy, the principles remain the same: smart planning, disciplined execution, and continuous learning. Here’s a comprehensive guide to help you take control of your financial future.

Set Clear, Achievable Financial Goals

Before you can build wealth, you need to define what wealth means to you. Are you saving for a down payment, retirement, a child’s education, or financial independence? Specific, measurable, achievable, relevant, and time-bound (SMART) goals provide direction and motivation.

- Short-term goals (1-3 years): Build an emergency fund, pay off a small credit card debt.

- Mid-term goals (3-10 years): Save for a down payment, buy a new car, pay off student loans.

- Long-term goals (10+ years): Retirement, child’s college fund, financial independence.

Regularly review and adjust your goals as your life circumstances change.

Master Your Budget and Track Spending

Understanding where your money goes is the bedrock of financial fitness. A budget isn’t about restriction; it’s about intentional spending and saving. Use apps, spreadsheets, or even pen and paper to categorize your income and expenses.

- The 50/30/20 Rule: Allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment.

- Identify spending leaks: Pinpoint areas where you can reduce unnecessary expenses without sacrificing your quality of life.

- Automate savings: Set up automatic transfers from your checking to your savings and investment accounts on payday.

Tackle Debt Strategically

High-interest debt, especially credit card debt, can be a major roadblock to wealth building. Prioritizing its elimination frees up significant cash flow for savings and investments.

- High-interest first (Debt Avalanche): Focus on paying off debts with the highest interest rates first, as this saves you the most money over time.

- Smallest balance first (Debt Snowball): Pay off the smallest debt first to gain psychological momentum, then roll that payment into the next smallest.

- Consider consolidation: For eligible individuals, consolidating high-interest debts into a lower-interest loan can simplify payments and reduce overall costs.

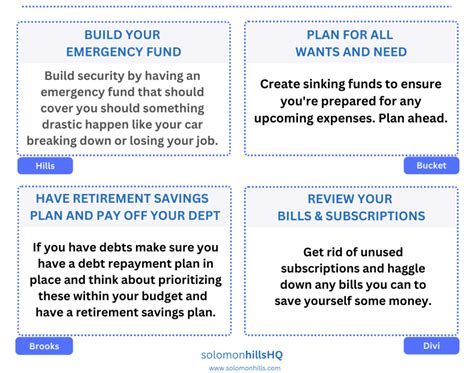

Build a Robust Emergency Fund

Life is unpredictable. An emergency fund acts as your financial safety net, preventing you from going into debt when unexpected expenses arise (job loss, medical emergency, car repair). Aim to save 3-6 months’ worth of essential living expenses in an easily accessible, high-yield savings account.

Invest for Growth and the Long Term

Saving money is crucial, but investing is how you make your money work harder for you, leveraging the power of compound interest. Start early, even with small amounts, and maintain a long-term perspective.

- Start with retirement accounts: Maximize contributions to tax-advantaged accounts like a 401(k) (especially if your employer offers a match) and an IRA.

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and geographies. Index funds and ETFs are excellent, low-cost options for diversification.

- Understand risk tolerance: Align your investments with your comfort level for risk and your time horizon. Younger investors typically have a higher capacity for risk.

- Avoid market timing: Focus on consistent contributions and stay invested through market fluctuations. Time in the market beats timing the market.

Diversify Your Income Streams

While often overlooked, increasing your income can significantly accelerate your wealth-building journey. Relying on a single source of income can be risky. Explore ways to generate additional income:

- Side hustles: Freelancing, consulting, driving for ride-sharing services, selling crafts.

- Skill development: Invest in new skills that can lead to promotions or higher-paying job opportunities.

- Passive income: Dividends from investments, rental property income, royalties.

Prioritize Financial Education & Regular Review

The financial landscape is constantly evolving, and so should your knowledge. Dedicate time to learning about personal finance, investing, and economic trends. Read books, listen to podcasts, and follow reputable financial experts.

Furthermore, regularly review your financial plan – at least once a year, or whenever significant life events occur. Check your progress towards goals, rebalance your investment portfolio, and adjust your budget as needed.

Building financial fitness and wealth is a marathon, not a sprint. It requires patience, discipline, and a commitment to continuous improvement. By consistently implementing these actionable steps, you’ll not only boost your financial well-being but also lay a solid foundation for lasting prosperity and peace of mind.