In today’s dynamic economic landscape, consistently growing wealth requires more than just earning a good salary; it demands a proactive, strategic approach to personal finance and investment. For men, taking actionable steps to secure their financial future is crucial for achieving long-term independence, supporting families, and realizing personal aspirations. This guide outlines practical investment strategies and habits to cultivate lasting wealth.

Building a Solid Financial Foundation

Before diving into complex investments, establishing a robust financial foundation is paramount. This involves meticulous budgeting, aggressive saving, and debt management.

Mastering Your Budget

The first step is understanding where your money goes. Create a detailed budget that tracks income and expenses. Utilize the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment) or a similar framework to allocate your funds effectively. Automate savings transfers to ensure consistency, treating your savings as a non-negotiable expense.

Prioritize eliminating high-interest debt, such as credit card balances, as the interest paid on these can significantly erode your ability to save and invest. Consolidate debts where possible or develop a strict repayment plan.

Strategic Investment Approaches for Growth

Once a solid financial base is established, the focus shifts to deploying capital strategically into investment vehicles that offer growth potential.

Diversifying Your Portfolio

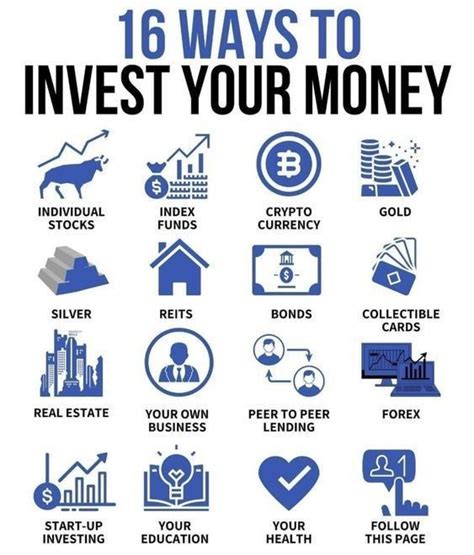

Diversification is key to mitigating risk. Instead of putting all your eggs in one basket, spread your investments across various asset classes:

- Stocks: Invest in a mix of individual stocks (after thorough research), exchange-traded funds (ETFs), and mutual funds, focusing on broad market indices (e.g., S&P 500) for long-term growth.

- Bonds: Incorporate bonds to provide stability and income, especially as you approach retirement. Government bonds and corporate bonds offer different risk/reward profiles.

- Real Estate: Consider real estate through direct property ownership, REITs (Real Estate Investment Trusts), or crowdfunding platforms for portfolio diversification and potential rental income/appreciation.

- Alternative Investments: Explore commodities, cryptocurrencies (with caution and thorough understanding), or private equity if they align with your risk tolerance and financial goals, but these typically require more expertise.

Embracing Long-Term Investing and Compounding

The most powerful tool for wealth growth is time. Start investing early to leverage the power of compounding interest, where your earnings generate further earnings. Adopt a long-term mindset, focusing on growth over decades rather than short-term market fluctuations.

Utilize tax-advantaged accounts like 401(k)s, IRAs, and HSAs to maximize your investment returns by deferring or reducing taxes. Contribute enough to your employer-sponsored 401(k) to at least capture any matching contributions – it’s essentially free money.

Continuous Learning and Risk Management

The investment world is constantly evolving. Staying informed and managing risk effectively are critical for sustained wealth accumulation.

Educate Yourself Continuously

Read financial news, books, and reputable blogs. Understand economic indicators, market trends, and investment principles. Consider financial certifications or courses if you want to deepen your knowledge. The more you understand, the better equipped you will be to make informed decisions and avoid costly mistakes.

Regular Portfolio Review and Rebalancing

Your financial goals and risk tolerance may change over time. Regularly review your investment portfolio (at least annually) to ensure it still aligns with your objectives. Rebalance your assets to maintain your desired allocation, selling off overgrown assets and buying into underperforming ones to bring your portfolio back into equilibrium.

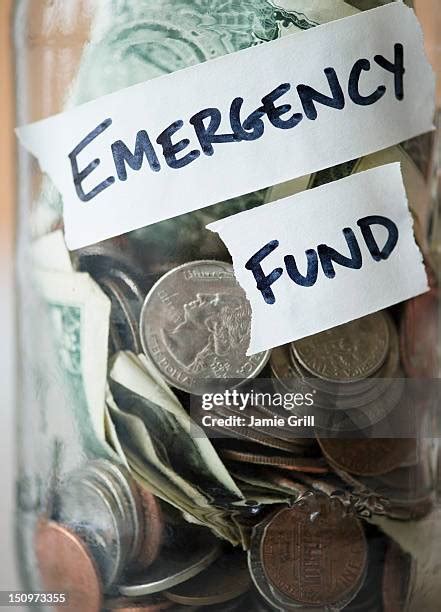

Emergency Fund and Insurance

An often-overlooked but crucial step is establishing a robust emergency fund covering 3-6 months of living expenses. This fund acts as a buffer against unexpected life events (job loss, medical emergencies) and prevents you from having to sell investments at an inopportune time. Additionally, ensure you have adequate insurance coverage (life, health, disability, home/auto) to protect your assets and income.

Conclusion

Consistently growing wealth as a man isn’t about finding a single secret strategy; it’s about disciplined execution of fundamental financial principles. By building a strong financial foundation, strategically diversifying investments, embracing a long-term view, continuously educating yourself, and managing risk, you can systematically build and sustain significant wealth over your lifetime. Start today, stay consistent, and adapt as your circumstances evolve.