Confronting the High-Interest Hurdle to Financial Independence

For many men, the pursuit of financial independence is a core aspiration, a bedrock for security, freedom, and the ability to make choices on their own terms. Yet, an often-overlooked and insidious obstacle stands firmly in the way: high-interest debt. Whether it’s persistent credit card balances, personal loans with steep rates, or even payday loans, these financial burdens can erode wealth, stifle growth, and delay the dreams of true financial freedom. It’s time to confront this challenge head-on with a clear, strategic approach.

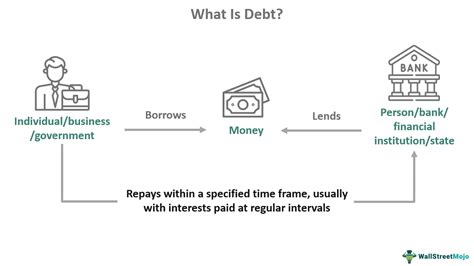

High-interest debt isn’t just a number; it’s a drain on your future. The compounding interest means you’re often paying significantly more than the original amount borrowed, trapping you in a cycle that can feel impossible to escape. Recognizing its impact is the first step toward reclaiming your financial power.

1. Know Your Enemy: Catalog and Understand Your Debt

You can’t defeat what you don’t fully understand. The initial, crucial step is to get a complete picture of all your high-interest debts. Gather statements for every credit card, personal loan, and any other high-APR obligations. List them out, noting the following for each:

- Creditor Name: Who you owe.

- Outstanding Balance: The total amount due.

- Interest Rate (APR): This is key to prioritizing.

- Minimum Payment: What you currently pay each month.

Once you have this consolidated view, you’ll see the full scope of the challenge. Simultaneously, create a detailed budget. Understand exactly where your money goes each month. This will help you identify areas where you can free up cash to direct towards your debt.

2. Choose Your Weapon: Debt Payoff Strategies

With a clear understanding of your debts, it’s time to select a payoff strategy. Two popular methods stand out:

- Debt Avalanche: This method prioritizes paying off debts with the highest interest rates first, while making minimum payments on all others. Once the highest-APR debt is gone, you roll that payment amount into the next highest-APR debt. This strategy saves you the most money on interest over time.

- Debt Snowball: This method focuses on psychological wins. You pay off the smallest balance first (while making minimum payments on others). Once it’s paid, you take the money you were paying on that debt and add it to the payment of the next smallest debt. The quick wins can provide powerful motivation to keep going, even if it costs slightly more in interest.

Choose the method that best suits your personality and financial discipline. Consistency is more important than the specific strategy.

3. Boost Your Ammo: Increase Income, Cut Expenses

To accelerate your debt payoff, you need more capital to throw at the problem. This can come from two main avenues:

- Increase Your Income: Look for opportunities to earn extra money. This could be a side hustle, freelance work, overtime at your current job, or even selling unused items around your home. Every extra dollar directed towards high-interest debt makes a significant difference.

- Cut Unnecessary Expenses: Review your budget with a critical eye. Can you cut back on dining out, subscriptions, or impulse purchases? Even small, consistent cuts can free up substantial funds over time. Think of it as temporary belt-tightening for long-term gain.

4. Consider Reinforcements: Consolidation and Refinancing

In some cases, you might be able to lower your overall interest burden by consolidating or refinancing your debts:

- Debt Consolidation Loan: If you have good credit, you might qualify for a personal loan with a lower interest rate than your credit cards. You’d use this loan to pay off multiple high-interest debts, leaving you with one single, lower-interest payment.

- Balance Transfer Credit Card: Some credit cards offer 0% APR for an introductory period (e.g., 12-18 months) on balance transfers. If you can transfer your high-interest balances and pay them off completely before the promotional period ends, this can be a powerful tool. Be wary of balance transfer fees and ensure you have a solid plan to pay it off, as the interest rate will jump significantly after the intro period.

These options aren’t a magic bullet; they’re tools. Use them only if they genuinely lower your interest and you’re committed to not accruing new debt.

5. Build Your Defense: Emergency Fund and Automation

As you tackle debt, it’s crucial to build a financial defense. Aim to establish a small emergency fund (e.g., $1,000) early on. This fund acts as a buffer against unexpected expenses, preventing you from falling back into debt when life inevitably throws a curveball.

Once you have a strategy, automate your payments. Set up automatic transfers for your minimum payments, and if possible, additional payments, on the day you get paid. This ensures you never miss a payment and consistently chip away at your debt. Make debt repayment a non-negotiable line item in your budget.

The Path to True Independence

Tackling high-interest debt is a marathon, not a sprint. It requires discipline, consistency, and a clear vision of the financial independence you’re striving for. Each payment you make is a step closer to taking control of your financial destiny, freeing up capital for investments, savings, and ultimately, a life built on your terms. This journey isn’t just about paying off loans; it’s about building lasting financial habits and empowering yourself to achieve genuine independence. Stay focused, stay disciplined, and watch as the burden of high-interest debt diminishes, revealing the clear path to your financial goals.