High-interest credit card debt can feel like a relentless uphill battle, with minimum payments barely scratching the surface of the principal while interest charges pile up. However, with a strategic approach, it’s possible to not only pay off these debts but also save a substantial amount of money and stress in the process. The ‘smartest’ way often depends on your personal financial situation and psychological make-up, but several proven methods stand out.

Understanding the High-Interest Trap

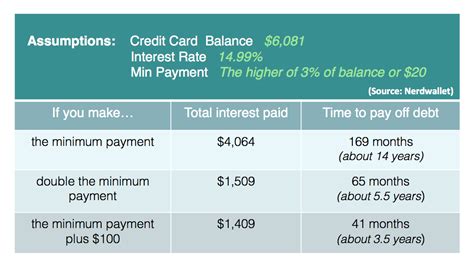

Before diving into solutions, it’s crucial to understand why high-interest debt is so dangerous. Credit card interest rates can soar well above 20%, meaning a significant portion of your monthly payment goes directly to interest, not reducing the amount you owe. This perpetual cycle can keep you indebted for years, costing you far more than the original purchases. Breaking free requires a clear plan and disciplined execution.

1. The Debt Avalanche Method: Mathematically Optimal

The debt avalanche method prioritizes paying off debts with the highest interest rates first. You make minimum payments on all your accounts except for the one with the highest APR. On that account, you throw every extra dollar you can find. Once the highest-interest debt is paid off, you take the money you were paying on it and apply it to the next highest-interest debt. This continues until all debts are clear.

- Pros: Saves you the most money on interest over time.

- Cons: Can feel slow initially, as smaller balances might not be the highest interest.

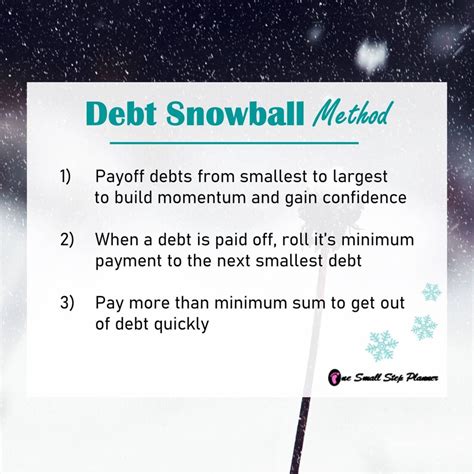

2. The Debt Snowball Method: Psychologically Motivating

The debt snowball method focuses on paying off the smallest balances first, regardless of the interest rate. You make minimum payments on all accounts except the one with the smallest balance, to which you apply all extra funds. Once that smallest debt is paid, you take the money you were paying on it and add it to the payment for the next smallest debt. The idea is that the quick wins provide psychological momentum to keep you going.

- Pros: Offers quick wins, boosting motivation.

- Cons: May cost more in interest over the long run compared to the avalanche method.

3. Balance Transfers: Leveraging 0% APR Offers

A balance transfer involves moving existing credit card debt from one or more cards to a new credit card, typically one offering a promotional 0% Annual Percentage Rate (APR) for an introductory period (e.g., 12-18 months). This strategy gives you a window of time to pay down your principal without accruing additional interest.

- Considerations:

- Transfer Fees: Most balance transfers come with a fee, typically 3-5% of the transferred amount.

- Promotional Period: Be sure you can pay off the debt before the 0% APR expires, otherwise, you’ll face high interest on the remaining balance.

- Credit Score: You’ll need a good to excellent credit score to qualify for the best balance transfer offers.

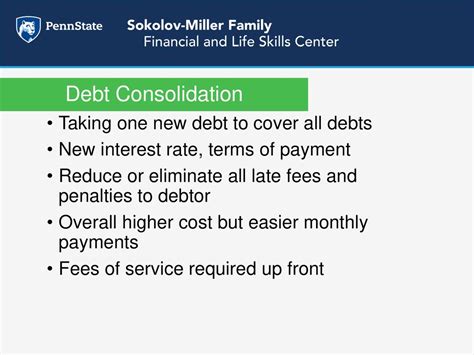

4. Debt Consolidation Loans: A Single, Lower Payment

Debt consolidation involves taking out a new loan to pay off multiple credit card debts. The goal is often to secure a lower interest rate, a fixed monthly payment, and a set repayment period, simplifying your finances and potentially reducing your total interest paid.

- Types: Personal loans, home equity loans (though using secured debt for unsecured debt is risky).

- Pros: Simpler to manage, potentially lower interest, fixed repayment schedule.

- Cons: Still requires discipline to not accrue new debt; can extend repayment period, potentially leading to more interest paid overall if the rate isn’t significantly lower.

5. Credit Counseling and Debt Management Plans (DMPs)

If you’re struggling to manage your debt, a non-profit credit counseling agency can help. They can assess your financial situation and, in some cases, help you enroll in a Debt Management Plan (DMP). Through a DMP, the agency negotiates with your creditors for lower interest rates and a single, manageable monthly payment. You pay the agency, and they distribute funds to your creditors.

- Pros: Lower interest rates, streamlined payments, structured support.

- Cons: Requires closing credit card accounts included in the plan, impacts credit score (though often less than bankruptcy).

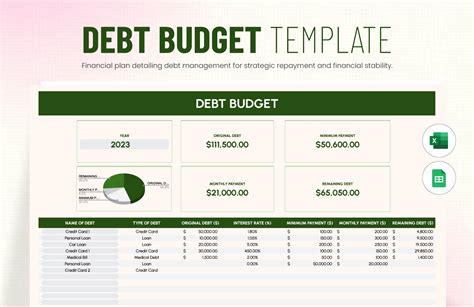

Foundational Steps for Any Strategy

Regardless of which method you choose, these foundational steps are critical for long-term success:

- Create a Detailed Budget: Understand exactly where your money is going and identify areas to cut back.

- Cut Unnecessary Expenses: Temporarily reduce or eliminate discretionary spending to free up more money for debt repayment.

- Increase Income: Explore options for a side hustle, overtime, or selling unused items.

- Avoid New Debt: Commit to not using credit cards while paying off existing balances.

- Build an Emergency Fund: Even a small starter fund can prevent new debt in case of unexpected expenses.

Making Your Choice

The ‘smartest’ way truly depends on you. If you’re disciplined and motivated by numbers, the debt avalanche is often superior. If you need psychological boosts to stay on track, the debt snowball might be more effective. Balance transfers and consolidation loans can provide breathing room and lower rates, but they require careful planning and a commitment to not accumulating new debt.

Conclusion

Paying off high-interest credit card debt requires more than just making payments; it demands a strategic approach, discipline, and commitment. By choosing the method that best suits your personality and financial situation, and by diligently sticking to your plan, you can successfully navigate your way out of debt and reclaim your financial peace of mind. Start today, and watch your progress unfold.