Taming the High-Interest Beast: Your Path to Financial Freedom

High-interest debt can feel like a relentless drag, eroding your income and postponing your financial dreams. Whether it’s credit card balances, personal loans, or other forms of expensive borrowing, the cumulative interest payments can significantly hinder your ability to save, invest, and build wealth. But the good news is that with a strategic approach and consistent effort, you can not only crush high-interest debt but also unlock a new level of financial freedom.

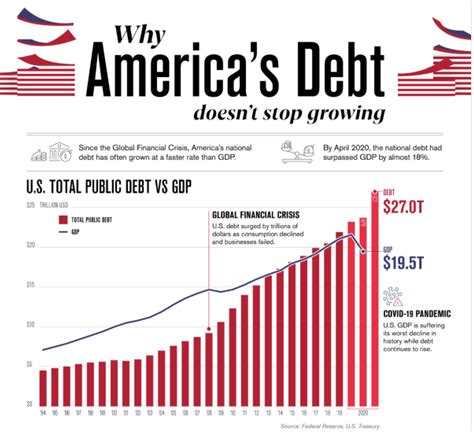

Understanding the Enemy: What Makes High-Interest Debt So Dangerous?

The danger of high-interest debt lies in its compounding nature. Even making minimum payments can mean that a significant portion, sometimes even all, of your payment goes straight to interest, barely touching the principal. This keeps you in a cycle of debt, where balances grow faster than you can pay them down. Common culprits include credit card debt, payday loans, and certain types of personal loans, all of which come with annual percentage rates (APRs) that can quickly spiral out of control.

Strategic Offense: Proven Methods to Crush Your Debt

1. The Debt Avalanche vs. Debt Snowball

These are two of the most popular and effective debt repayment strategies:

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the highest-rate debt is paid off, you take the money you were paying on it and apply it to the next highest-rate debt. This method saves you the most money in interest over time.

- Debt Snowball: Start by paying off the smallest debt balance first, while making minimum payments on all other debts. Once the smallest debt is gone, you roll that payment amount into the next smallest debt. This method provides psychological wins early on, which can be motivating for many.

Choose the method that best aligns with your personality and financial discipline. Both require consistent extra payments to be truly effective.

2. Balance Transfers for Lower Interest

If you have good credit, you might qualify for a balance transfer credit card offering a 0% APR for an introductory period (typically 12-18 months). This can be a powerful tool, as it allows you to pay down your principal without accruing additional interest during that promotional window. Be mindful of balance transfer fees (usually 3-5% of the transferred amount) and ensure you can pay off the transferred balance before the introductory period ends, or you’ll face high interest rates on the remaining balance.

3. Debt Consolidation Loans

A debt consolidation loan allows you to combine multiple high-interest debts into a single new loan, often with a lower interest rate and a fixed monthly payment. This simplifies your payments and can reduce your overall interest costs. However, it’s crucial to ensure the new loan’s interest rate is significantly lower than your current debts and to avoid taking on new debt once your old accounts are paid off.

4. Sharpen Your Budgeting Skills

No debt repayment strategy can succeed without a solid budget. A budget helps you understand where your money is going and identify areas where you can cut back. Every dollar saved from discretionary spending (dining out, entertainment, subscriptions) can be redirected towards your high-interest debt, accelerating your repayment plan. Consider using budgeting apps or spreadsheets to track your income and expenses meticulously.

5. Increase Your Income (If Possible)

Sometimes, simply cutting expenses isn’t enough. Exploring ways to increase your income, such as taking on a side hustle, working overtime, or negotiating a raise, can provide extra funds to aggressively tackle your debt. Even a small increase can make a big difference when consistently applied to your highest-interest balances.

Beyond Debt: Building Your Financial Freedom

Once you’ve systematically crushed your high-interest debt, the journey towards financial freedom truly begins. Here’s what comes next:

- Build an Emergency Fund: Aim for 3-6 months’ worth of living expenses in a separate, easily accessible savings account. This fund acts as a buffer against unexpected costs, preventing you from falling back into debt.

- Start Investing: Once your emergency fund is solid, begin investing for your long-term goals, such as retirement or a down payment on a home. Compound interest, which was once your enemy, now becomes your greatest ally.

- Live Below Your Means: Continue the disciplined spending habits you developed while paying off debt. This mindset will help you save more, invest more, and build lasting wealth.

- Review and Adjust: Regularly review your financial plan, adjust your budget as needed, and stay informed about personal finance strategies.

The Bottom Line

Crushing high-interest debt and boosting your financial freedom is a marathon, not a sprint. It requires discipline, sacrifice, and a clear plan. By understanding your debt, employing smart repayment strategies, and maintaining a commitment to responsible financial habits, you can escape the debt trap and build a secure, prosperous future for yourself. The smartest way forward is often the most direct: confront your debt head-on, pay it down aggressively, and then redirect that financial energy into building your wealth.