High-interest credit card debt can feel like a heavy anchor, dragging down your financial progress and causing immense stress. The good news is that with a smart strategy and consistent effort, you can not only pay it off but crush it quickly, freeing up your finances for more productive goals. The key is to be intentional and choose the method that best suits your financial situation and psychological motivation.

Choose Your Weapon: Debt Avalanche or Debt Snowball

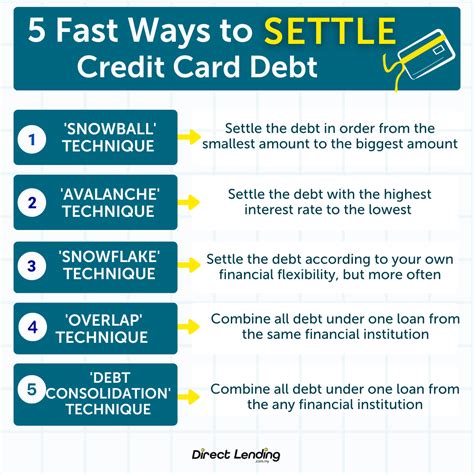

When facing multiple credit card debts, two popular strategies emerge: the debt avalanche and the debt snowball. Both require committing extra funds to debt repayment, but their approach differs significantly.

The debt avalanche method focuses on interest rates. You list all your debts from the highest interest rate to the lowest. You then make minimum payments on all cards except the one with the highest interest rate, to which you apply all your extra payments. Once that card is paid off, you roll the money you were paying on it (plus the minimum payment) to the next highest interest rate card. This method saves you the most money in interest over time.

Conversely, the debt snowball method prioritizes psychological wins. You list your debts from the smallest balance to the largest. You make minimum payments on all cards except the one with the smallest balance, attacking it with all your extra funds. Once that smallest debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next smallest debt. This creates a “snowball” effect, offering quick wins that keep you motivated, even if it costs slightly more in interest in the long run.

Strategic Balance Transfers: A Powerful Play

One of the quickest ways to stop high-interest debt in its tracks is a balance transfer. This involves moving existing credit card balances to a new credit card that offers a 0% introductory APR for a promotional period (typically 12-21 months). During this period, all your payments go directly to the principal, allowing you to pay down debt much faster without battling interest charges.

However, be cautious: look out for balance transfer fees (usually 3-5% of the transferred amount), which can negate some savings. Crucially, aim to pay off the entire transferred balance before the promotional period ends, as the interest rate will revert to a much higher variable rate. Avoid making new purchases on the balance transfer card during this time.

Debt Consolidation Loans: Streamline and Save

A personal loan for debt consolidation can be a game-changer if you have good credit. You take out a single loan with a lower, fixed interest rate to pay off multiple high-interest credit card debts. This simplifies your payments to one manageable monthly bill and often significantly reduces the total interest you pay over time. The predictability of fixed payments can also make budgeting easier.

Shop around for the best interest rates and terms, and ensure the loan’s APR is substantially lower than your current credit card rates. While it provides a clear path to becoming debt-free, it’s vital to avoid accumulating new credit card debt once your old balances are paid off, or you could end up in a worse position.

Boost Your Payments: Accelerate Repayment

Regardless of the strategy you choose, the fastest way to crush debt is to pay more than the minimum required payment. Every extra dollar you put towards your principal reduces the total interest you’ll pay and shortens your repayment timeline. Look for ways to free up cash: create a strict budget, cut unnecessary expenses, temporarily pause discretionary spending, or even take on a side hustle to generate additional income.

Consider dedicating any windfalls—like tax refunds, bonuses, or unexpected gifts—directly to your highest-interest debt. Even small, consistent extra payments can make a significant difference over time.

Consider Professional Help: Credit Counseling

If you feel overwhelmed or unsure where to start, non-profit credit counseling agencies can offer invaluable assistance. A certified credit counselor can help you create a personalized budget, negotiate with creditors for lower interest rates or waived fees, and even enroll you in a Debt Management Plan (DMP). In a DMP, you make one monthly payment to the agency, which then distributes funds to your creditors. This often results in reduced interest rates and a clear, finite repayment schedule, typically 3-5 years.

The Path to Freedom

Crushing high-interest credit card debt fast requires a combination of strategic planning, discipline, and sometimes, a little external help. Whether you choose the mathematical precision of the avalanche, the motivational boosts of the snowball, the immediate impact of a balance transfer, or the streamlining power of a consolidation loan, the most important step is to start. Commit to your plan, track your progress, and celebrate your milestones. Financial freedom is within reach.