Understanding the High-Interest Debt Challenge for Men

High-interest debt, often lurking in the form of credit card balances, personal loans, or payday loans, can be a relentless financial drain. For men, the pressure to provide, maintain a certain lifestyle, or even bounce back from unexpected setbacks can exacerbate the challenge, leading to cycles of stress and missed opportunities. Tackling this debt isn’t just about numbers; it’s about regaining control, reducing stress, and building a more secure future for oneself and one’s family. The good news? There are proven, strategic ways to conquer it swiftly.

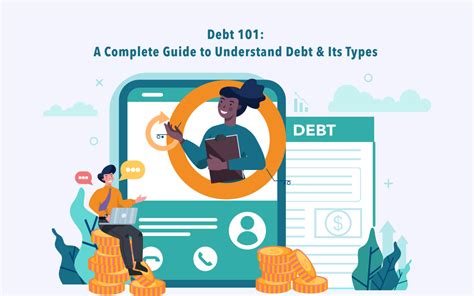

The Core Strategy: Prioritize and Attack

The first step is always to understand the full scope of your debt. List all high-interest debts, including the creditor, current balance, interest rate, and minimum payment. This clarity is crucial.

Debt Avalanche: The Smartest Attack

While the debt snowball (paying off smallest balance first) offers psychological wins, the debt avalanche is mathematically the smartest and fastest way to tackle high-interest debt. Here’s how it works:

- List all your debts from the highest interest rate to the lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Throw every extra dollar you can find at that highest-interest debt until it’s gone.

- Once the first debt is paid off, take the money you were paying on it (minimum payment + extra) and apply it to the next highest-interest debt.

This method minimizes the total interest you pay, leading to a faster overall payoff.

Strategic Tools to Accelerate Your Payoff

Balance Transfers: Buying Time and Lower Rates

If you have excellent credit, a balance transfer credit card can be a powerful tool. These cards often offer 0% APR for an introductory period (e.g., 12-21 months). Transfer your high-interest credit card balances to one of these cards. This gives you a crucial window to pay down the principal without accruing interest. Be mindful of transfer fees (typically 3-5%) and ensure you can pay off the transferred amount before the promotional period ends, or the standard high APR will kick in.

Debt Consolidation Loans: Streamlining Your Payments

For multiple high-interest debts, a personal loan specifically for debt consolidation can simplify your finances. The goal is to get a single loan with a lower, fixed interest rate than what you’re currently paying on your individual debts. This can reduce your monthly payment, save on interest, and provide a clear end date for your debt. Always compare the APR, fees, and repayment terms carefully, and ensure you don’t take on new debt once consolidated.

Boosting Your Cash Flow: The Foundation of Fast Payoff

No strategy works without available funds. Focus on two critical areas:

Aggressive Budgeting and Expense Reduction

Go through your spending with a fine-tooth comb. Identify non-essential expenses you can temporarily cut or significantly reduce. This might mean fewer restaurant meals, canceling unused subscriptions, or finding cheaper alternatives for daily needs. Every dollar saved is a dollar that can go towards your high-interest debt. Create a strict budget and stick to it.

Increasing Income Streams

Look for ways to earn extra money. This could involve freelancing, taking on a side hustle, selling unused items, or negotiating a raise at your current job. Even a few hundred extra dollars a month can make a dramatic difference when applied consistently to your highest-interest debt.

The Mental Game: Discipline and Consistency

Tackling debt, especially high-interest debt, requires mental fortitude.

- Stay Focused: Remind yourself of your “why”—financial freedom, less stress, future security.

- Celebrate Small Wins: Acknowledging progress keeps motivation high.

- Avoid New Debt: This is paramount. Cut up credit cards if necessary or freeze them.

- Build an Emergency Fund: Even a small one (e.g., $1,000) can prevent new debt in an emergency.

Taking Action: Your Roadmap to Financial Freedom

- List Debts: Get a clear picture of all high-interest debts.

- Choose Your Strategy: Implement the debt avalanche. Explore balance transfers or consolidation if credit allows.

- Optimize Cash Flow: Create a lean budget and actively seek ways to increase income.

- Automate Payments: Set up automatic payments to ensure consistency and avoid missed payments.

- Monitor Progress: Regularly review your debt balances and payments to stay on track.

Conclusion: Reclaim Your Financial Power

High-interest debt can feel overwhelming, but it is not insurmountable. By adopting a disciplined, strategic approach focused on the debt avalanche, leveraging tools like balance transfers and consolidation, and aggressively optimizing your cash flow, men can swiftly eliminate these burdens. Taking control of your finances is a powerful act that leads to greater peace of mind and paves the way for future wealth building. Start today, and reclaim your financial power.