Conquering Debt While Forging Wealth: A Man’s Financial Playbook

For many men, the quest for financial security often feels like a constant battle between slaying the dragon of debt and building the fortress of investment capital. It’s a dual challenge that demands a strategic, disciplined, and often aggressive approach. The smartest way to rapidly achieve both isn’t to focus on one exclusively, but to skillfully integrate them into a powerful, synergistic financial plan.

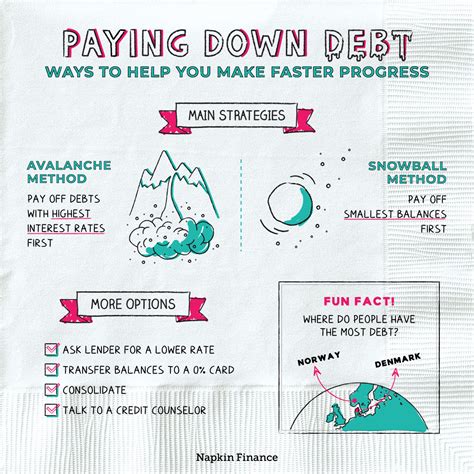

The Debt Decimation Strategy: Attack High-Interest First

Before any significant capital can be built, high-interest debt must be neutralized. This is crucial because the interest rates on credit cards, personal loans, or even some student loans can erode potential investment gains. The most financially intelligent method for rapid debt repayment is often the Debt Avalanche.

- Identify All Debts: List every debt, noting the total amount owed, the minimum payment, and the interest rate.

- Target the Highest Interest: Focus all extra payments on the debt with the highest interest rate, while making minimum payments on all others.

- Snowball Effect (Post-Avalanche): Once the highest-interest debt is paid off, take the money you were paying on that debt and add it to the payment of the next highest-interest debt. This creates a powerful snowball effect, accelerating your progress.

To fuel this avalanche, look for opportunities to increase your income (side hustles, overtime, negotiating a raise) and aggressively cut unnecessary expenses. Every extra dollar should be a weapon against your debt.

Building Your Financial Foundation: Emergency Fund & Employer Match

While the Debt Avalanche is in full swing, there are two non-negotiable financial steps that must be taken to build a robust foundation:

- Establish an Emergency Fund: Before seriously investing, aim for a starter emergency fund of $1,000 to $2,000. This acts as a buffer against unexpected expenses, preventing new debt from derailing your payoff efforts. Once high-interest debt is gone, expand this to 3-6 months of living expenses.

- Capture the Employer Match: If your company offers a 401(k) match, contribute at least enough to receive the full match. This is essentially free money – an immediate, guaranteed return on your investment that you should never leave on the table, even if you have other debts.

These two steps provide stability and kickstart your investment journey without significantly impeding your debt repayment.

Accelerating Capital Growth: Aggressive Savings & Investment

Once high-interest debt is vanquished and your emergency fund is solid, it’s time to pivot your aggressive financial habits towards investment. The same intensity you applied to debt repayment now fuels your wealth building.

- Automate Everything: Set up automatic transfers from your checking to your investment accounts immediately after you get paid. “Pay yourself first” ensures you don’t spend money that should be invested.

- Increase Contribution Rates: Aim to contribute 15% or more of your income to retirement accounts (401k, IRA) and other investment vehicles. As your income grows, resist lifestyle inflation and direct raises towards increasing your investment contributions.

- Strategic Budgeting: Continue to live below your means. Differentiate between needs and wants, and consciously choose to allocate more towards investments rather than discretionary spending.

Smart Investment Strategies for Long-Term Wealth

With capital flowing, the next step is intelligent allocation. For most men building wealth, a diversified, long-term approach is key.

- Diversification: Don’t put all your eggs in one basket. Invest across different asset classes like stocks (growth, value), bonds, and potentially real estate. Index funds and ETFs are excellent, low-cost ways to achieve broad diversification without needing to pick individual stocks.

- Tax-Advantaged Accounts: Max out your 401(k) and IRA (traditional or Roth) contributions. These accounts offer significant tax benefits that supercharge your long-term growth.

- Understand Your Risk Tolerance: Young men typically have a higher capacity for risk, allowing for a more aggressive equity-heavy portfolio. As you age or approach specific financial goals, you might gradually shift towards more conservative investments.

- Long-Term Mindset: Resist the urge to chase fads or panic during market downturns. True wealth is built over decades through consistent contributions and allowing compound interest to work its magic.

Discipline, Consistency, and Review

The smartest financial plan is only as good as its execution. Discipline and consistency are paramount. Regularly review your budget, debt repayment progress, and investment portfolio. Adjust as needed based on life changes, market conditions, and evolving financial goals. Consider seeking advice from a fee-only financial advisor to ensure your strategy aligns with your unique circumstances and aspirations. This integrated approach – aggressively paying down debt while consistently building investment capital – is the most intelligent path for men to achieve rapid financial independence and build lasting wealth.