The Crucial Decade: Why Your 30s are Prime for Wealth Building

Your 30s are a pivotal time for wealth accumulation. Unlike your 20s, you likely have more stable income and less student debt (hopefully), and unlike your 40s or 50s, you still have decades for your investments to compound. For men, leveraging this period effectively can mean the difference between a comfortable retirement and a financially strained one. The goal isn’t just to save, but to invest intelligently for maximum long-term growth.

Laying the Foundation: Goals, Budget, and Emergency Fund

Before diving into specific investments, establish a strong financial bedrock. Define clear financial goals: Do you want to buy a house? Fund your children’s education? Retire early? Knowing your targets will shape your investment strategy. Next, create a detailed budget to understand your cash flow and identify funds available for investing. Crucially, build an emergency fund covering 3-6 months of living expenses. This acts as a safety net, preventing you from having to sell investments prematurely during unexpected hardships.

Maximize Tax-Advantaged Retirement Accounts

This is arguably the smartest first step for long-term wealth. Take full advantage of employer-sponsored plans like a 401(k) or 403(b), especially if there’s a company match – that’s free money! Aim to contribute at least enough to get the full match, then consider maxing out your contributions. Complement this with an Individual Retirement Account (IRA) – either a Traditional or Roth, depending on your income and tax situation. These accounts offer significant tax benefits that accelerate wealth growth over decades.

Prioritize High-Contribution Limits and Tax Benefits

- 401(k)/403(b): Employer contributions, tax-deferred growth, potential for large contributions.

- IRA (Traditional/Roth): Tax deductions (Traditional) or tax-free withdrawals in retirement (Roth), flexibility.

- HSA (Health Savings Account): If eligible, this is a triple-tax advantaged account (tax-deductible contributions, tax-free growth, tax-free withdrawals for qualified medical expenses). It’s a powerful retirement savings vehicle once you’ve covered healthcare costs.

Embrace Diversification with Low-Cost Index Funds and ETFs

Once your tax-advantaged accounts are funded, focus on broad market exposure through low-cost index funds or Exchange Traded Funds (ETFs). These vehicles offer instant diversification, minimizing risk compared to investing in individual stocks. They typically track major market indexes like the S&P 500, giving you exposure to hundreds of companies with a single investment.

- Vanguard, Fidelity, Schwab: Look for funds with low expense ratios (e.g., <0.10%).

- Asset Allocation: In your 30s, a more aggressive allocation (e.g., 80-90% stocks, 10-20% bonds) is often appropriate due to your long time horizon. As you age, you can gradually shift towards a more conservative mix.

Strategic Real Estate and Alternative Investments

While often a later-stage investment, some men in their 30s might consider real estate. This could involve purchasing a primary residence (which builds equity) or, for the more ambitious, an investment property. Real Estate Investment Trusts (REITs) offer a more liquid way to invest in real estate without the direct responsibilities of landlording. Other alternative investments, like peer-to-peer lending or even cautious venture capital (if you have the disposable income and risk tolerance), can be explored but should remain a small portion of a diversified portfolio.

Invest in Yourself: The Most Underrated Asset

Your greatest asset is your ability to earn. Investing in your career through education, skill development, networking, and even side hustles can significantly boost your income potential. A higher income translates to more capital available for investing, accelerating your wealth accumulation. Never stop learning about personal finance, market trends, and economic principles.

Regular Review and Rebalancing

Your investment strategy isn’t a set-it-and-forget-it plan. Life changes, market conditions evolve, and your financial goals may shift. Conduct an annual review of your portfolio. Rebalance as needed to maintain your desired asset allocation. For example, if stocks have performed exceptionally well, you might sell some to buy more bonds to return to your target percentages. This disciplined approach helps manage risk and ensures your portfolio remains aligned with your long-term objectives.

Conclusion: Consistency and Discipline are Key

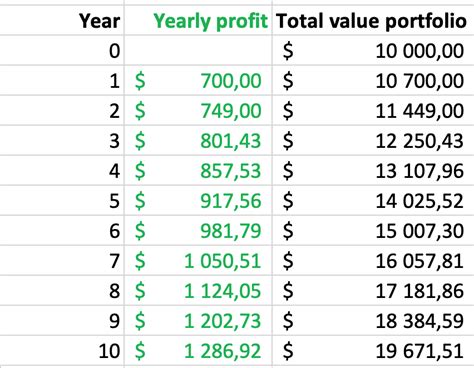

The smartest way for men to invest in their 30s is not about chasing get-rich-quick schemes, but rather about consistent, disciplined execution of proven strategies. Maximize your tax-advantaged accounts, build a diversified portfolio with low-cost funds, invest in your earning potential, and regularly review your plan. Time is your most powerful ally in investing; start now, stay consistent, and let compounding do the heavy lifting for your long-term wealth.