Embarking on the journey of wealth building is a pivotal moment for any man. The concept of the ‘smartest first investment’ isn’t just about picking a hot stock; it’s about establishing a robust financial foundation that supports long-term growth and stability. True wealth isn’t built overnight, but rather through disciplined choices, strategic allocations, and the powerful forces of time and compound interest.

Laying the Foundation: Debt and Emergency Fund

Before any money goes into the market, the absolute smartest first step is to secure your financial bedrock. This means tackling high-interest debt and establishing an emergency fund. High-interest debt, such as credit card balances, acts like an anchor, negating investment gains. Paying these off is often the highest guaranteed ‘return’ you can get.

Simultaneously, building an emergency fund of 3-6 months’ worth of living expenses provides an essential safety net. This fund prevents you from dipping into your investments or incurring new debt when unexpected life events occur, allowing your long-term capital to remain untouched and continue growing.

The Cornerstone: Diversified Low-Cost Index Funds

Once your foundation is solid, the single most effective first investment for most men building long-term wealth is a diversified, low-cost index fund or Exchange Traded Fund (ETF). Specifically, a fund that tracks a broad market index like the S&P 500 is an excellent choice. Here’s why:

- Diversification: You instantly own small pieces of hundreds of companies, spreading risk far more effectively than investing in individual stocks.

- Low Cost: These funds have minimal management fees, meaning more of your money stays invested and grows for you.

- Passive Management: No need to pick winners or time the market; the fund simply mirrors the performance of the index. Historically, the S&P 500 has delivered impressive long-term average annual returns.

Investing consistently into such a fund through a Roth IRA or 401(k) (especially if your employer offers a match – that’s free money!) leverages tax advantages while capitalizing on market growth.

Harnessing Compound Interest Early

The magic ingredient in long-term wealth building is compound interest. Starting early with even modest contributions to a diversified index fund allows your money to grow exponentially over decades. The earlier you start, the less you have to save overall to reach significant wealth. Time in the market, not timing the market, is the most crucial factor.

Many men make the mistake of waiting until they earn more or feel more financially savvy. The reality is, the power of compounding is so immense that delaying even a few years can cost hundreds of thousands, if not millions, in potential future wealth. Consistency is key – automate your investments to ensure regular contributions.

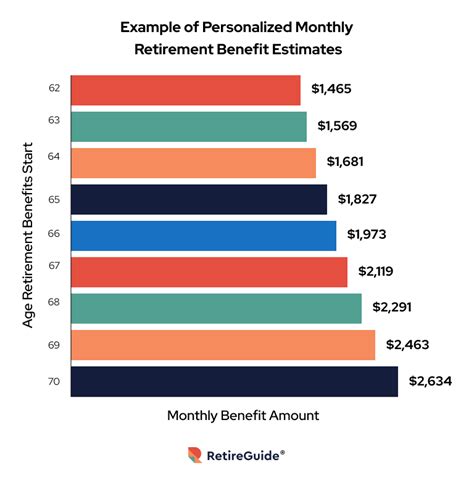

Considering Other Avenues: Retirement Accounts and Real Estate

While index funds are often the best starting point, integrate them wisely within retirement vehicles. Maxing out contributions to a 401(k), especially to get any employer match, is non-negotiable. A Roth IRA offers tax-free growth and withdrawals in retirement, making it another powerful tool.

For some, after a solid foundation and initial market investments, real estate can become a compelling long-term wealth builder. This could involve direct property ownership for rental income and appreciation, or even REITs (Real Estate Investment Trusts) for indirect exposure. However, real estate typically requires more capital, active management, and carries different risks than diversified stock market investments, making it often a secondary rather than a first investment.

The Discipline of Consistency and Education

The smartest first investment isn’t a one-time decision; it’s the beginning of a lifelong commitment to financial discipline and continuous learning. Regularly review your portfolio, rebalance when necessary, and stay informed about personal finance principles. Avoid chasing fads or making emotional investment decisions. Focus on your long-term goals and stick to your strategy.

Building wealth is a marathon, not a sprint. The smartest first step for men is to establish a strong financial base, then consistently invest in low-cost, diversified index funds, allowing time and compound interest to work their profound magic.