A Foundation of Financial Strength: Why It Matters for Men

For men, financial security isn’t just about personal comfort; it often underpins the ability to provide, lead, and leave a legacy. Crushing debt and building lasting wealth requires more than just earning money; it demands smart strategies, discipline, and a proactive mindset. This guide outlines actionable steps designed to empower men to take control of their finances, eliminate burdens, and forge a path to enduring prosperity.

Phase 1: Conquering Debt with Precision

Debt can feel like a heavy anchor, dragging down financial progress. The first step towards wealth is to systematically dismantle this burden. Begin by understanding every dollar you owe: who you owe, how much, and at what interest rate. This clarity is crucial for effective planning.

The Budgeting Blueprint: Your Financial GPS

A robust budget isn’t restrictive; it’s empowering. It’s your financial GPS, showing you exactly where your money goes and where it needs to go. Track every expense for a month to identify leaks. Then, create a realistic budget that prioritizes needs over wants, allocates funds for debt repayment, and reserves a portion for savings. Tools and apps can make this process seamless, offering visual insights into your spending habits.

Attack Strategies: Snowball vs. Avalanche

Once your budget is in place, choose your debt attack strategy. The debt snowball method focuses on psychological wins: pay off the smallest debt first, then roll that payment into the next smallest. The debt avalanche method is mathematically superior: tackle debts with the highest interest rates first, saving you money in the long run. Both require commitment; choose the one that aligns with your motivation style.

Phase 2: Building a Fortress of Wealth

With debt under control, the focus shifts to building assets and securing your financial future. This phase is about strategic growth and long-term vision.

Automate Your Savings and Investments

Make saving and investing non-negotiable by automating it. Set up automatic transfers from your checking account to savings, retirement accounts (401k, IRA), and investment portfolios immediately after you get paid. This ‘pay yourself first’ approach ensures consistent progress and removes the temptation to spend money before it’s saved.

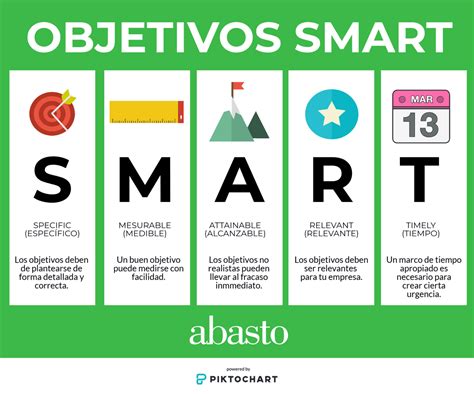

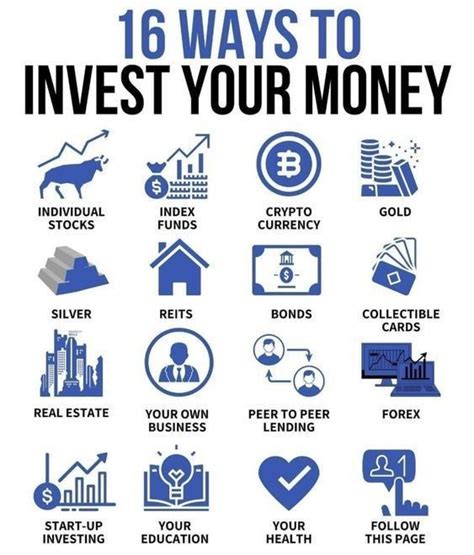

Diversify Your Investment Portfolio

Don’t put all your eggs in one basket. Diversification is key to mitigating risk and maximizing returns over time. Explore a mix of assets: stocks, bonds, mutual funds, exchange-traded funds (ETFs), and potentially real estate. Understand your risk tolerance and invest according to a long-term plan, ideally with guidance from a qualified financial advisor.

Boost Your Earning Potential

While cutting expenses is vital, increasing income accelerates wealth building. Look for opportunities to enhance your skills, pursue higher-paying roles, negotiate salary increases, or explore side hustles. Leveraging your professional expertise or developing new competencies can significantly impact your financial trajectory.

Beyond the Numbers: Mindset and Long-Term Vision

True wealth building is as much about mindset as it is about math. It requires patience, discipline, and the ability to resist instant gratification. Cultivate a long-term perspective, understanding that consistent, smart decisions today pave the way for a prosperous tomorrow.

Protecting Your Assets: Insurance and Estate Planning

A comprehensive financial plan isn’t complete without protecting what you’ve built. Ensure you have adequate insurance coverage—life, health, disability, and property—to safeguard against unforeseen events. Furthermore, consider estate planning: a will, living trust, and power of attorney ensure your assets are distributed according to your wishes and your loved ones are cared for.

The Man’s Edge: Leveraging Strengths and Overcoming Challenges

Men often possess a strong drive for achievement and a willingness to take calculated risks, qualities that can be powerful assets in financial endeavors. Channel this drive into disciplined investing and career advancement. Conversely, be mindful of potential pitfalls like impulsive spending or an over-reliance on a single income stream. Adaptability and continuous learning are your greatest tools.

Crushing debt and building lasting wealth is a journey, not a destination. It requires consistent effort, smart choices, and a commitment to continuous financial education. By implementing these strategies, men can not only achieve financial independence but also establish a secure legacy that provides freedom and opportunities for generations to come.