Laying the Financial Foundation: Why It Matters

For men, taking control of personal finances isn’t just about accumulating money; it’s about building security, freedom, and the ability to pursue life’s opportunities without constant financial stress. While societal expectations might sometimes push for risk-taking, true financial strength comes from a balanced approach: aggressive debt reduction combined with strategic wealth accumulation. This article will guide you through the smart money moves that can transform your financial landscape.

First Steps: Understand Your Financial Landscape

You can’t fix what you don’t understand. The first critical step is to get a clear picture of your current financial situation. This means knowing your net worth (assets minus liabilities), tracking every dollar you earn and spend, and creating a realistic budget.

- Track Your Spending: Use apps, spreadsheets, or a simple notebook to record where your money goes. This reveals spending patterns and identifies areas for cuts.

- Create a Budget: A budget isn’t restrictive; it’s a roadmap. Allocate funds for essentials, debt repayment, savings, and discretionary spending. The 50/30/20 rule (50% needs, 30% wants, 20% savings/debt) is a good starting point.

- Know Your Net Worth: Calculate your total assets (cash, investments, property) minus your total liabilities (debts). This number provides a snapshot of your financial health and a benchmark for growth.

Aggressive Debt Elimination Strategies

Debt, especially high-interest debt, is a wealth killer. Before you can truly build significant wealth, tackling your debt burden is paramount.

Prioritize High-Interest Debt

Focus on debts with the highest interest rates first, like credit cards or personal loans. The ‘debt avalanche’ method suggests paying the minimum on all debts except the one with the highest interest, on which you pay as much as possible. Once that’s paid off, you roll that payment amount into the next highest interest debt.

Consider Debt Snowball Method

Alternatively, the ‘debt snowball’ method prioritizes paying off the smallest debt first, regardless of interest rate. The psychological wins of quickly eliminating small debts can provide motivation to continue.

Negotiate with Creditors

Don’t be afraid to call your credit card companies or loan providers. You might be able to negotiate a lower interest rate, a modified payment plan, or even a settlement, especially if you’re facing hardship.

Building Real Wealth: Essential Steps

With debt under control, the path to wealth building becomes clearer and more impactful.

Establish an Emergency Fund

This is non-negotiable. Aim for 3-6 months’ worth of living expenses stored in a high-yield savings account. This fund acts as a buffer against unexpected events like job loss or medical emergencies, preventing you from going back into debt.

Maximize Retirement Accounts

Start early and contribute consistently. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s free money! Beyond that, explore Roth IRAs or traditional IRAs for additional tax-advantaged growth.

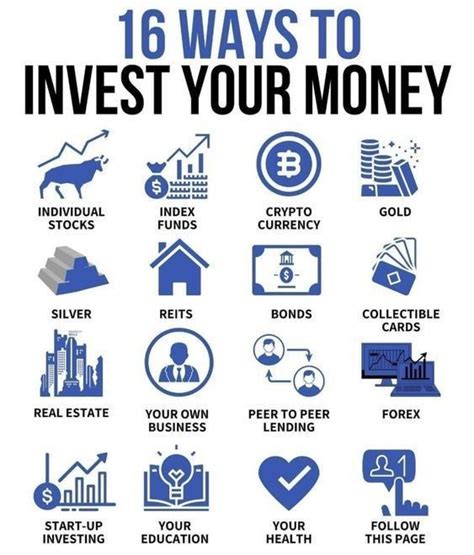

Invest Consistently and Diversify

Don’t try to time the market. Instead, adopt a strategy of consistent investing (dollar-cost averaging) into a diversified portfolio of index funds or ETFs. These typically offer broad market exposure at low costs. Consider a mix of stocks and bonds appropriate for your age and risk tolerance.

Advanced Wealth Growth & Diversification

Once the foundations are strong, you can explore other avenues for accelerating wealth growth.

Explore Real Estate

Whether it’s your primary residence appreciating over time, or investing in rental properties, real estate can be a powerful wealth builder. Understand the market, your budget, and the responsibilities involved.

Consider Alternative Investments

Depending on your risk appetite and knowledge, you might look into opportunities beyond traditional stocks and bonds, such as peer-to-peer lending, fractional ownership in assets, or even starting your own business.

Continuous Learning and Skill Development

Your greatest asset is often yourself. Investing in your skills, education, and career development can lead to higher income, which is the most significant accelerator for wealth building.

Protecting Your Assets and Legacy

Building wealth is one thing; protecting it for the long term is another.

Adequate Insurance Coverage

Ensure you have appropriate health, life, disability, and property insurance. These act as financial safety nets that prevent unforeseen catastrophes from wiping out your hard-earned wealth.

Estate Planning

It’s never too early to consider a will, power of attorney, and potentially a trust. This ensures your assets are distributed according to your wishes and minimizes stress for your loved ones.

Conclusion: Discipline and Long-Term Vision

Smart money moves for men aren’t about quick fixes or get-rich-quick schemes. They are about discipline, consistency, and a long-term vision. By diligently tackling debt, saving aggressively, investing wisely, and continuously educating yourself, you can build a financial fortress that provides security, empowers your choices, and sets a strong foundation for future generations. Start today, stay committed, and watch your real wealth grow.