Laying the Groundwork: Why Budget Optimization is Key

For men aiming for rapid wealth building and an early exit from the daily grind, a meticulously optimized budget isn’t just a spreadsheet; it’s a powerful blueprint. It transforms vague financial aspirations into actionable steps, providing clarity on where every dollar goes and, more importantly, where it could go to serve your long-term goals. This isn’t about deprivation, but about intentionality and strategic allocation.

Mastering Your Cash Flow: The First Step to Control

You can’t optimize what you don’t understand. The first, non-negotiable step for any smart man on the path to financial freedom is to gain absolute clarity on his cash flow. This means tracking every penny earned and every penny spent. Utilize budgeting apps, spreadsheets, or even a simple notebook – the method matters less than the consistency.

- Income Tracking: Document all sources of income, including salary, bonuses, side gigs, and investment dividends.

- Expense Categorization: Classify your spending into fixed expenses (rent, loans) and variable expenses (food, entertainment, utilities). This granular view reveals your financial habits.

Strategic Expense Reduction: Cutting the Fat, Not the Muscle

Once you have a clear picture of your spending, the optimization truly begins. This isn’t about living like a monk, but about identifying and eliminating financial “fat” – expenditures that don’t align with your values or contribute to your wealth-building goals.

Review your variable expenses with a critical eye. Can you cook more often instead of dining out? Do you truly use all your subscriptions? Are there cheaper alternatives for utilities or insurance? Even small, consistent cuts can free up significant capital over time.

Income Acceleration: Beyond the 9-to-5

While cutting expenses is vital, truly rapid wealth building often requires boosting your income. Smart men actively seek opportunities to earn more.

- Skill Enhancement: Invest in courses or certifications that can lead to promotions or higher-paying roles in your primary career.

- Side Hustles: Explore freelancing, consulting, or starting a small business in your spare time. Leverage your existing skills or develop new ones.

- Negotiation: Don’t shy away from negotiating your salary, bonuses, or rates for services you provide. Your worth isn’t fixed.

The Power of Automation & Smart Investing

The smartest way to ensure your budget optimization efforts lead to wealth is to automate your savings and investments. Pay yourself first.

Set up automatic transfers from your checking account to a high-yield savings account and your investment portfolio immediately after payday. This removes the temptation to spend the money and ensures consistent contributions, leveraging the power of compounding.

Investment Strategies for Growth:

- Diversify: Don’t put all your eggs in one basket. Spread investments across different asset classes (stocks, bonds, real estate, index funds).

- Long-Term Focus: Adopt a buy-and-hold strategy, focusing on growth over decades rather than short-term gains.

- Maximize Retirement Accounts: Fully utilize tax-advantaged accounts like 401(k)s, IRAs, and HSAs.

Debt Annihilation: Clearing the Path to Freedom

High-interest debt (credit cards, personal loans) is a wealth destroyer. Every dollar spent on interest payments is a dollar not working for your future. Prioritize aggressively paying down these debts. Strategies like the “debt snowball” or “debt avalanche” can provide a structured approach.

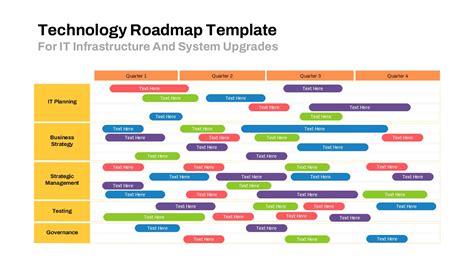

Building Your Early Retirement Roadmap

Early retirement isn’t an accident; it’s a well-executed plan. Define your “FIRE number” – the amount of money you need invested to cover your annual expenses indefinitely. Work backward from this goal, setting milestones and regularly reviewing your progress.

- Define Your FIRE Number: A common rule of thumb is 25 times your anticipated annual expenses in retirement.

- Regular Reviews: Your budget isn’t static. Review it monthly or quarterly, adjusting as your income, expenses, or goals change.

- Stay Disciplined: The path to early retirement requires consistency and discipline. Celebrate small wins, but always keep the long-term vision in sight.

Conclusion: The Intentional Path to Financial Freedom

Optimizing your budget for rapid wealth building and early retirement is a proactive choice. It’s about taking control, making conscious decisions, and aligning your spending with your deepest financial aspirations. For smart men, it’s not just about accumulating money, but about buying back time and achieving the freedom to live life on their own terms. Start today, stay consistent, and watch your financial future transform.