A 401k is an excellent cornerstone for retirement planning, offering tax advantages and often employer matching contributions. However, relying solely on your 401k might not be enough to reach your ambitious wealth accumulation goals or achieve financial independence ahead of schedule. To truly accelerate your wealth, it’s crucial to look beyond this single vehicle and explore a broader spectrum of investment opportunities.

Diversify with Taxable Brokerage Accounts

Once you’ve maximized your 401k contributions, a traditional taxable brokerage account should be your next stop. These accounts offer immense flexibility, allowing you to invest in a wide range of assets without the withdrawal restrictions of retirement accounts. You can buy individual stocks, bonds, Exchange Traded Funds (ETFs), and mutual funds, tailoring your portfolio to your specific risk tolerance and financial objectives.

The key advantage here is liquidity and control. While capital gains and dividends are taxed annually, you have unrestricted access to your funds, making them suitable for mid-term goals or building a substantial investment war chest. Diversifying across different asset classes within a brokerage account can also help mitigate risk and enhance returns.

Explore Real Estate Investments

Real estate has long been a proven path to wealth creation. Beyond owning your primary residence, consider investing in income-generating properties. This could include rental properties that provide consistent cash flow and potential appreciation, or exploring Real Estate Investment Trusts (REITs).

REITs allow you to invest in large-scale income-producing real estate without the direct management responsibilities. They trade like stocks on major exchanges, offering liquidity and diversification across various property types (e.g., residential, commercial, industrial). Direct property ownership, while more involved, can offer significant tax advantages and the opportunity for leverage.

Harness the Power of Individual Retirement Accounts (IRAs)

While often mentioned alongside 401ks, IRAs (Individual Retirement Arrangements) provide additional tax-advantaged savings opportunities that you control directly, independent of an employer. A Roth IRA, in particular, can be a powerful tool for wealth acceleration.

Contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free – including all earnings. This can be invaluable for future wealth, especially if you anticipate being in a higher tax bracket later in life. Traditional IRAs, on the other hand, offer tax-deductible contributions in many cases, growing tax-deferred until retirement. Maximizing these accounts complements your 401k by providing more tax-efficient growth potential.

Consider Alternative Investments

For sophisticated investors with a higher risk tolerance and longer time horizon, alternative investments can offer diversification and potentially higher returns, though they often come with increased risk and illiquidity. These might include:

- Private Equity/Venture Capital: Investing in private companies or startups, often through funds.

- Peer-to-Peer (P2P) Lending: Lending money directly to individuals or businesses for higher interest rates.

- Commodities: Investing in physical goods like gold, oil, or agricultural products.

- Cryptocurrencies: A volatile but potentially high-growth asset class, suitable for a small portion of a highly diversified portfolio.

These options require thorough due diligence and understanding but can provide a distinct uncorrelated asset class to further diversify your wealth-building efforts.

Entrepreneurship and Side Gigs

Sometimes, the fastest way to accelerate wealth isn’t through traditional investments but by creating your own income streams. Starting a side business, freelancing, or even launching a full-time entrepreneurial venture can dramatically increase your income potential beyond what a salary or investment returns alone might offer.

Profits from your own business can be reinvested into growth, used to pay down debt, or funneled into your investment accounts, turbocharging your wealth accumulation. This path often requires significant effort and risk but offers unparalleled control over your earning potential.

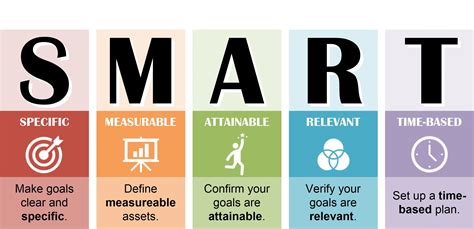

Key Principles for Accelerated Growth

Regardless of the avenues you choose, a few core principles underpin successful wealth acceleration:

- Consistency: Regular contributions, even small ones, add up significantly over time.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different asset classes and geographies.

- Risk Management: Understand the risks associated with each investment and align them with your personal risk tolerance.

- Long-Term Vision: Wealth building is a marathon, not a sprint. Resist the urge to react to short-term market fluctuations.

- Continuous Learning: Stay informed about market trends, new investment opportunities, and financial planning strategies.

Your 401k is a fantastic starting point for retirement savings, but it’s just one piece of a comprehensive wealth-building puzzle. By strategically utilizing taxable brokerage accounts, exploring real estate, maximizing IRAs, considering alternative investments, and even embracing entrepreneurship, you can create a robust, diversified financial plan designed to accelerate your wealth and achieve financial independence well beyond your expectations.