For many men, the drive to provide, achieve, and build a lasting legacy extends beyond professional success into the realm of financial security. Smart investing isn’t just about accumulating money; it’s about making informed decisions today that will empower your future, support your family, and provide freedom. This guide dives into actionable strategies designed specifically for men looking to grow their wealth and secure a robust financial future.

Understanding Your Financial Landscape

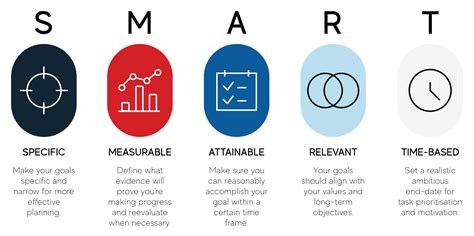

Before diving into specific investments, it’s crucial to understand your current financial situation, define your goals, and assess your risk tolerance. This foundational step is often overlooked but is paramount for crafting an effective investment strategy.

- Assess Current Finances: Get a clear picture of your income, expenses, assets, and liabilities. Use budgeting tools to track where your money goes.

- Define Financial Goals: Are you saving for retirement, a down payment on a house, your children’s education, or early financial independence? Specific goals help tailor your investment approach.

- Determine Risk Tolerance: How comfortable are you with market fluctuations? Your age, income stability, and financial obligations all play a role in determining your acceptable level of risk.

Key Pillars of Smart Investing

Building wealth is a marathon, not a sprint. It requires discipline, continuous learning, and adherence to proven principles.

1. Start Early and Invest Consistently

The power of compounding is your greatest ally. The earlier you start investing, the more time your money has to grow exponentially. Even small, regular contributions can amount to significant wealth over decades.

- Automate Savings: Set up automatic transfers from your checking account to your investment accounts.

- Increase Contributions: As your income grows, aim to increase your investment contributions.

2. Diversification is Key

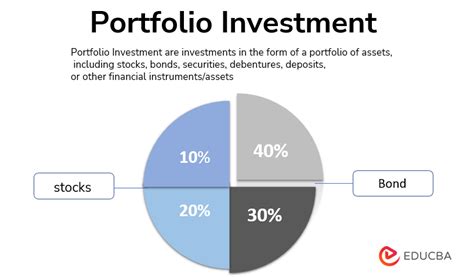

Never put all your eggs in one basket. Diversification across different asset classes (stocks, bonds, real estate, commodities), industries, and geographies helps mitigate risk and smooth out returns over time.

A well-diversified portfolio is more resilient to market downturns in any single sector.

3. Understand Different Investment Vehicles

Familiarize yourself with various investment options to find what aligns with your goals and risk tolerance.

- Stocks: Offer potential for high returns but come with higher risk. Consider blue-chip companies, growth stocks, or dividend stocks.

- Bonds: Generally less volatile than stocks, providing a steady income stream. Good for balancing a portfolio.

- Mutual Funds & ETFs: Professionally managed or passively tracked baskets of securities, offering instant diversification.

- Real Estate: Can provide rental income and appreciation, but requires significant capital and management.

- Retirement Accounts (401(k), IRA): Tax-advantaged accounts that are essential for long-term wealth building. Maximize contributions, especially if your employer offers a match.

Strategies for Accelerated Wealth Growth

1. Maximize Tax-Advantaged Accounts

Don’t leave free money on the table. Contribute at least enough to your employer’s 401(k) to get the full company match – it’s an immediate, guaranteed return on your investment. Beyond that, fully fund your IRAs (Roth or Traditional) and consider HSAs if eligible, as they offer triple tax advantages.

2. Continuous Learning and Adaptation

The financial world is constantly evolving. Stay informed about market trends, economic indicators, and new investment opportunities. Read books, follow reputable financial news, and consider consulting with a financial advisor.

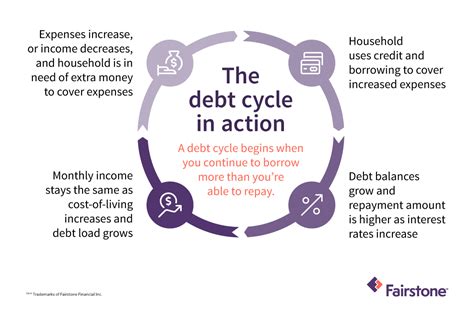

3. Manage Debt Wisely

High-interest debt (like credit card debt) can quickly erode your investment returns. Prioritize paying off expensive debt before significantly increasing your investment contributions. Low-interest debt (like a mortgage) can sometimes be leveraged as part of a broader financial strategy, but careful management is always necessary.

Avoiding Common Pitfalls

- Emotional Investing: Don’t make investment decisions based on fear or greed. Stick to your strategy and avoid panic selling during market downturns.

- Chasing Fads: Be wary of “get rich quick” schemes or investing heavily in unproven trends without thorough research.

- Ignoring Fees: High fees can significantly eat into your returns over time. Be mindful of expense ratios on funds and trading commissions.

- Lack of an Emergency Fund: Before investing heavily, ensure you have 3-6 months of living expenses saved in an easily accessible, liquid account. This prevents you from having to sell investments at a loss during an unexpected crisis.

Securing Your Financial Future

Beyond investing, a secure financial future involves comprehensive planning:

- Estate Planning: Create a will, power of attorney, and consider trusts to ensure your assets are distributed according to your wishes.

- Insurance: Adequately insure yourself and your family with life insurance, health insurance, disability insurance, and property insurance to protect against unforeseen events.

- Regular Review: Periodically review your investment portfolio and financial plan to ensure it still aligns with your goals, risk tolerance, and life circumstances.

Conclusion

Smart investing for men is about taking a proactive, informed, and disciplined approach to building wealth. By understanding your financial landscape, embracing key investment principles, leveraging tax advantages, and avoiding common pitfalls, you can set yourself on a path toward significant wealth growth and a truly secure financial future. Start today, stay consistent, and watch your financial legacy grow.