In today’s complex financial world, the dream of crushing debt and building significant wealth might seem daunting. However, with a smart budgeting approach, these goals are not only achievable but can be realized faster than you think. It all begins with understanding where your money goes and consciously directing it towards your financial aspirations.

The Foundation: Master Your Cash Flow

Before you can tackle debt or build wealth, you need a clear picture of your current financial situation. This means meticulously tracking every dollar that comes in and goes out. Many people avoid this step, fearing what they might find, but it’s the most crucial part of gaining control.

1. Track Everything: Income & Expenses

Use apps, spreadsheets, or even a pen and paper to log all your income sources and every single expense for at least a month. Categorize your spending (e.g., housing, food, transportation, entertainment). This exercise reveals your true spending habits, highlighting areas where you might be unknowingly hemorrhaging money.

2. Create a Realistic Budget

Once you know where your money is going, allocate specific amounts to each category. A good starting point is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Be honest with yourself and make your budget sustainable – an overly restrictive budget is one you won’t stick to.

Crushing Debt: Strategic Elimination

Debt is a major barrier to wealth creation. Developing a clear, actionable plan to eliminate it is paramount.

1. Prioritize High-Interest Debt First (Debt Avalanche)

List all your debts from highest interest rate to lowest. Focus all extra payments on the debt with the highest interest rate while making minimum payments on the others. Once the highest-interest debt is paid off, roll that payment amount into the next highest-interest debt. This method saves you the most money in interest over time.

2. The Debt Snowball Method for Motivation

Alternatively, list your debts from smallest balance to largest. Pay off the smallest debt first, then roll its payment into the next smallest. This method provides psychological wins as debts are paid off quickly, keeping you motivated. Choose the method that best suits your personality.

3. Explore Debt Consolidation or Negotiation

For high-interest credit card debt, consider a balance transfer to a lower-interest card (if you can pay it off before the promotional period ends). You can also contact creditors to negotiate lower interest rates or payment plans, especially if you’re facing hardship.

Building Wealth: Accelerate Your Growth

Once debt is under control, your focus shifts to growing your assets.

1. Build an Emergency Fund

Before investing, save 3-6 months’ worth of living expenses in an easily accessible, high-yield savings account. This fund acts as a financial safety net, preventing new debt accumulation when unexpected expenses arise.

2. Automate Savings and Investments

Set up automatic transfers from your checking account to your savings and investment accounts on payday. “Pay yourself first” ensures that money is allocated to your future before you have a chance to spend it.

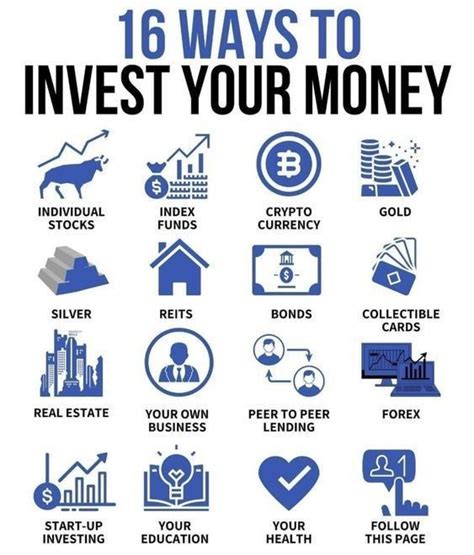

3. Start Investing Early and Consistently

Time is your greatest ally in investing. Even small, consistent contributions to retirement accounts (401k, IRA) and brokerage accounts can grow significantly due to compound interest. Focus on diversified, low-cost index funds or ETFs for long-term growth.

4. Increase Your Income Streams

Look for ways to boost your earnings. This could involve negotiating a raise, pursuing a promotion, acquiring new skills, or starting a side hustle. More income provides more capital to accelerate debt repayment and investment.

Maintaining Momentum & A Long-Term Vision

Financial success isn’t a one-time event; it’s an ongoing journey.

1. Regularly Review Your Budget

Life changes, and so should your budget. Review it monthly or quarterly to ensure it still aligns with your goals and current circumstances. Adjust as needed.

2. Avoid Lifestyle Creep

As your income increases, resist the urge to immediately upgrade your lifestyle proportionally. Instead, dedicate a significant portion of any new income to savings and investments. This is key to rapidly building wealth.

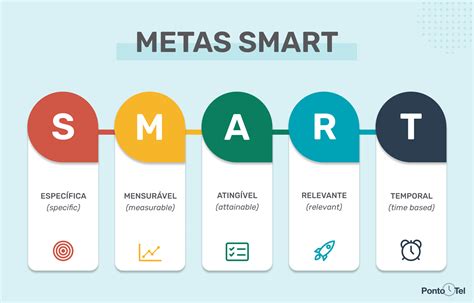

3. Set Clear Financial Goals

Define what “wealth” means to you. Is it early retirement, buying a home, or financial independence? Clear, measurable goals provide direction and motivation.

Conclusion

Crushing debt and building wealth fast isn’t about complex financial wizardry; it’s about discipline, consistency, and a smart approach to your money. By mastering your budget, strategically eliminating debt, and consistently investing, you can transform your financial future and achieve the freedom you desire. Start today, and watch your smart budgeting habits pave the way to lasting prosperity.