Embarking on the investment journey can feel daunting, but it’s a crucial step towards securing your financial future. For beginners, the key is to adopt smart, long-term strategies that prioritize steady growth over quick gains, minimize risk, and capitalize on the power of compounding. This guide will illuminate the path to building lasting wealth, starting with foundational investment vehicles and proven strategies.

Why Start Investing Early? The Power of Compounding

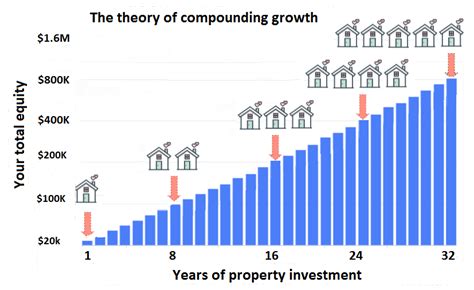

One of the most powerful concepts in investing is compounding—the process where your earnings generate their own earnings. The earlier you start, the more time your money has to grow exponentially. Even small, consistent investments made early can accumulate into significant wealth over decades, far surpassing larger investments started later.

Time in the market, not timing the market, is often cited as the most effective strategy. By investing consistently over a long period, you smooth out market fluctuations and benefit from the overall upward trend of the economy.

Foundational Investment Vehicles for Beginners

Index Funds and ETFs: The Beginner’s Best Friend

For those new to investing, direct stock picking can be risky and time-consuming. Index funds and Exchange-Traded Funds (ETFs) offer an excellent alternative. They are designed to track a specific market index (like the S&P 500), giving you instant diversification across hundreds or thousands of companies with a single purchase.

- Index Funds: These are mutual funds that aim to match the performance of a market index. They are passively managed, leading to very low fees (expense ratios) compared to actively managed funds.

- ETFs: Similar to index funds, ETFs also track an index but trade like stocks on an exchange throughout the day. They offer diversification, low costs, and flexibility.

Both index funds and ETFs are fantastic choices for beginners because they provide broad market exposure, reduce company-specific risk, and require minimal ongoing management.

Robo-Advisors: Automated Simplicity

If the thought of even choosing an index fund feels overwhelming, robo-advisors are a perfect solution. These digital platforms use algorithms to manage your investments based on your financial goals, risk tolerance, and time horizon. They typically invest your money into a diversified portfolio of low-cost ETFs.

Robo-advisors offer several benefits for beginners:

- Low fees: Significantly cheaper than traditional financial advisors.

- Automation: Handles rebalancing and tax-loss harvesting automatically.

- Accessibility: Low minimum investment requirements, making them accessible to almost everyone.

Popular examples include Vanguard Personal Advisor Services, Fidelity Go, Charles Schwab Intelligent Portfolios, Betterment, and Wealthfront.

Key Strategies for Long-Term Success

Dollar-Cost Averaging: Consistency is King

Dollar-cost averaging (DCA) is a simple yet powerful strategy where you invest a fixed amount of money at regular intervals (e.g., $100 every month), regardless of market conditions. This strategy automatically buys more shares when prices are low and fewer shares when prices are high, lowering your average cost per share over time.

DCA removes the emotion from investing and prevents you from trying to ‘time the market,’ which is nearly impossible to do consistently.

Diversification: Don’t Put All Your Eggs in One Basket

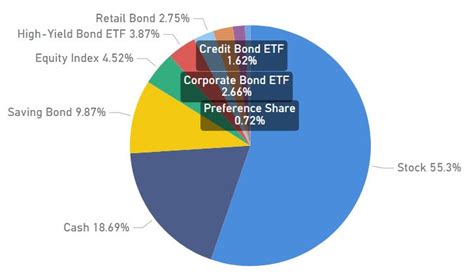

We’ve touched on this with index funds and ETFs, but true diversification goes beyond just different companies. It means spreading your investments across various asset classes (stocks, bonds, real estate), industries, and geographies. This strategy helps mitigate risk, as a downturn in one area is often offset by gains or stability in another.

Focus on the Long Term: Ignore the Noise

The stock market experiences ups and downs; volatility is a natural part of investing. For long-term wealth building, it’s crucial to resist the urge to panic during market corrections or chase hot trends. A long-term perspective—thinking in terms of decades, not months or years—allows you to ride out market cycles and benefit from sustained growth.

Setting Up Your Investment Journey

Open the Right Account

Consider tax-advantaged accounts first: a Roth IRA or Traditional IRA for retirement savings, or a 401(k) if offered by your employer (especially if they provide a matching contribution, which is free money!). For non-retirement goals or if you’ve maxed out retirement accounts, a taxable brokerage account is your next step.

Start Small and Be Consistent

You don’t need a large sum to begin. Many platforms allow you to start with as little as $50 or $100. The key is to start, and then make regular, automated contributions. Even modest, consistent contributions can lead to substantial wealth over time.

Continuous Learning

While the strategies above are robust, financial literacy is an ongoing process. Continue to read, learn, and understand the basics of personal finance and investing. The more you know, the more confident you’ll become in making informed decisions.

Conclusion

Building long-term wealth through investing is an achievable goal for anyone, regardless of their starting point. By embracing low-cost, diversified investment vehicles like index funds and ETFs, leveraging the automation of robo-advisors, and committing to strategies like dollar-cost averaging and a long-term mindset, beginners can confidently lay a strong foundation for financial success. Start today, stay consistent, and watch the power of compounding work its magic over the years.